Understanding Market Volatility

In today’s unpredictable economic environment, market volatility remains a constant challenge for investors. Geopolitical tensions, shifts in government policy and unforeseen global events all contribute to frequent market fluctuations, often creating stress and uncertainty. Recent activity in the markets has served as a powerful reminder of just how quickly sentiment can shift. In the first week of April, domestic equity markets experienced a few dramatic swings both up and down, similar to those seen in the early days of the COVID-19 pandemic. This activity was largely triggered by shifting news about U.S. tariffs, which rattled investor confidence and reignited concerns over global trade tensions. While volatility like this can be alarming in the short run, it is important to remember that corrections are points in time, while the potential for wealth happens over the long term.

These abrupt changes highlight how reactive markets can be and underscore the importance of building resilient portfolios. It is important to stay focused on long-term financial goals rather than reacting emotionally to short-term market changes. While volatility is an unavoidable aspect of investing, how we respond to it can make a significant difference in the long-term success of our strategies. A level-headed, disciplined approach is essential in navigating these uncertain times.

Personal Discipline

Emotional discipline is one of the most important—yet often overlooked—skills for investors. Markets are naturally volatile, and it is easy to let emotions take the wheel. Emotions are often a false indicator of opportunity; fear during downturns can drive investors to sell at a loss, while overconfidence in bull markets may lead to taking on too much risk.

Any emotional reaction during a volatile time can derail long-term financial goals and lead to costly mistakes. To avoid these traps, it is essential to build a solid investment plan. Define your goals, understand your risk tolerance and commit to a long-term strategy. A solid plan can also prevent obsessively monitoring the markets. Constant updates can amplify anxiety and push you toward rash decisions. Instead, stay focused on the big picture. Market swings are a normal part of investing. By maintaining emotional balance and trusting your plan, you will be far better equipped to ride out volatility with confidence.

Working with your Advisor

One of the most effective ways to navigate market volatility is to work closely with your financial advisor. In times of uncertainty, having a knowledgeable and objective partner by your side can be invaluable. Financial advisors bring not only technical expertise but also perspective—something that can be difficult to maintain when you are emotionally invested in your own portfolio. They can provide clarity during turbulent periods, helping you avoid knee-jerk reactions or market timing, thus keeping your strategy aligned with your long-term goals.

An advisor’s value goes far beyond investment selection. They help you construct a well-diversified portfolio that reflects your personal goals, timeline and risk tolerance—key components that may act as a buffer against market swings. For instance, while U.S. equities have struggled thus far in 2025, a well-balanced portfolio that includes global equities, commodities and fixed income may potentially deliver more stability. Your advisor can help you remain positioned to benefit from potential upside in stronger segments of the market while mitigating downside exposure.

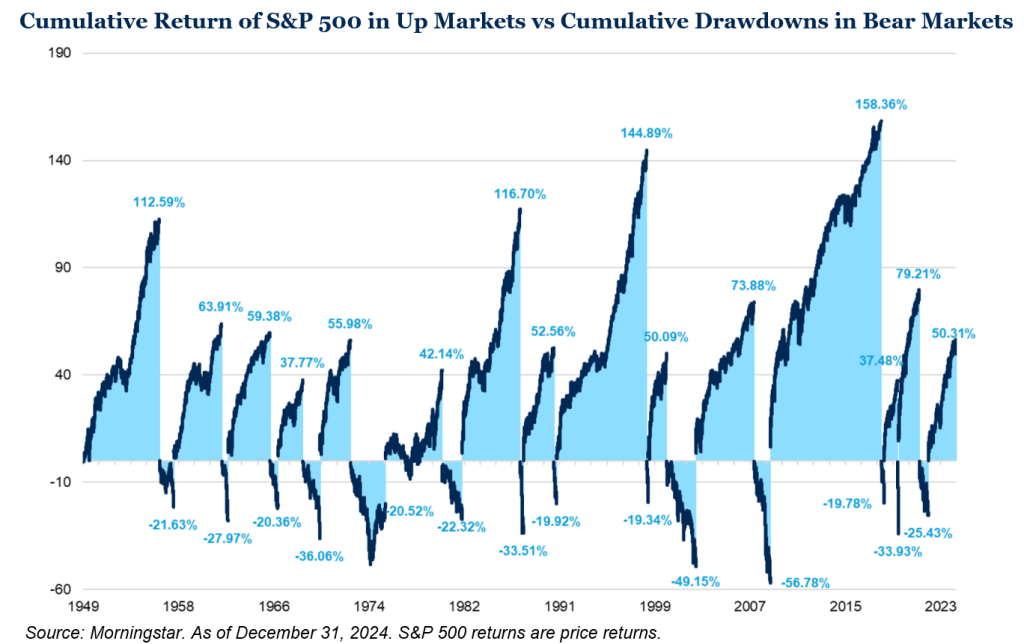

Your advisor also plays a proactive role in portfolio management. This includes monitoring your allocation for rebalancing opportunities, capitalizing on tax-loss harvesting strategies, making tactical adjustments as market conditions evolve and stress-testing your financial plan against various market scenarios to help you stay aligned with your goals. Advisors understand that bear markets and corrections are a normal part of the long-term market cycle, as reflected in the graphic below.

