As a fiduciary, selecting and monitoring investment managers is an important part of the investment process and prudent management of an endowment or foundation portfolio. This process requires a great deal of care and diligence to ensure the pool of assets is able to meet the goals and objectives of the organization it is meant to support. An investor can carry out a rigorous process for selecting the optimal asset allocation for their portfolio, however, if the selected investment managers consistently fall short of expectations and fail to produce adequate risk-adjusted returns, the portfolio will have a difficult time meeting the needs of the organization in the long run.

Manager Selection Process

Initial Screening

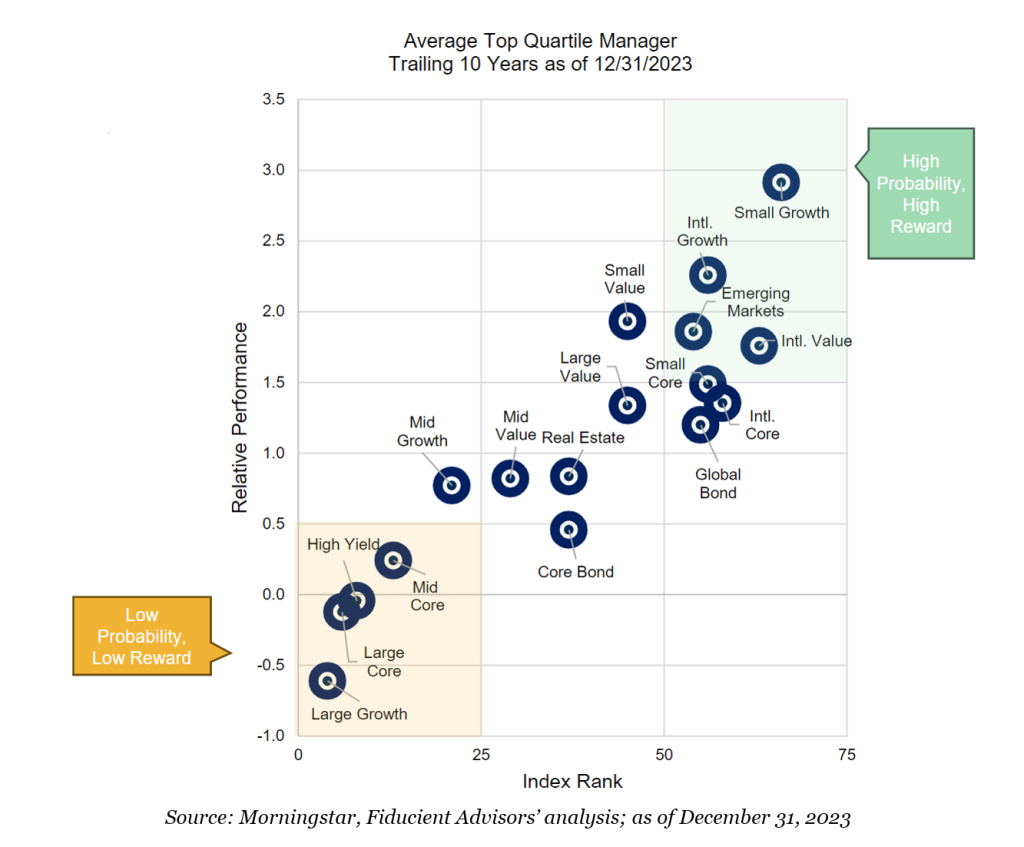

The first step in any manager selection process is an initial screen to help narrow the list of potential candidates within the investment universe. An important decision on the initial screen is whether to select an active or passive manager. At Fiducient Advisors, we believe in selecting active managers in asset classes where the benchmark regularly falls near or below the median active manager and the magnitude of active management outperformance has the potential to be meaningful. In asset classes where there is lower probability of outperformance and the potential reward for selecting a good active manager is low, we recommend utilizing a low-cost index fund that closely follows the benchmark. The below chart from our Active vs. Passive Research Paper illustrates this spectrum.

Once the active versus passive decision is made, other initial screens may include manager tenure, AUM size, investment vehicle options, and/or any liquidity provisions or requirements potentially contained in an Investment Policy Statement.

Qualitative Review

Part two of the manager selection process involves doing a high-level qualitative review of the prospective investment strategies that pass the initial screen. This includes a review of both the firm and the specific strategy under review. Qualitative items to consider consist of the firm’s overall philosophy to investing, the depth, knowledge and expertise of the portfolio management teams, growth and stability of the firm and the repeatability of the investment process that aligns with the firm’s philosophy. If the firm and strategy remain compelling as a potential fit for investment, they move on to the next stage in the process.

