Why Adequate Property and Casualty Insurance Matters

When asked about your insurance coverage, you might naturally think about life insurance. However, it is equally important to consider your property and casualty insurance, as overlooking this coverage could be a costly mistake.

With the increase in natural disasters over the past decade, ensuring your property and casualty insurance offers adequate protection is more important than ever. Many homeowners may not have accounted for the rising costs needed to fully replace their properties, putting them at risk. As it relates strictly to homeowners insurance, a recent article in The Wall Street Journal noted:

A 2022 survey by the American Property Casualty Insurance Association, a trade group, found that a majority of insured homeowners had not taken steps to ensure their coverage was keeping pace with inflation and increased building costs, which could leave them underinsured if a catastrophe strikes.

According to the survey, only 30% of insured homeowners had increased their coverage to compensate for rising building costs, and less than half (40%) updated their insurance after completing renovations or a remodel.

When you consider that, on average nationwide, the costs of construction materials and labor increased by 40% and 16%, respectively, between 2019 and 2023, according to real-estate data firm CoreLogic, that means that a lot of homeowners are currently underinsured. 1

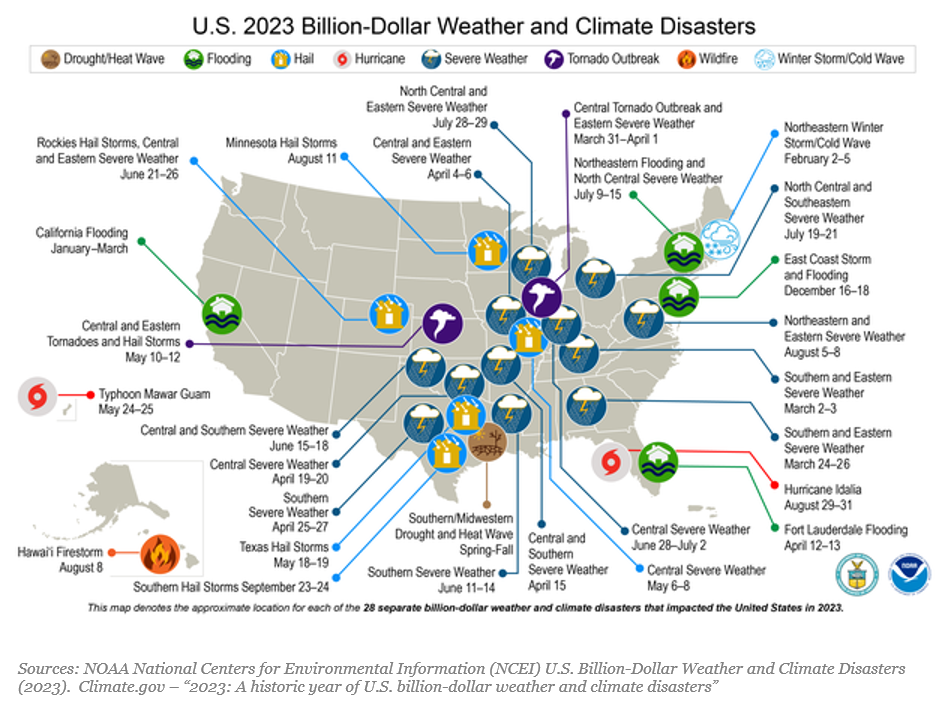

To highlight the significant effect of natural disasters across the country, the graphic below shows 28(!) distinct billion-dollar disasters that affected the United States in 2023 alone.

With all of this in mind, what are key considerations to help ensure sufficient property and casualty insurance coverage?

Set property coverage limits appropriately

Homeowners often believe that insuring their home for its current market value is enough, but rebuilding costs may be higher due to increasing material and labor expenses. Additionally, older policies may not reflect recent remodeling or upgrades. To protect against this, ensure your insurance covers the full replacement cost of your property, including any special features like custom cabinetry or high-end appliances.

Evaluate liability coverage limits

Consider the liability coverage provided by your insurance and evaluate that protection against your overall net worth. Ensure that liability limits on homeowners and automobile insurance pair up with the limits provided by umbrella insurance to avoid any gaps in coverage. High net-worth individuals, in particular, should have an umbrella insurance policy in place to protect, at a minimum, a substantial portion of their overall net worth.

Review policy exclusions

Understand the limits covered by your policy for instances such as flooding, mold or other specific risks. Policy exclusions can vary considerably between insurance providers, so knowing these limits in advance is crucial to avoid surprises during a claim.

Consider deductibles

Choose a deductible that balances affordability with the amount of risk you are willing to bear. Higher deductibles typically result in lower premiums, but you will need to make sure the out-of-pocket cost (deductible) is manageable in the event of a claim.

Monitor premium costs

Rising premiums might encourage you to shop around for a new policy, but cost shouldn’t be the only factor. Weigh the premium cost against the coverage and exclusions provided. A cheaper policy may leave you with insufficient protection when you need it most.

Don’t forget your valuables

Items like jewelry, fine art, furs or collectibles may not be fully covered by a standard policy. Make sure you have additional insurance to reflect the true value of these high-cost possessions.

Taking the time to understand your property and casualty insurance in relation to your assets is a critical step in financial planning. If it has been a while since you last reviewed your insurance policies or if your financial situation has changed significantly, it may be time to reassess your insurance needs to help ensure proper protection.

To obtain a complimentary detailed review of your current property and casualty insurance coverage, please contact a member of The Wealth Office team at Fiducient Advisors.

Resource: We believe the list below provides a brief summary of information needed to perform a comprehensive property and casualty insurance review.

Homeowners Insurance

- Declaration pages for existing insurance policy

- Does the existing homeowners insurance policy include flood insurance/coverage? What are the policy limits for flood damage?

- Does the existing homeowners insurance policy include any additional coverage for valuables?

- Year the home was built

- Construction type (brick, brick veneer, stucco)

- Roof shape (gable, hip) and roof covering

- Is there a central station fire and burglar alarm system?

- Is there a back-up generator? Residential interior sprinkler system?

- Is there a mortgagee?

- Approximate square footage of home

Automobile Insurance

- Declaration pages for existing insurance policy

- VIN numbers for all covered vehicles as well as year, make, and model

- Insured drivers’ names, dates of birth, and drivers license numbers

- If any drivers are of “school age”, do they have at least a “B” average?

- Any recent accidents or violations

- Are all vehicles garaged at the insured’s residence?

Umbrella/Excess Liability Insurance

- Declaration pages for existing insurance policy

- Current insurance policy coverage limits

- Are there any other exposures which should also be listed on the umbrella/excess liability insurance policy (other properties, motorcycle, watercraft, recreational vehicles, etc.)?

Valuables/Miscellaneous

- Do you own any other vehicles – motorcycles, watercraft, recreational vehicles?

- Do you own any valuables (jewelry, fine art, fur, wine, etc.) that require additional insurance coverage?

1 Source: The Wall Street Journal: “You Have Homeowners Insurance. Is It Enough to Rebuild Your House?” By Robyn A. Friedman. October 2, 2024.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.