Over the past few years, public equity market returns have outpaced private market returns. For the period ending June 30, 2024, the S&P 500 Index has gained 24.6% over the trailing twelve months and 10% annualized over the trailing three years.1 Comparatively, the U.S. Private Equity Index has gained 7.1% over the trailing twelve months and 6.9% annualized over the trailing three years.2 However, if looking beyond the performance over the past few years, private markets have outperformed public equity markets by more than 2% annualized over the trailing decade.3 As one might expect, this result is due to a variety of factors, including an illiquidity premium and operating expertise in a less efficient market.

Larger institutions tend to have greater exposures to private equity and venture capital than smaller endowment and foundation peers.4 However, even the smallest institutions will sometimes include private markets (equity and debt) exposure in order to diversify the total portfolio with the goal to achieve better returns.

Due to intricacies within private markets, it is important for investment committees and organizations to consult with their financial advisors as they consider implementing this investment strategy. Factors such as the impacts of illiquidity and the investment mechanics related to private markets will be an important part of their discussion and decision-making process.

Private Markets Illiquidity

When evaluating the illiquidity associated with private markets investments, committees should be aware of any restrictions or covenants associated with financing or bond issuances related to the nonprofit or organization. Additionally, if an endowment or foundation has meaningfully variable portfolio draws from year-to-year, investment consultants and the committees they serve should evaluate the impact to illiquid private markets portfolio allocations in the event of a market drawdown or large total portfolio outflows. In a calendar year with considerable public market drawdowns and more stable private market performance, organizations might naturally consider a larger allocation to private markets within the overall portfolio.

Investment Horizon

When evaluating the illiquidity associated with private markets investments, organizations should understand that it is common for these strategies to have an investment horizon stretching to 15 years or longer. Generally, for the initial several years, private market investments often exhibit a ‘J-Curve’ performance pattern, highlighting the long-term nature of these strategies. An organization’s investment consultant can explain the implications of this performance pattern and make sure the committee is comfortable with the strategy. Importantly, the endowment and foundation universe and related portfolios oftentimes exhibit a timeline into perpetuity. Therefore, private market investments could align with the broader portfolio as a long-term investment strategy, depending on the nonprofit’s unique circumstances.

If illiquidity and a longer investment horizon associated with private markets remain acceptable for the organization, the next conversation should determine the optimal strategies for implementation within a broader nonprofit portfolio. There are three key considerations for optimal implementation: direct investment or fund-of-funds, commitment to investing with strong operators, and an overall deployment and pacing of allocations across vintage years, private market sectors and strategies. Diversified investment strategies for endowments and foundations should consider:

Direct Investment or Fund-of-Funds

When determining whether to build a private markets allocation through direct investment with singular funds or a Fund-of-Funds, both total portfolio size and the private markets allocation tend to determine to decision. For portfolios able to make Fund Commitments in excess of $3 million on an annual basis, an investment consultant could build a diversified portfolio of direct investments over the course of several years. Oftentimes, private markets funds will require investment commitment minimums of $1 million. Thus, a diversified portfolio could make three or more fund commitments on an annual basis. For a nonprofit with a smaller total portfolio or a limited allocation to private market investments within their overall portfolio (where annual fund commitments are less than $3 million), a Fund-of-Funds may provide an effective solution for maintaining private markets exposure. In many instances, investors will pay a second layer of investment management fee and experience a longer fund life when utilizing Fund-of-Funds.

Strong Operators

If an investment portfolio opts to build private markets allocations utilizing direct fund exposure, committees should focus their respective allocations on alignment with managers who have demonstrated consistent operating expertise. Deep operating and sector expertise ultimately support sustainable, fundamental and organic underlying business growth. Additionally, value-add initiatives translate to both earnings growth and higher quality companies that become more attractive when attempting to exit an investment. Funds that rely on financial engineering of returns versus Funds that focus on operational excellence introduce additional risks when borrowing costs to fund investments remain elevated. Oftentimes, private markets seek to reduce costs with underlying businesses to create a more attractive valuation. However, Funds that demonstrate operational excellence and expertise have the potential to work both sides of the equation – controlling costs while meaningfully growing revenue.

Disciplined Pacing of Private Market Commitments

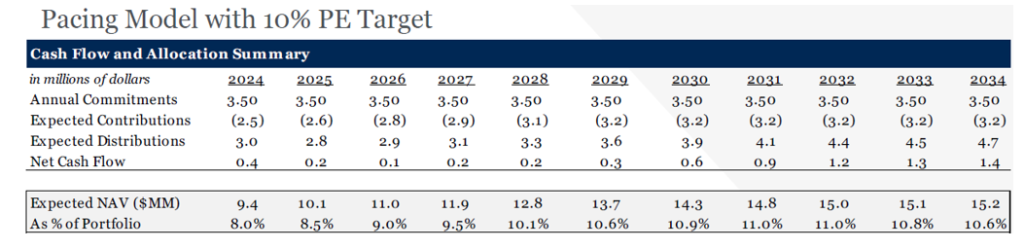

Prudent portfolio management involves diversification across a portfolio. Diversification is equally important when deploying capital commitments to private market strategies. Portfolios can achieve prudent diversification across vintage years, strategy types (buyout, growth equity, venture capital, etc.) and sectors. Committees should work with their investment consultant to create a pacing model (sample below5) that highlights expectations based on commitment levels to create a long-term plan to match the long-term asset class.

A private markets investment can introduce an exciting element and complement to public market investment allocations within nonprofit portfolios. Before moving forward with this strategy, committees should first, determine suitability for their organization and second, discuss implementation with their investment consultant. To discover the potential of private markets and consider strategically building out your portfolio today, kindly contact the professionals at Fiducient Advisors.

1Cambridge Associates. As of June 30, 2024.

2Cambridge Associates. As of June 30, 2024.

3Cambridge Associates. As of June 30, 2024.

42023 NACUBO-Commonfund Study of Endowments, (page 37)

5Pacing model is based on the methodologies presented in Takahashi,D. and S. Alexander (2001). Illiquid alternative asset fund modeling. Journal of Portfolio Management Winter, 90–100. Fiducient’s pacing model assumptions/deviations from Takahashi/Alexander Model: Capital call and distribution paces are based on historical observations from data provided by Pitchbook and vary based on asset class. There are no assurances these historical averages will hold into the future. Allocation plan is solving for the allocation that yields the lowest sum of absolute difference between the target allocation and the actual allocation across the next 13 years.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.