Novice and expert investors alike have used the adage “buy low, sell high” to guide many of their investment decisions for as long as trading markets have existed. While this prudent investment advice seems simple and obvious enough to be found within a fortune cookie, more often than not, putting such a sound tip into practice is much more challenging than anticipated. As with any market maxim, following this wise guidance is never quite as straightforward as investors would believe – or hope.

With many areas of the financial markets down double digits during the first half of 2022, the subject of rebalancing is surfacing more frequently in committee meetings. But when, and how, should a portfolio be rebalanced? Deliberate on the following considerations prior to your next buy/sell decision.

Portfolio rebalancing, which involves periodically selling high-performing assets and using proceeds to fund purchases of lower-performing assets, could be considered a cousin of the “buy low, sell high” philosophy and is generally accepted as good practice.

In a stable market, if asked whether this type of rebalancing benefits a diversified portfolio, most investors would agree and nod approvingly. However, as the market rapidly fluctuates, portfolio rebalancing of this type can become a more challenging and emotionally charged exercise.

Why? The primary driver likely involves a powerful behavioral bias investors exhibit referred to as loss aversion. This is the pattern of behavior observed when investors prefer to avoid the unpleasantness associated with an anticipated negative experience (loss), felt disproportionately greater in the investor’s psyche than any sense of potential satisfaction derived from an equivalent positive experience (gain). When rebalancing requires us to pull support from assets that are giving us pleasure for those that are giving us pain, we undermine our behavioral instincts.

To help combat these emotions, we recommend codifying language into your organization’s investment policy statement (IPS) that explicitly covers rebalancing considerations and the process for executing. We note that more than 90 percent of university endowments currently follow some sort of formal rebalancing policy.1 As with any element of your IPS, there are significant benefits to memorializing the organization’s portfolio rebalancing guidelines.

1. First, expectations concerning rebalancing are initiated and defined ahead of time. Whether rebalancing needs to be a part of the overall investment strategy is not a discussion to be debated midstream. The organization’s stakeholders should understand and agree there will be points in time where the portfolio will be rebalanced, along with the rationale for doing so.

2. Second, setting it in ink helps to alleviate the (inevitable) emotion that arises from making difficult decisions. If a stakeholder believes that policy rebalancing language should not be followed due to prevailing market conditions, there is a governance structure in place to ensure such a proposal is met with the appropriate levels of approval. This obstruction provided by complying with governance standards can be just enough of an impediment to ensure adequate deliberation and to delay or prevent any impulsive reactions.

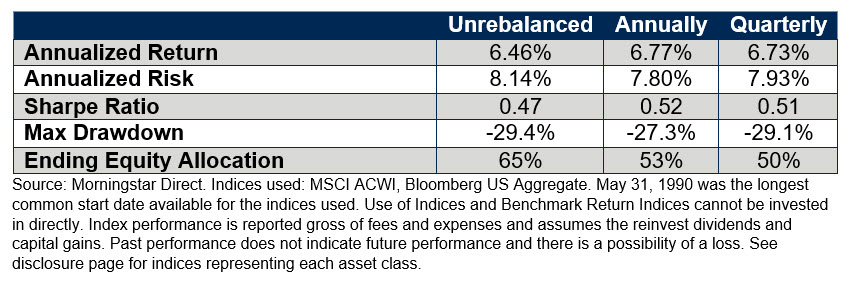

To illustrate the potential benefits of rebalancing, consider a hypothetical 50/50 mix of global equities and U.S. bonds with a start date of May 31, 1990. In the subsequent period (ended June 30, 2022), what happens to the portfolio if it is rebalanced annually, quarterly or not at all?

After more than three decades, the unrebalanced portfolio has the lowest return, highest risk and highest maximum drawdown of all the options. Perhaps most importantly, with an ending equity allocation of 65 percent, it is now a substantially different portfolio than when initially constructed.

If agreed that portfolio rebalancing is prudent and should be formally outlined, which methods and options are most appropriate for fiduciaries to consider?

