In a recent study completed by the National Institute on Retirement Security, more than half (55%) of all Americans are concerned they cannot achieve financial security in retirement.1 With pending questions and consternation regarding social security benefits, it is increasingly necessary to develop a rock-solid gameplan. Highly compensated executives may have further considerations when it comes to wealth planning and post-work life retirement, particularly if they are eligible to receive some form of executive compensation. When it comes to executive compensation and wealth planning, avoiding simple mistakes is crucial. However, such missteps are avoidable when you build a knowledge base to recognize intricacies and warning signs involving potential situations or opportunities which could support your financial goals.

What is Executive Comp?

Executive compensation, (“EC”), refers to both financial and non-financial rewards given to top-level executives in corporations. This typically includes, but is not limited to:

- Stock Options: The right to buy company stock at a predetermined price in the future, providing executives with the potential for financial gain if the company’s stock price increases.

- Restricted Stock: Actual shares of company stock that are granted to executives but typically come with restrictions on when they can be sold.

- Performance Shares: Shares of company stock awarded based on achieving predetermined performance goals.

- Deferred Compensation: Portions of an executive’s salary or bonus that are set aside and paid out at a later date, often to provide incentives for long-term performance.

- Stock Appreciation Rights (SARs): A type of employee compensation linked to a company’s stock performance during a prescribed period. Unlike an option of stock, SARs can be paid in cash and do not require the employee to own an equity/asset.

- Employee Stock Purchase Plans (ESPPs): A program allowing executives to buy stock in their company at a discount. Employees have the option of making contributions to their company stock through payroll deductions. ESPPs allow the benefit of partial ownership and alignment of vision for the organization.

Five Costly Mistakes

While receipt of EC can be a huge benefit for executives, it is important to understand the full implications of how this compensation can affect wealth planning. Here are five common pitfalls to watch out for:

1. Ignoring Tax Implications: Executives often receive compensation packages that include stock options, bonuses and other incentives.

- Salary & Bonuses: Salary and bonus payments are taxed as ordinary income and carry the standard applicable federal/state taxes. Cash bonuses paid separately are subject to separate withholdings. Per Northern Trust, this figure is, “typically 22% for amounts under $1 million and 37% for amounts over $1 million. Depending on the size of the bonus, the executive’s marginal tax rate may be higher than 22%, in which case this withholding method will likely be insufficient to cover their entire tax liability.”2

- RSAs: Restricted Stock Awards is a form of payment that transfers the stock to a recipient, subject to individual vesting policy. The stock is taxed at ordinary income for federal and state purposes when vesting occurs. Upon any sale of the RSA, any gains or losses are taxed at an individual’s standard capital gain/loss bracket.

- Deferred Compensation: Deferred compensation plans allow an executive to delay a portion of taxes based upon when they choose to receive their cash comp. Per Jane G. Ditelberg, Director of Tax Planning at Northern Trust Institute, “the taxpayer must make the deferral election by June 30 of the year preceding payment, while for other types of compensation, the executive has until December 31 of the calendar year preceding the payout.”3

Failing to understand the tax implications of these benefits can lead to significant financial losses as on average, equity compensation comprises over half of an executive’s total compensation.

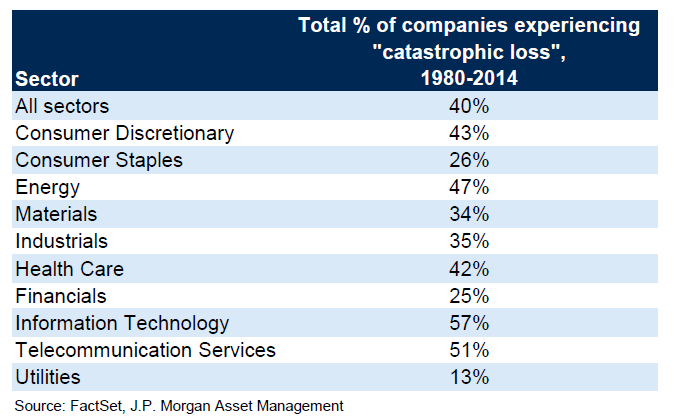

2. Overconcentration in Company Stock: Many executives receive a significant portion of their compensation in company stock or stock options. While this can align their interests with shareholders, it also exposes them to risks if the company underperforms or faces financial difficulties. According to a study on historical market conditions by J.P. Morgan, over half the companies in the Russell 3000 experienced a “catastrophic loss” from 1980 to 2014. Catastrophic, in this instance, is defined as a 70% pullback. See below for a graphic summarizing a sector-by-sector breakdown.4

