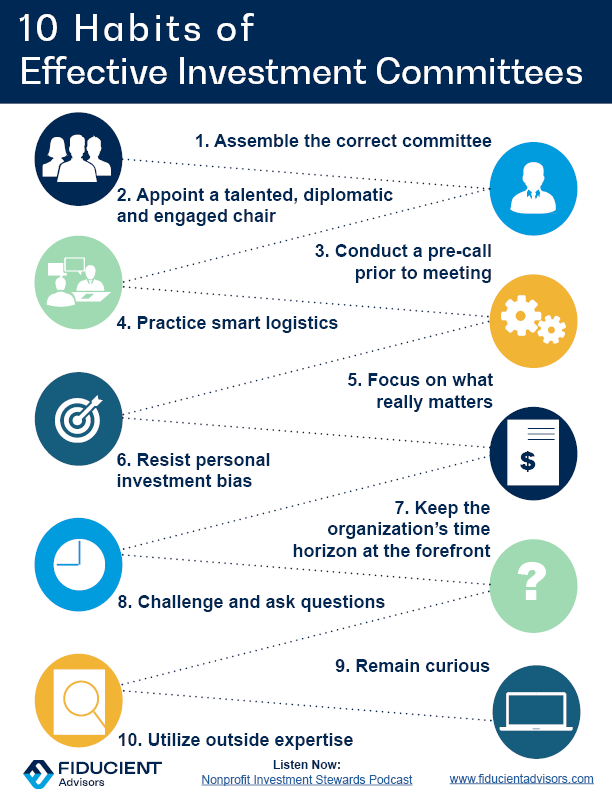

Would you like your investment committee to utilize best practices and produce better outcomes? This rundown from a recent episode of the podcast I co-host with one of my Fiducient Partners should prove insightful. Ten Habits of Effective Investment Committees is based on what I and my talented colleagues have gleaned over the years from observing many well-run investment committees.

1. Assemble the correct committee. Like most successful teams, it all begins with having not only talented, but the right mix of players. A Plan Sponsor may wish to include colleagues from human resources, finance and perhaps legal on their committee. Regardless of which departments are represented, you want members who possess a solid understanding, but also are willing to think about the greater good. A spirit of collaboration and lack of ego will go a long way in helping participants obtain a financially secure retirement.

