Nonprofit Investment Committees have a heavy fiduciary responsibility but can sometimes lack the structure to maximize their effectiveness. While establishing a formal approach to committee composition and practices may sound straightforward, committees often fail to develop a thoughtful approach to the makeup of who is on their “bench,” which can lead to ineffective meetings or focus on unimportant issues. Here are some best practices for Investment Committees to follow as they first consider the makeup of the Investment Committee and then develop a sound governance process. Formalizing these activities can ultimately help them become better stewards while fulfilling their fiduciary responsibilities.

Finding Committee Members Who Can Contribute

Boards should carefully consider the characteristics of potential committee members, along with how those members will contribute to the organization’s mission and goals. It is helpful to have Committee members with investment backgrounds, if possible. Many Committees are comprised of volunteers who lack sufficient time and expertise to oversee investment decisions, so members with a background in investments may be beneficial. When the committee lacks sufficient time and expertise to manage the investment program, consider a discretionary/Outsourced Chief Investment Officer (OCIO) arrangement with your consultant. Most investment decisions would then be delegated to the consultant, freeing up committee time for more strategic thinking and discussion to continue propelling the organization’s mission forward.

New Perspectives and Fresh Ideas

While investment expertise is very helpful to the committee composition, it is also important to include members with diverse backgrounds and experiences that bring a range of perspectives to the group. Additionally, the Committee can benefit from term limits for members to foster fresh views on strategy and approach. It might also be helpful to have committee members stagger terms so that existing members can assist and educate new members by providing a historical perspective of activities and continuity in approach. Committees that do not change composition are prone to stale thinking and justification of current approaches by rationalizing that “this is the way we’ve always done it,” regardless of how conditions may have changed. As always, Committee members must disclose all conflicts of interest and make decisions solely in the best interests of the nonprofit.

Committee Members Who Question the Process

Challenges bring about growth, and therefore, all questions should be considered valuable. Committee members need to understand the issues being discussed and ask questions when they need clarification. This level of engagement is at the heart of an effective committee, which encourages open-minded interaction rather than passive acceptance. Simply trusting the opinions of other Committee members and having faith that they “know what’s best” is not good stewardship. If something seems wrong or amiss with the process or approach – speak up, voice your opinion or ask for more information.

Choosing the Right Leader

An effective Committee Chair keeps discussions on topic by following an agenda, while encouraging feedback from everyone. The Chair should share their own opinions in a manner which allows others to disagree and/or present opposing views and opinions in a respectful and courteous manner. If the Committee Chair appears to have outsized influence on committee decision-making, to avoid “group think,” the Chair (or other influential committee members) should consider withholding their opinions until the end of the discussion topic and solicit feedback from others first. Leading a committee requires striking a careful balance between personal opinions and the group’s decisions regarding the best interests of the organization.

The Importance of Documentation

Committees should have a charter and/or Investment Policy Statement (IPS) clearly defining responsibility for investment decisions delegated to the Committee. The IPS is critical and minimally provides broad outlines of oversight. The Board should approve the committee charter and IPS. As a best practice, investment policy statements should be reviewed annually and updated as necessary. Additionally, the Committee should distribute detailed agendas in advance of meetings while providing meeting minutes for approval by all Committee members. This ensures a paper trail that establishes robust institutional memory and can be referenced at any point in time in the future.

The Value of Time

A well-written Investment Policy Statement, engaged committee members and a dedicated Chairperson are all critical elements for creating a focused committee; however, these factors on their own do not assure success. Consider what the volunteer investment committee members are putting into the organization’s mission. These committee members are typically generous, intelligent and accomplished, but they also have time constraints. It is important to ensure that members are willing to spend time preparing for meetings by reviewing performance reports, meeting materials, and previous meeting minutes. The committee needs a clearly defined scope, detailed agendas and a disciplined decision-making framework to be productive overall.

Structure and Size for Effective Decision-Making

When it comes to size, larger nonprofits often have more volunteer committee members than smaller organizations, which can seem to be an advantage. However, larger committees are not necessarily better. Too many cooks in the kitchen can clog up decision-making and effectiveness. The ideal committee is big enough to offer diversity in thought, but not so large that unending discussion leads to a stalemate and lost time. Efficient investment committees typically have an odd number, typically ranging from five to nine members. Having an odd number ensures that decisions can be made by majority vote in the event consensus cannot be reached. Committees larger than nine members often become unmanageable, sometimes resulting in insufficient time for members to voice their concerns – and therefore likely making it even more difficult to reach a decision.

The End Goal

Ultimately, we believe an effective Committee focuses its time and resources on the actual drivers of not only long-term performance but on big picture issues, which will likely increase the odds of achieving your objectives and perpetuating your institution’s mission.

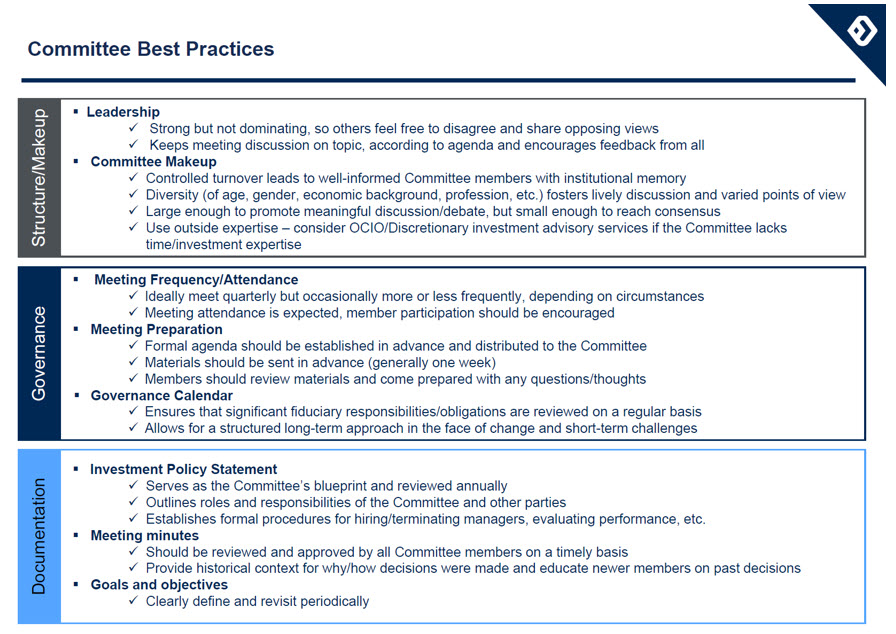

A concise takeaway list for best practices including but not limited to the topics in detail above. Note: this is not meant to be a complete list of all fiduciary duties and responsibilities. Please consult your legal advisor for advice about your specific situation.

Fiducient Advisors assists nonprofit organizations and committees/boards in establishing a robust fiduciary governance process which includes regular review and maintenance of the Investment Policy Statement. We help clients construct custom investment strategies to meet their objectives and goals while serving as a resource for our clients on a broad variety of topics. We understand that our work must help advance our clients’ missions, as investing for the benefit of others has never been more important. Therefore, we commit to helping boards, committees and staff perform as responsible financial stewards for the organizations they care about most. Whatever the objectives, we view ourselves as our clients’ “strategic partner,” striving to achieve their goals with less time, cost and burden.

If you would like more information, please reach out to any of the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.