A calendar-based policy sets a predetermined calendar-based interval at which point the portfolio is rebalanced to target allocation weights. For example, policy language that states the portfolio will be rebalanced annually (at year end). Specifying the timing and mode of frequency can be used to determine precisely when and how often, e.g., monthly, quarterly, semi-annually. A benefit to a calendar-based approach is that it is easily understood and easy to implement yet still offers the policy discipline so important to the success of a rebalancing program. Stakeholders and their advisors, to remain policy compliant, are unlikely to deviate from this straightforward approach, which in turn means the portfolio is not likely to deviate significantly from its target investment strategy for any extended period of time.

Opponents of this approach argue that financial markets move on their own time and “don’t care” about the calendar. Sole dedication to a particular date ignores market movement that occurs in between those intervals to the portfolio’s potential detriment. Another consideration of a calendar-based approach is the level of frequency. For some, more frequent (monthly, weekly, daily) sounds like a good idea, but in these cases you can indeed have “too much of a good thing” as all rebalancing actions require trading, which incurs additional transactional costs. If left unchecked, trading costs associated with frequent rebalancing will accumulate and potentially erode any expected investment benefits.

A market value-based policy involves regularly examining the market value of the portfolio at various levels including asset class, sub-asset class and individual components.

To identify significant deviations, one common approach is to set a range around portfolio target percent weights e.g., target 20% +/- 5% = 15-25% range. When market movements cause a breach of these ranges, they present an opportunity to rebalance

Advocates of this approach argue that if the benefit of rebalancing is designed to take advantage of the relative movement of markets (i.e., selling markets that are high and buying ones that are low), then it should ideally occur when those movements actually happen, not at an arbitrary calendar interval. It allows appreciating/depreciating assets to realize their positive/negative momentum before any action is taken. Opponents say this method remains more difficult to monitor and administer and, since all market environments are different, it is unlikely that any ranges will be set at the optimal rebalancing point, thus adding unnecessary complexity to the process. Nevertheless, this is the preferred approach among the university endowment community; 60 percent of university endowments follow a market value-based policy.2

A risk-based policy mirrors the market value approach but with emphasis on the portfolio’s target to expected risk.

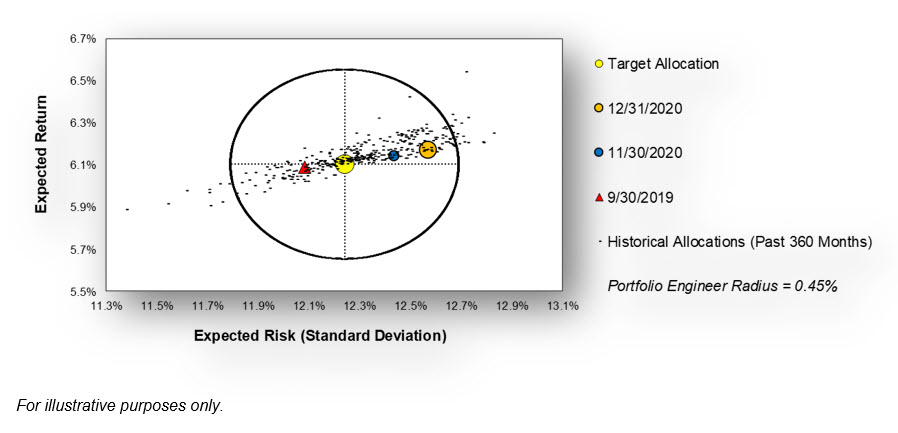

Fiducient Advisors advocates for this method. Rather than focusing on a calendar date or market value deviations of specific portfolio components, the objective is to assess the overall aggregate impact of market movement on total portfolio risk. The rationale here is fairly straightforward if not warranted; if it is determined that a specific risk/return profile is required to achieve stated investment objectives, then the overarching goal should be to maintain the integrity of that risk/return profile. If left completely untouched, market movements will eventually result in a portfolio that is meaningfully different from a risk /return perspective from its starting point.

While frequent rebalancing may help keep the risk/return profile intact, as referenced earlier, it can add harmful trading costs while at the same time not permitting asset class movements to capture their full momentum.

To anticipate these drawbacks, Fiducient Advisors’ Portfolio Engineer® is intentionally designed to harmonize maintaining risk profile consistency along with allowing beneficial movements in asset classes by creating a radius of allowable portfolio risk “drift”. This novel design can enable portfolio optimization by rebalancing only when the portfolio’s risk/return profile is observed outside the bounds of the radius.

