In our 2025 Outlook, “Bridging the Divide” we highlight “The Age of Alpha” in markets due to valuations, concentration and volatility. These factors create a foundation for active management, strategic portfolio construction and a focus on the evaluation of alternative asset classes. With that in mind, it is worth revisiting the role of alternative investments, which are a main source of alpha in client portfolios.

Allocations to alternative investments have evolved and shifted over time. Nonprofit investors are now asking if hedge funds or “marketable alternatives” are suitable for their organization’s investment portfolio, especially given that investors have recently tilted their alternative investment allocations towards private markets instead.. According to NACUBO survey data, growth and interest in private equity and venture capital has significantly outpaced marketable alternatives. In the 2018 survey1, private equity and venture capital represented 21% of all participants in endowment portfolios, while in 20232 that number grew to 29%. Over the same period, the allocation to marketable alternatives declined from 19% to 16%.

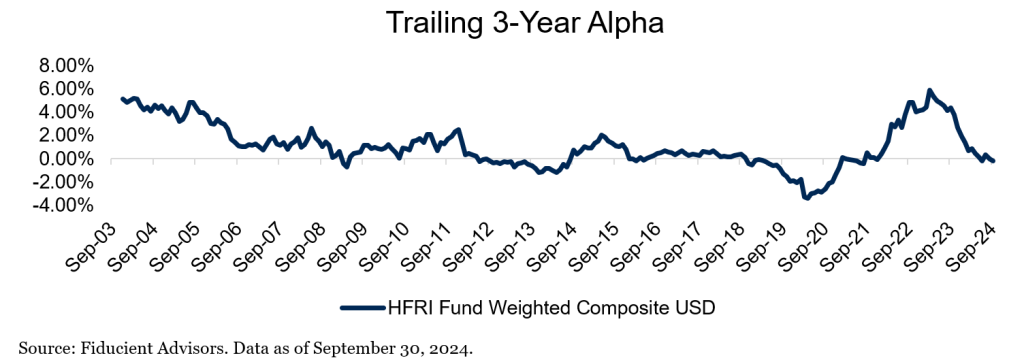

While some investors have the perception of diminished returns following the Global Financial Crisis, marketable alternatives have been additive to portfolios on a risk-adjusted basis. Relative to a 60% MSCI ACWI / 40% Bloomberg US Aggregate Bond portfolio, marketable alternatives provided positive alpha in over 73% of the past 250 trailing three-year periods3. This perception may be partially attributed to marketable alternatives’ relative underperformance to equities over this extended and extraordinary bull market.

The common saying about marketable alternatives suggests they offer “equity-like returns with bond market volatility.” Perhaps the saying needs some revisiting, because nonprofits investing in marketable alternatives would be incredibly disappointed with “equity-like returns” or even bond-like returns in 2022. Recognizing that a diversified portfolio of marketable alternatives may not match the performance of strong equity markets while also avoiding losses during market downturns does not mean they are not advantageous for many portfolios. Furthermore, equity market returns may be more modest going forward. According to Fiducient Advisors’ 2025 10-year Capital Market Forecasts, U.S. equities are forecasted to return 5.6%. This environment presents an attractive relative opportunity for marketable alternatives.

It is critical for investors to consult with an independent financial advisor for guidance in defining the role and objective marketable alternatives may play in an investment portfolio. We revisit the advantages and considerations of investing in marketable alternatives today along with some additional thoughts for your organization.