A trusted advisor is not just someone who manages your money; they are a long-term partner in helping you navigate financial life with confidence. By maintaining this relationship and ensuring open communication during both stable and volatile periods, you can more effectively manage market fluctuations and remain focused on what truly matters: achieving your financial objectives.

Navigating Volatility for Long-Term Success

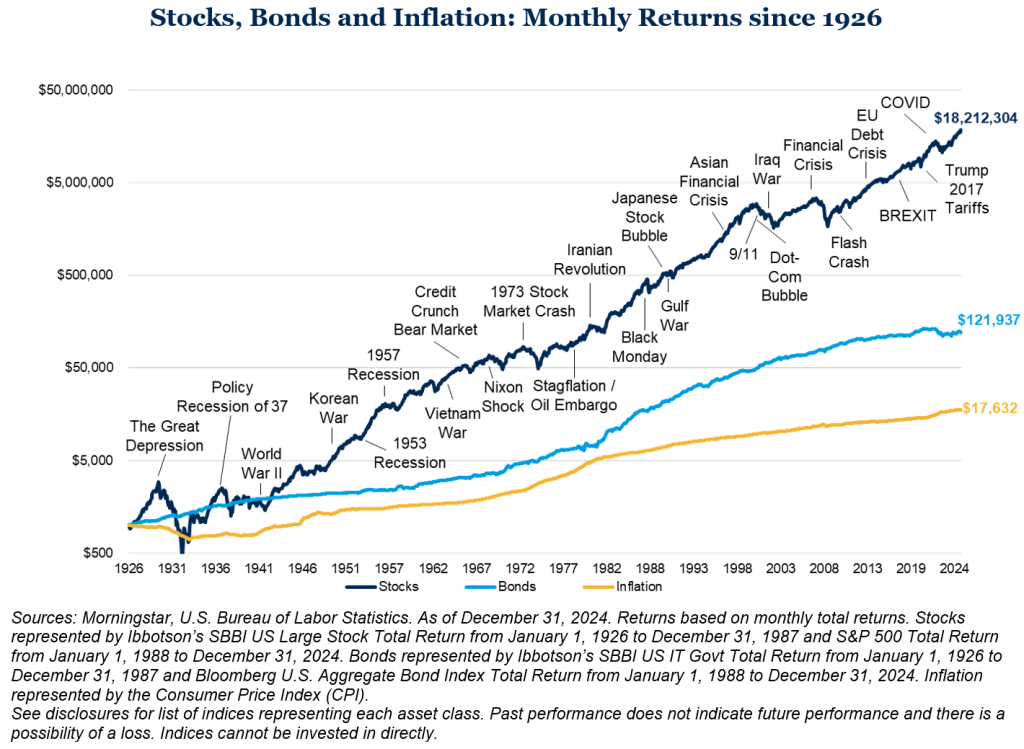

While market volatility is an inherent part of investing, it does not have to derail your long-term financial goals. By working with a trusted financial advisor, focusing on long-term objectives and maintaining emotional discipline, you can manage market fluctuations more effectively. Despite some of the fragility in domestic markets in early 2025, diversification can help smooth out the ride and may even provide growth opportunities in volatile market conditions. Though emotional investing is part of who we are, it is always important to remember that this too shall pass. See, for example, the following chart which notes various significant historical events and their impact on the markets over time.

By embracing these strategies and taking advantage of opportunities in various parts of the market, you can ride out market uncertainty with confidence and remain focused on your long-term goals.

For more information regarding how to approach market uncertainty or how to create a long-term investment plan, please contact any of the professionals at Fiducient Advisors.

When referencing asset class returns or statistics, the following indices are used to represent those asset classes, unless otherwise noted. Each index is unmanaged, and investors cannot actually invest directly into an index:

Stocks represented by Ibbotson’s SBBI US Large Stock Total Return from January 1, 1926 to December 31, 1987 and S&P 500 Total Return from January 1, 1988 to December 31, 2024.

Bonds represented by Ibbotson’s SBBI US IT Govt Total Return from January 1, 1926 to December 31, 1987 and Bloomberg U.S. Aggregate Bond Index Total Return from January 1, 1988 to December 31, 2024.

Inflation is measured by the Consumer Price Index (CPI).

Consumer Sentiment Index is measured by the University of Michigan Survey of Consumers.

Disclosures – Index & Benchmark Definitions

Fixed Income

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- IA SBBI US IT Government index measures the performance of a single issue of outstanding US Treasury note with a maturity term of around 5.5 years. It is calculated by Morningstar. Returns for 1934 to 1986 are obtained from the CRSP Government Bond File and returns for 1987 to 2014 are calculated from The Wall Street Journal prices.

Equity

- The S&P 500 Index is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- IA SBBI US Large Stock index tracks the monthly return of S&P 500. The history data from 1926 to 1969 is calculated by Ibbotson.

Other

- Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.

- Consumer Sentiment Index focuses on three areas: how consumers view prospects for their own financial situation, how they view prospects for the general economy over the near term, and their view of prospects for the economy over the long term. The Expectations Index represents only a small part of the entire survey data that is collected on a regular basis. Each monthly survey contains approximately 50 core questions, each of which tracks a different aspect of consumer attitudes and expectations. The samples for the Surveys of Consumers are statistically designed to be representative of all American households, excluding those in Alaska and Hawaii. Each month, a minimum of 600 interviews are conducted by telephone from the Ann Arbor facility.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.