So, Should You Rebalance Now?

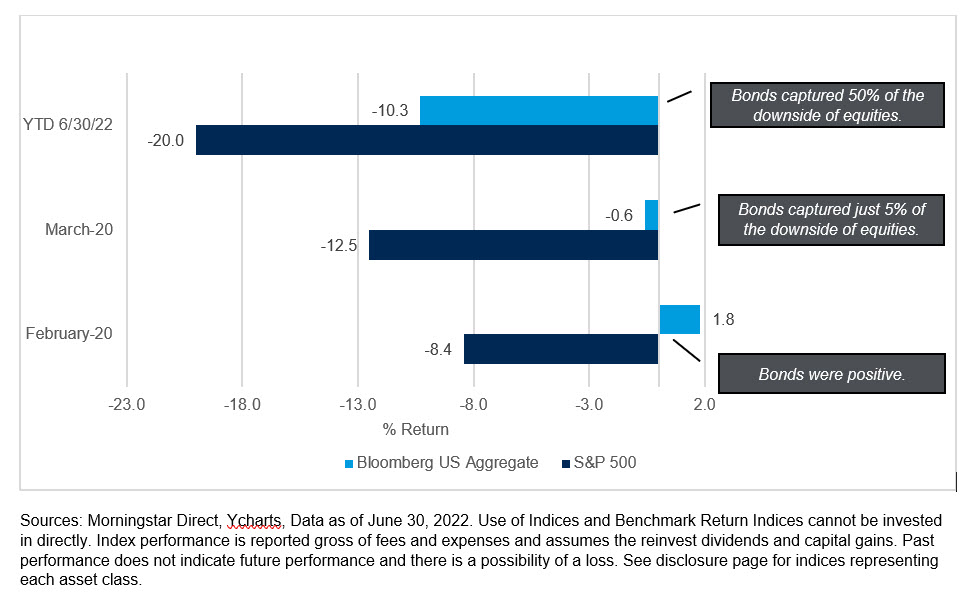

With the equity markets down substantially in 2022, many are wondering if now is the time to rebalance. Intuitively, this makes sense as some sort of rebalancing has often been an outcome of prior market declines. But the drawdown in 2022 has been different, in that both stocks and bonds have fallen together. In fact, through the first half of the year, we have had two consecutive quarters where both the S&P 500 and the Bloomberg U.S. Aggregate index were negative. Until this year, this had only happened in 15 previous quarters since 1976.

As an example, consider the return protection provided by bonds in 2022 versus during the COVID-19 market drawdown of 2020. This year, bonds have captured more than 50 percent of the downside of the S&P 500.

The tandem declines of both stocks and bonds in 2022 has resulted in portfolios whose stock/bond percentage allocations have not diverged as much as in previous market drawdowns, which results in total portfolio risk not changing as much as it did in prior periods. For the Portfolio Engineer®, this means a less compelling case for rebalancing at this time.

Summary

Importantly, rebalancing methods do not necessarily need to be an either/or proposition – what matters most is that a method is chosen and articulated within your IPS. Approximately one quarter of university endowments surveyed reported using both a calendar and market value-based approach.3

Nonetheless, rebalancing should not be an exercise in hunting for market bottoms to time the perfect portfolio shift, but rather, rebalancing should be viewed as a thoughtful part of a prudent investment process that is both defensible and documented. It is an essential component of an integrated approach to asset allocation and portfolio management. As such, we would amend the motto of rebalancing enthusiasts everywhere and add: be prepared to “rebalance your portfolio before the market does it for you.”

For additional information, please contact any of the professionals at Fiducient Advisors.

1, 2, 3 2021 NACUBO-TIAA Study of Endowments, Figure 8.1-s. Study covers fiscal year of July 1, 2020 – June 30, 2021. Data as of February 18, 2022

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

MSCI ACWI (All Country World Index) ex. U.S. Index captures large and mid-cap representation across Developed Markets countries (excluding the United States) and Emerging Markets countries. The index covers approximately 85% of the global equity opportunity set outside the U.S.

The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.