The importance and necessary steps to help ensure you are well positioned.

Importance of Life Insurance1

For high-net-worth individuals, having an effective life insurance plan is crucial not only for protecting your legacy but also for leveraging financial opportunities. When most people think about risk management within their financial lives, they often think about diversification and allocation decisions. While those decisions are important, risk management does not stop with asset allocation, but more importantly leads us to critical insurance conversations and decisions. Life insurance can provide financial protection for loved ones and family. Appropriate life insurance planning can help achieve many common objectives from providing income replacement, meeting educational expenses, paying off debt or can assist with funeral and burial expenses. For others, it can also be a critical step to estate planning, providing liquidity to pay estate taxes or other expenses. Additionally, it can provide you with peace of mind, knowing you have taken the necessary steps to protect your loved ones’ financial futures, even if you are no longer around to provide for them.

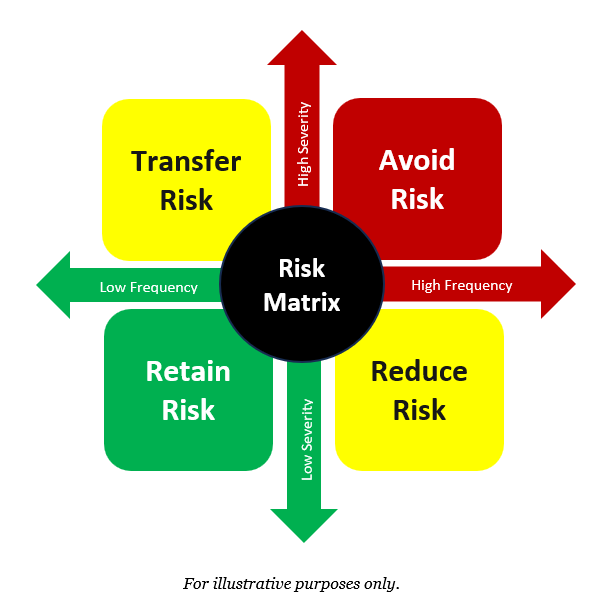

Review of the Risk Assessment Matrix

Life insurance falls in the ‘Transfer Risk’ portion of the matrix below, being in the Low Frequency & High Severity portion of the chart, with the primary objective being to protect your finances from significant risk exposure that could be detrimental to your family’s ability to survive financially upon your passing. Many typically handle this by transferring that risk to a third party, like an insurance company.

Essential Steps to Help Ensure your Life Insurance is Working to its Fullest Potential

1. Assess Your Coverage Needs

Your life insurance needs can be complex, especially when managing significant assets. Start by reviewing your current coverage to ensure it aligns with your financial goals and obligations. Typical coverage equates roughly to between 10 to 16 times your annual income. Consider additional factors such as:

- Debt Repayment: Confirm your policy covers outstanding debts, including mortgages and business loans.

- Estate Taxes: Evaluate whether your coverage can handle potential estate taxes to preserve your wealth for heirs.

- Income Replacement: Ensure adequate coverage to replace your income and maintain your family’s lifestyle.

2. Explore Different Policy Types

Not all life insurance policies are created equal. For high-net-worth individuals, exploring various types of policies can help maximize benefits:

- Term Life Insurance: Offers a death benefit for a specified term with no cash value accumulation. It is ideal for young families and adults who need insurance for a set number of years, in some instances mirroring the time until your expected retirement or final mortgage payments.

- Whole Life Insurance: Provides lifelong coverage with a cash value component that grows over time. It is more expensive but can be a good option if you want permanent insurance coverage and the opportunity to accumulate savings.

- Universal Life Insurance: Offers flexibility in premiums and death benefits, along with a cash value component.

- Variable Life Insurance: Includes investment options within the policy, allowing for additional potential growth of the cash value.

Understanding the features of each policy type can help you choose the best fit for your financial strategy.

3. Consider Riders2

Add-ons or riders can help enhance your policy. Common riders include:

- Accelerated Death Benefit: Allows you to access some of your death benefit if you are diagnosed with a terminal illness.

- Term Rider: Added to a whole life insurance policy to increase the death benefit for a certain amount of time (akin to additional Term Insurance).

- Guaranteed Insurability Rider: In some circumstances with Term Insurance, you will need to prove insurability to renew your policy after the term limit has ended. Some people want the assurance that they will automatically be insurable down the road, even if you develop a health condition since retaining the original policy.

- Waiver of Premium: Waives premiums if you become disabled and can’t work.

- Child Term Rider: Provides coverage for your children.

4. Help Optimize Your Policy for Tax Efficiency

Life insurance can help offer significant tax advantages, but proper planning is essential. Consider the following:

- Tax-Deferred Growth: Guarantee your policy’s cash value grows tax-deferred, enhancing its long-term value.

- Tax-Free Death Benefit: Confirm that the death benefit will be received tax-free by your beneficiaries.

- Trust Planning: Explore placing your policy in an irrevocable life insurance trust (ILIT) to remove it from your estate, potentially reducing estate taxes.

5. Review Beneficiary Designations

Beneficiary designations play a crucial role in how your life insurance proceeds are distributed. Regularly review and update your beneficiaries to help ensure your policy aligns with your current wishes and estate plan. Consider naming primary and contingent beneficiaries to provide clarity and prevent potential disputes.

6. Conduct Regular Policy Reviews

Life circumstances and financial goals can change, making it essential to periodically review your life insurance policy. Schedule annual reviews with your financial advisor to:

- Update Coverage: Adjust coverage amounts as needed based on changes in your financial situation or family needs.

- Evaluate Performance: Assess the performance of any cash value components or investment options.

- Confirm Beneficiary Information: Make certain that beneficiary designations remain current.

In Closing

Effective life insurance planning is a cornerstone of a comprehensive wealth management strategy. While we do not sell insurance, we are happy to walk through this critical life insurance review with you and pragmatically review this process step-by-step to ensure you have a well thought out plan in place!

If you have questions or need assistance with a life insurance review, we’re here to help. Please contact a Fiducient Advisors’ team member to schedule a consultation and help optimize your life insurance strategy for your unique needs.

1Life insurance for high net worth applicants – Bankrate March 18, 2024

2What Are Life Insurance Riders? | 8 Common Types of Riders (insuranceblogbychris.com)

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.