Due Diligence Questionnaire

Once a strategy makes it to this stage of the selection process, Fiducient Advisors sends a detailed due diligence questionnaire to the manager. This questionnaire includes further qualitative and quantitative questions that help us understand the finer points of the manager’s people, process, philosophy and historical performance. Quantitative analysis may include questions on the attribution of performance (what are the key drivers of returns?), capture ratios (how does a manager perform in “up” markets versus “down” markets?), and historical drawdowns (when a manager suffers negative performance, what is the magnitude and duration of these periods?). If a manager continues to look favorable after reviewing the responses to the questionnaire, they move on to the final part of the selection process.

“Deep-Dive” Review

Finally, managers that reach the final stage of the selection process should undergo a deep-dive research process. This includes on-site interviews that examine the manager’s buy/sell process, portfolio construction methodology and compliance. Operational due diligence is also included in this step. Operational due diligence includes a review of topics like key service providers – for example, audit services, legal counsel, and custodian, to name a few – stability of the leadership team, back-office operations, cybersecurity, insider trading policies and alignment of incentives. This final step of the selection process helps weed out managers that may not be the right fit for the needs of the endowment’s portfolio.

Only after a thorough selection process should a manager be considered for investment. Consistently following this type of process can help ensure that the best managers rise to the top of the list for possible implementation in an organization’s portfolio.

Ongoing Monitoring and Evaluation

Once a manager is selected for investment, the work does not stop there! The final key piece of manager selection is ongoing monitoring and evaluation. Periodic review of the investment strategy is necessary. After all, as an investor, it is important to make sure that the manager continues to execute as expected.

Reviewing manager performance requires more than just comparing the manager’s return versus the appropriate benchmark. It is critical to understand what the drivers are of underperformance or outperformance. We need to understand not just what happened, but why it happened and what does it mean? Was the investment manager’s style out of favor during the period being reviewed? Did the manager deviate from their process and philosophy outside of their area of expertise in an effort to “chase” returns? These types of questions help provide context for a deeper understanding of the source of returns.

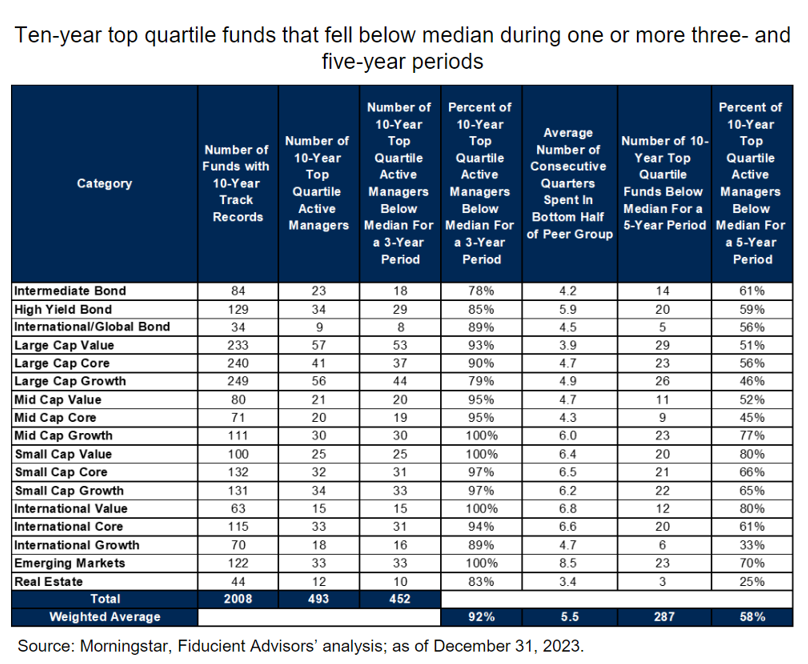

Lastly, it is imperative that investors remain patient during periods of underperformance from active managers – barring any other significant qualitative reasons (senior portfolio manager retires, leaving behind a team with significantly less experience, for example) – and not hastily make a decision to fire a manager. Often, top-quartile managers face adversity along the way. Our latest 10-year review shows that 92% of top quartile managers over a ten-year period experience at least one three-year period where their results fall into the bottom half of their peer group.

While decisions to terminate one manager in favor of another are never easy, they should also follow a clearly defined process that takes into account changes in both qualitative and quantitative factors that may have changed since the incumbent manager was initially added to the portfolio.

Having a consistent process in place to review, approve and monitor the investment managers in your organization’s portfolio is part of a prudent governance process and will aid in the long-term success of the portfolio.

For more information on how we select and monitor investment managers, please contact any of the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.