In today’s fast-paced world, financial stress is an overwhelming burden many employees carry with them every day. It is not just about the dollars and cents; it is about peace of mind and the ability to focus on work without the constant worry of financial woes. For Plan Sponsors and employers, understanding and addressing financial wellness can be a game-changer.

The Number One Stressor in the Workplace

Personal finances have become the top stressor in the workplace. A 2023 survey by PwC reported that 57% of employees indicated financial stress as their primary concern.1 This isn’t just a personal issue; it significantly impacts workplace productivity and overall employee well-being. When employees are stressed about money, they are less focused, more distracted and potentially less productive. The 2024 Wellness Barometer Survey by BrightPlan found that employee financial stress cost U.S. employers approximately $183 billion annually.2 These financially stressed employees are over two times more likely to look for a new job.3

Impact on Employer’s Bottom Line

Financial stress doesn’t just affect the individual; it seeps into the organizational fabric, impacting the employer’s bottom line. Issues such as turnover, absenteeism and presenteeism (being physically present but mentally elsewhere) are directly linked to financial stress.

• Turnover: Employees overwhelmed by financial stress are more likely to seek new opportunities that offer better financial stability or benefits, increasing turnover rates. The cost of replacing an employee can be as much as 120%-200% of the annual salary of the position affected as reported by the national research university, UMass Lowell.4

• Absenteeism: Financially stressed employees are more likely to take unplanned leave, further disrupting workflow and productivity.

• Presenteeism: Even when employees show up for work, financial stress can cause them to be less engaged and productive, affecting the overall morale of the workplace. According to the 2024 SoFi Future of Workplace Report, employees spend an average of 14 hours per week stressing about finances, over half that time (8.2 hours) during working hours.5

The Role of Financial Wellness Programs

Implementing financial wellness programs can be a pivotal strategy for attracting and retaining employees. These programs are not a one-size-fits-all solution but are part of a comprehensive approach to total wellness.

Attracting and Retaining Talent

In a competitive job market, prospective employees are typically looking beyond salary. They want a holistic package that includes benefits aimed at improving their overall well-being, including financial health. Offering financial wellness programs can position your organization as a desirable place to work.

Customizable Solutions

Financial wellness should be tailored to meet the diverse needs of your workforce. What works for one employee might not work for another. Personalized solutions can provide employees with the tools they need to manage their unique financial situations effectively.

Integration with Other Benefits

Financial wellness is the connective tissue between various benefits offered to employees and how these benefits inform an employee’s financial plan. For example, understanding how healthcare plans, retirement savings and other benefits contribute to long-term financial health can help employees make better-informed decisions.

Generating Wealth in the Workplace

A significant portion of people’s wealth is generated in the workplace through salaries, retirement plans and other benefits. Employers have an opportunity to influence their employees’ financial well-being positively. By offering financial wellness programs, you empower employees to make better financial decisions, which can lead to greater financial stability and, ultimately, a more productive workforce.

Employee Expectations

73% of employees want and expect their employers to offer financial wellness programs.[1] These programs are no longer viewed as perks but as essential components of the employment package. Meeting these expectations can significantly enhance employee satisfaction and loyalty.

Introducing “Wellness by Fiducient”

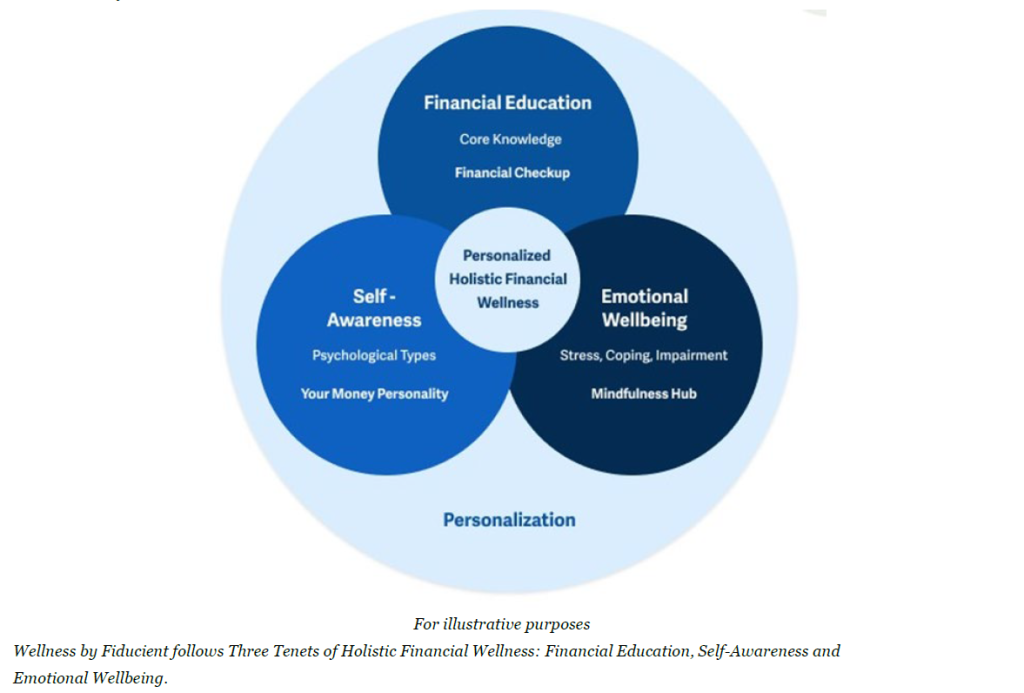

Recognizing the importance of financial wellness, Fiducient Advisors has launched a new program called “Wellness by Fiducient.”

Wellness by Fiducient offers a holistic financial wellness program that includes education, coaching and resources to support employees’ well-being. Our personalized approach allows individuals to tailor their financial goals and create actionable plans to help achieve long-term success.

By integrating Wellness by Fiducient into your organization’s benefits package, you can provide your employees with the support they need to manage their financial health effectively. This may not only benefit the employees but also may enhance overall workplace productivity and morale.

How to Get Started

Financial wellness in the workplace is a critical factor that employers can no longer afford to overlook. With personal finances being the number one stressor for employees, implementing comprehensive financial wellness programs can significantly improve employee well-being and organizational productivity. Programs like Wellness by Fiducient offer tailored solutions that strive to meet the diverse needs of the workforce, making your organization a more attractive and supportive place to work.

Investing in your employees’ financial wellness is not just a benefit to them—it’s a strategic move that benefits your entire organization. Take the first step towards a financially healthier workplace today by exploring the opportunities that financial wellness programs can offer.

If you are interested in learning more about how Wellness by Fiducient can benefit your organization, please contact Andrew Lendnal at alendnal@fiducient.com.

To learn more about our investment consulting services, please visit our website.

1PWC: “Employee Financial Wellness Survey.” 2023

2BrightPlan: “Wellness Barometer Survey.” 2024

3Salary Finance: “Inside the Wallets of Working Americans.” 2020

4Umass Lowell. “Financial Costs of Job Stress.” 2019.

5SoFi: “The Future of Workplace Report.” 2024

62022 SmartDollar Employee Benefits Study

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.