One way to help ensure you avoid this pitfall is the strategy known as “scaling Out” of your position. It is the inverse of “Dollar Cost Averaging” (DCA). The idea of DCA is to make fixed/standard purchases regardless of market conditions. Scaling out would have the same inverse principals, i.e., forfeiting or selling 5% of stock every quarter as you approach or enter retirement and investing those proceeds into a more balanced portfolio in line with your goals. This can normalize returns over the long term as opposed to trying to time the market with a lump sum liquidation payout.

3. Neglecting Estate Planning/Wealth Planning: Estate planning considerations, especially for executives, is a necessity. Failing to create a comprehensive estate plan can lead to higher estate taxes, delays in asset distribution and disputes among beneficiaries. Executives should work with estate planning professionals to ensure their wishes are met and their assets are protected. For further details on financial planning and tips to assist you in meeting your financial goals, please see our 2024 Financial Planning Guide. Without a clear roadmap, executives may miss opportunities to grow their wealth and secure their financial future.

4. Expiration of Compensation: According to recent data aggregated by Fiducient Advisors, only 45% of executives end up exercising all granted options before expiration. Companies have various rulings on payouts for compensation, stock qualified option plans and non-qualified option plans. “Option plans differ from restricted stock in that options are granted at a strike price and can be exercised at any time between vesting date and expiration. Stock options can expire worthless if the current value of the company stock is less than the grant price. Do nothing, however, and they will expire worthless. Be aware that expiration periods can sometimes be much shorter than that (or reduced if you decide to leave the company).”5 It is essential to consult with your personal tax advisors to optimize efficiency and minimize liability and risk to you and your family.

5. Ignoring Corporate Governance and Compliance: EC is often subject to regulatory requirements and corporate governance guidelines. Failing to comply with these rules can lead to legal issues, reputational damage and even financial penalties. Per the SEC, it is legally required for companies to “disclose the criteria used in reaching executive compensation decisions and the degree of the relationship between the company’s executive compensation practices and corporate performance.”6 Both the Dodd Frank Act and the Tax Cuts and Jobs Act left a significant impression on EC regulation and disclosure policy. Organizations, executives and even their advisors must stay informed about regulatory changes and ensure that compensation practices are transparent and compliant.

Take a Proactive Approach

When our Private Wealth team speaks with families, the number one concern is… retirement! “Will I have enough money to sustain our lifestyle; can I meet my goals of providing for the next generation; what if there is an emergency or a downturn in the market”? Our clients who have been fortunate enough to attain an executive level role have a unique opportunity to structure their retirement in a way that best fits their lifestyle. However, this is a double-edged sword. There is a litany of tax considerations, timing mechanisms, and policies and procedures which must be carefully navigated to ensure you take full advantage of a situation. It is vital to keep a constant line of communication between your estate planner, financial advisor and tax professional to ensure timelines are met, efficient portfolio construction and balancing is undertaken and payout structuring is coordinated.

To discuss the implications of EC you receive, or for assistance with estate and wealth planning, connect with our team of experts at Fiducient Advisors. Our seasoned professionals and insights are ready to help guide you towards financial success.

1National Institute on Retirement Security: Americans’ View of Retirement. February 2024.

2Northern Trust: Executive Compensation Tax: Options, Stocks Grants and Bonuses. 2024

3Northern Trust: Executive Compensation Tax: Options, Stocks Grants and Bonuses. 2024.

4J.P. Morgan: The Agony & The Ecstasy. March 2021.

5Mercer Advisors: Executive Compensation: 4 Perks and Pitfalls. January 2024.

6U.S. Securities and Exchange Commission: Executive Compensation.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.