Advantages

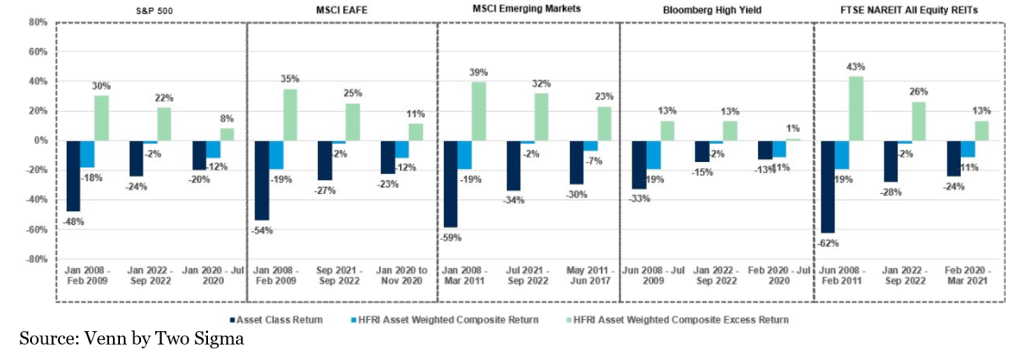

Capital Preservation: Marketable alternatives have shown a consistent ability to protect capital relative to risk assets4. The below chart shows the three largest drawdowns for US equity, non-US developed equity, emerging market equity, high yield bonds and real estate alongside the corresponding drawdown for marketable alternatives over the same period. In each drawdown scenario, marketable alternatives demonstrated a better ability to protect capital.

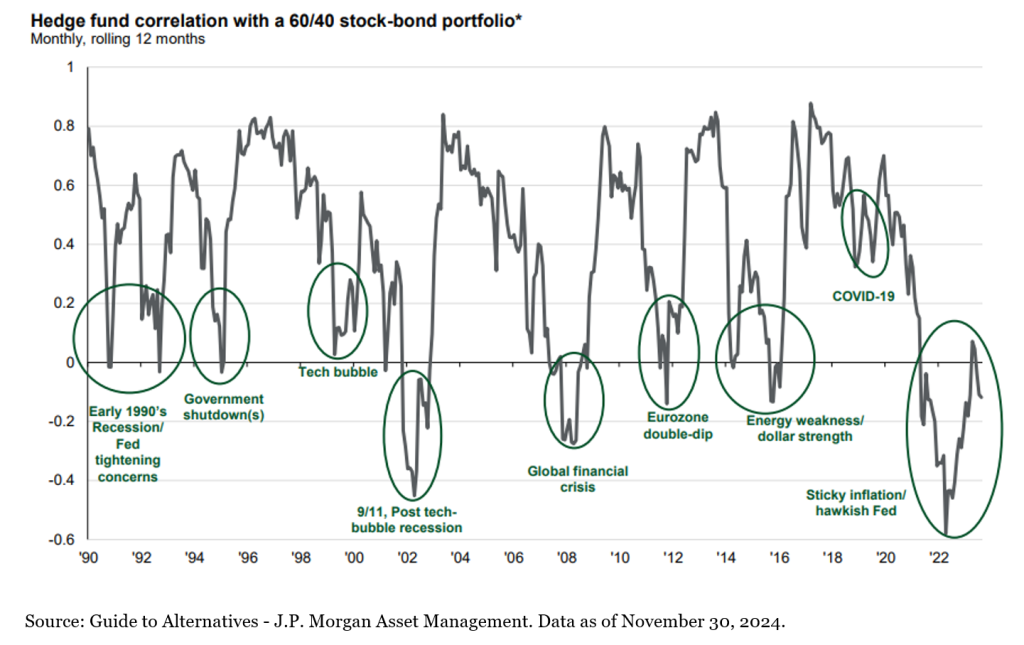

Diversification: Marketable alternatives have historically provided diversification in portfolios, which provides investors with the potential ability to generate a higher expected return for an aggregate total portfolio while reducing the overall equity allocation. Additionally, in periods of extreme market stress, when the benefits of diversification are most needed, marketable alternatives correlations with a 60/40 stock-bond portfolio have tended to decrease.

Considerations

Fees: Marketable alternatives have historically been associated with higher management fees and (trading) expenses relative to more traditional investment vehicles. Fund of funds carry additional costs, typically in the form of netting costs along with another layer of management and/or incentive fees.