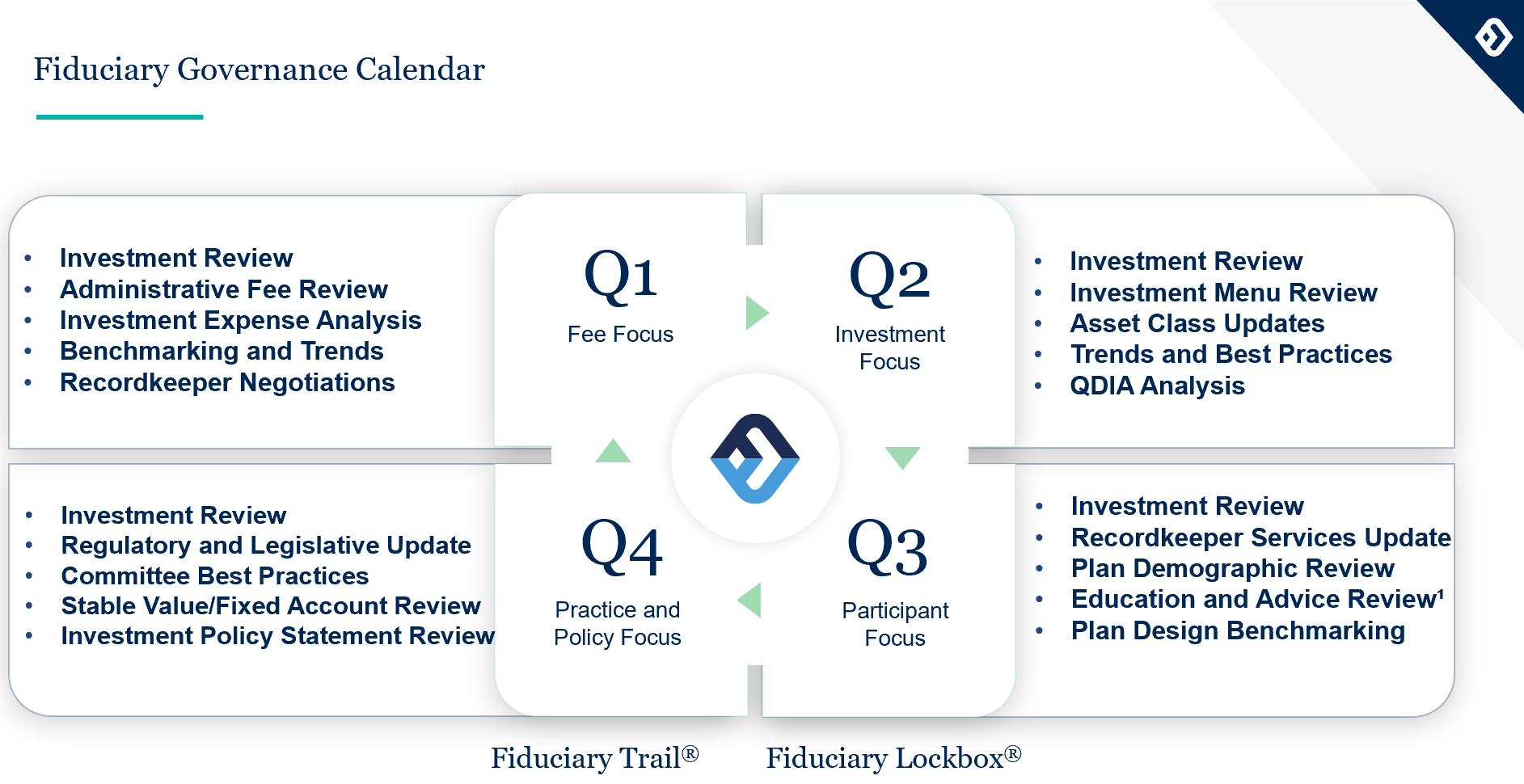

2. Focus on what really matters. Committees often meet quarterly, but regularly get hung up on the previous 90-days of performance. While there is a fiduciary obligation to monitor performance and replace investments as warranted, the truth is that overemphasizing short-term performance swings can prove counterproductive. To be sure, our best clients routinely examine investment results. However, unless there is a “problem fund” or some other incident, the greater portion of a quarterly meeting is spent on matters that can ultimately make for a better retirement plan. We use our proprietary Fiduciary Governance Calendar to systematically address important topics such as Investment Menu Design, Administration Fees, Legislative Updates and more.

3. Practice smart logistics. This sounds simple and should be if your committee proceeds with intentionality. Some common themes among our clients with highly effective investment committees include:

a. Conducting a pre-call to the meeting: While not always necessary, a planning call between the client (perhaps HR and/or finance point persons) and our investment team affords great opportunity to tighten the agenda and anticipate potential challenges or wrinkles.

b. Ensuring that committee members attend and are engaged.

c. Scheduling meetings for the full calendar year in advance.

d. Sending materials in advance and maintaining meeting minutes (Fiducient’s Fiduciary Lockbox® can help ease administrative burden).

4. Remain curious. The best committees act as continuous learners. We find they are always interested in what other Plan Sponsors do well and they strive to stay informed on relevant trends. Interestingly, good committees periodically engage in debate and are comfortable enough to challenge one another and ask questions. A telling sign of a valued committee member is someone who can make a statement or disagree, but on behalf of plan participants, not their own interests.

Being an investment committee member encompasses duties and responsibilities, but also great opportunity to enhance your plan for the benefit of participants and your organization. Feel free to access additional resources below and to reach out to me or any of our professionals at Fiducient Advisors for assistance.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.