All of us struggled with the unexpected this past year, much of it involving strife and heartache – especially for charitable organizations and those they serve. But one thing played out better than you expected: the investment returns in your endowment or foundation portfolio. Be careful though, lapsing into a false sense of security could prove perilous. Here are four good steward initiatives investment committees can act on now to improve their odds of success.

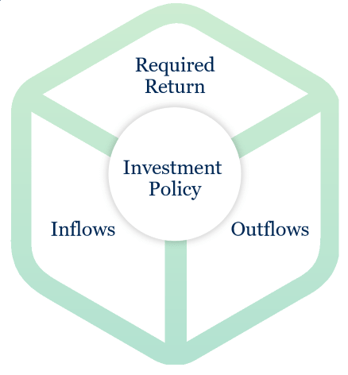

1. Update your Three Levers exercise. Organizational inflows, outflows and required return are elements we routinely reassess with clients, all before launching into portfolio construction or modification. It sounds simple and typically is. However, recent developments have complicated the environment as well as the task.

• Will the pandemic have long-term impact on your nonprofit’s cashflow, liquidity requirements and how your committee ultimately chooses to allocate investments?

• With returns for stocks and bonds likely lower over the coming decade, should your committee take on more risk to maintain legacy return targets?

• What percent of your charitable organization’s budget is derived from portfolio earnings and should your spending policy be ratcheted down?

Sitting on several nonprofit boards myself, I know that simply posing these questions to your committee should lead to an eyes-wide-open, potentially invaluable, discussion. For more insight, you can download our 6 Tips to Managing Endowment & Foundation Investments HERE.

2. Prepare for a portfolio gut punch. Is this a prediction for the type of “hundred-year flood” that stocks experienced in 2008 or at the onset of the pandemic? No. But since bottoming out in March of last year, the extraordinary gains stocks achieved have exceeded nearly everyone’s expectations.

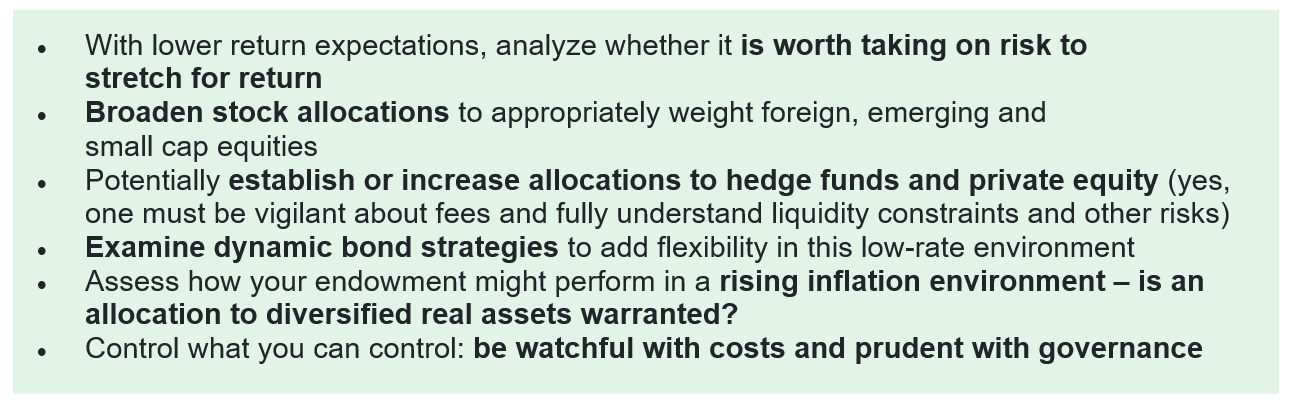

Sure, bullish investors can argue why stocks will continue to perform well. On the other hand, valuations appear to range from full to outright exorbitant. Given this backdrop, here are ways in which investment committees can demonstrate good stewardship:

Access more on these and other suggestions in our 2021 Outlook: Poised for Growth Report.

3. Become intentional with your ESG and DEI policies. Did you know that until financial accounting standards were established in the 1930s, each company developed and used their own approach to preparing and sharing financial information? Today the accounting standards that investors rely upon are taken for granted. While it will be some time before similar standards exist for Environmental – Social – Governance along with Diversity – Equity – Inclusion, there is no mistaking that greater accountability is part of our future.

Efforts and the resulting impact concerning ESG and DEI are growing in importance to many stakeholders as evidenced by:

• Asset managers like Blackrock and others flexing their muscle with an increasing portion of the assets they oversee. Learn more on our recent podcast here.

• A wide range of investment committees are studying, evaluating and implementing ESG and DEI strategies.

• Investment advisors can not only help educate clients but also require more and better reporting from investment managers. Fiducient Advisors and other firms are pioneering transparency and change through the Institutional Investment Diversity Cooperative and other efforts. Access our DEI Webcast here.

Of course, the basis for any ESG or DEI initiative is twofold: to do the right thing, as defined by your organization and its mission, and to produce better outcomes. Recent trends give hope to investment committees that desire to Do Right and Do Well.

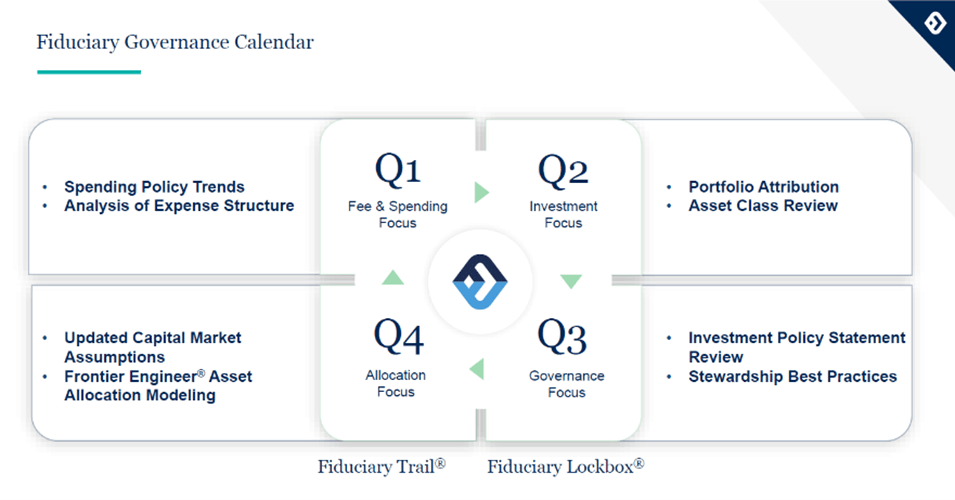

4. Improve endowment results with strong governance. One of the most important factors in ensuring long-term success of your charitable organization is committing to a strong governance process. All too often investment committees get mired in the short-term, asking transitory questions like: What was our performance for the quarter? How did we perform when compared to our peers?

While these matters are not insignificant, they can cloud the big picture. Rather, nonprofit leaders tasked with overseeing perpetual investment programs (such as endowments and foundations) must remain focused on long-term strategy linked to their overarching mission.

A calendar-based approach to governance, like the one displayed below which we implement on behalf of our clients, provides the discipline and structure necessary to establish and maintain strong governance.

Up Your Odds for Success

The world hurled many challenges at nonprofits and their investment committees over the past year. Performing these four stewardship acts should fortify your endowment and help your charitable organization navigate continued uncertainty.

To discuss these and other strategies for your portfolio, please feel free to contact me or any of the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.