Additionally, the rise of multi-manager platforms has increased the prevalence of pass-through fee models. Multi-manager platforms are marketable alternatives that employ many specialized hedge fund managers and strategies collectively under one entity, typically using a centralized risk model. These firms typically employ pass-through models where expenses, such as compensation, technology costs and netting fees are charged to the fund.

While higher fees create an additional hurdle, it is important to note that marketable alternatives report returns net of all fees.

Leverage: Underlying marketable alternatives strategies often require leverage, with the goal of increasing return potential while also potentially increasing risk. As such, it is critical to ensure leverage is prudently deployed.

Esoteric Risks: Marketable alternatives introduce unique characteristics not commonly associated with standard fixed income or equity funds, including illiquidity, limited transparency, additional regulatory scrutiny, strategy complexity and restrictive investment terms. Additionally, marketable alternatives, which are typically much smaller firms when compared to other asset managers, introduce heightened operational risks around cash controls, compliance and cyber security. Thorough operational due diligence helps to identify and mitigate these risks.

Additional Thoughts:

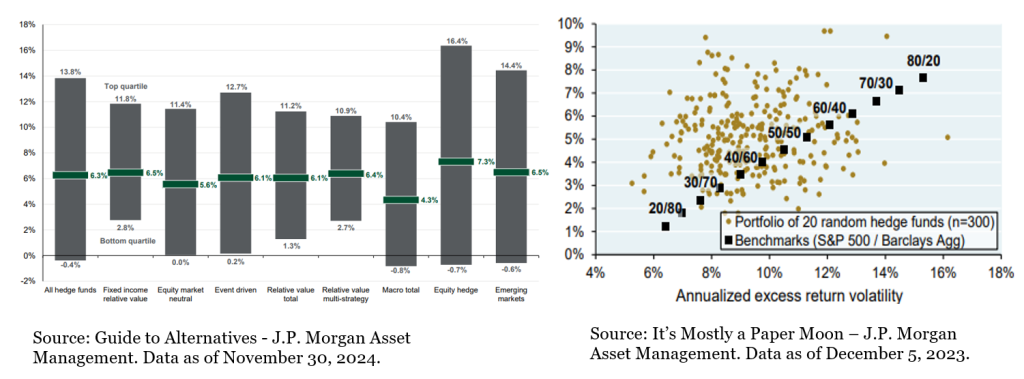

Given the unique risks associated with marketable alternatives, manager selection and diversification are critical. An investment consultant can assist with prudent management of marketable alternatives allocations. The below chart (left) shows the dispersion of returns across several types of marketable alternatives strategies, highlighting the value add of manager selection. While manager selection is vital, the below chart (right) displays the benefits of diversification, as even a random sample of marketable alternatives tends to outperform an efficient frontier.5

When constructing a marketable alternatives portfolio, it is important to understand that in the truest sense, a hedge fund is not an asset class but rather a legal structure facilitating trading strategies invested across various asset classes and regions. Furthermore, marketable alternatives will utilize a varying degree of net exposure and leverage. As such, their risk and return targets can vary drastically across the industry. It is with this understanding that Fiducient Advisors constructs portfolios, making sure the risk and return targets of individual funds align with the risk and return targets of the broader portfolio and match the unique objectives of each client.

For many institutional investors, especially endowments and foundations, the objective is to increase real purchasing power (surpassing spending and inflation after fees) while assuming the minimum level of risk possible. For these investors, Fiducient Advisors believes a diligently sourced portfolio of diverse marketable alternatives is not only suitable, but valuable to portfolios and can provide enhanced risk-adjusted returns.

To discover the potential of marketable alternatives and start strategically building out your portfolio today, contact the professionals at Fiducient Advisors.

12018 NACUBO-TIAA Study of Endowments

22023 NACUBO-Commonfund Study of Endowments

3Morningstar

4Venn by Two Sigma

5Guide to Alternatives – J.P. Morgan Asset Management

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.