On March 27, 2020, the federal government passed into law the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act. While most media coverage focuses on the funds from the $2 trillion Act allocated toward individuals and small businesses, the sweeping legislation also offers some financial relief to the nonprofit sector as well. In this update, we highlight some of the key nonprofit-applicable provisions in the Act and provide an update on where the programs stand today.

1. Paycheck Protection Program

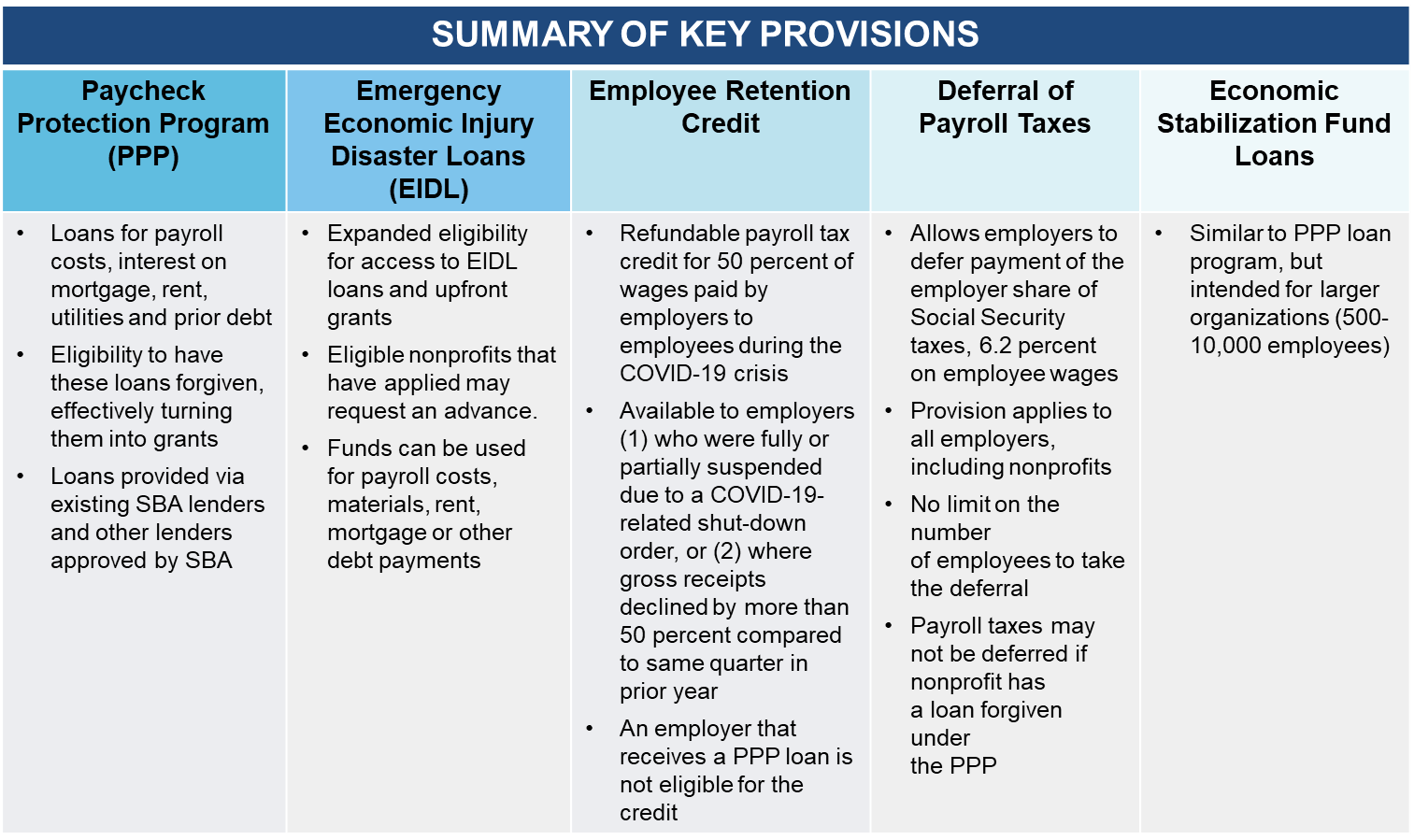

The Paycheck Protection Program (PPP) offers loans to 501(c)(3) and 501(c)(19) tax-exempt organizations with fewer than 500 employees. The Small Business Administration (SBA) administers these low-interest loans. The goal of these loans is to give small businesses enough funding to survive the COVID-19 shutdown for two months. Although the SBA is sponsoring the program, the Act requires national and regional banks across the country to process requests for these loans.

Loan amounts are based on 2.5 times the applicant’s average monthly payroll costs from the trailing 12-month period. The principal on these loans may be forgiven entirely though accrued interest must be repaid at the rate of one percent. Loan forgiveness is contingent on the following key criteria:

a. 75 percent of the loan funds must be used for Payroll Costs, which are defined as:

i. Wages and salaries up to $100,000 per employee on an annualized basis

ii. Paid leave

iii. Separation/dismissal payments

iv. Healthcare plan costs

v. Retiree benefits

vi. State and local payroll taxes (no federal)

vii. Bonuses paid in the normal course of business

b. The remaining 25 percent of the loan may be used to pay for the following:

i. Utilities

ii. Fuel for vehicles

iii. Transportation expenses

iv. Lease and/or mortgage payments

v. Auto loan interest payments for vehicles used to conduct company business

c. Limit salary reductions to no more than 25 percent

d. Maintain staffing levels for eight weeks after receiving the loan

As of May 6, the SBA and participating banks distributed all but about $90 billion of the approximately $669 billion appropriated in relief funds for the first two rounds of the PPP. While there have been no official statements or directives provided by the government regarding the potential for a third round of PPP funding, Larry Kudlow, director of the U.S. National Economic Council, remarked that such a third round “may be” necessary during a May 3 interview with CNN.

2. Emergency Economic Injury Disaster Loans

The SBA also sponsors the Emergency Economic Injury Disaster Loans (EIDL) program, which is normally intended to support businesses affected by natural disasters. The CARES Act expanded this program to offer COVID-19 relief, including for nonprofit organizations. Unlike PPP, the SBA is handling all EIDL requests directly without participation from external banks.

The program offers loans of up to $2 million with a set interest rate of 2.75 percent for nonprofits. An attractive component of this program is the four-year deferral timeframe for beginning principal and interest payments. Nonprofits are also eligible to receive advanced payments of $10,000, which do not need to be repaid. These funds must be used to pay for ordinary and necessary operating expenses, liabilities and other outstanding bills. Funds may not be used to replace lost revenue or lost profits, and cannot be used for business expansion. As of early May, the EIDL grant program was changed to offer organizations $1,000 per employee up to 10 employees from its original offering of $10,000 per organization.

The CARES Act allocated $120 billion to the EIDL program over two rounds of funding. As of early May, the SBA is no longer accepting applications but is still processing applications that were already submitted.

3. Employee Retention Credit

This provision of the CARES Act is intended to encourage employers to keep employees on payroll even if the business has temporarily closed due to the COVID-19 pandemic. The benefit provides a refundable credit of up to $5,000 per each full-time employee retained between March 13 and December 31, 2020. Organizations qualify if they were ordered to fully or partially cease operations due to the COVID-19 crisis or if gross receipts fell below 50 percent of the same quarter in 2019.

Unlike the prior two provisions, this credit does not require an application and can be claimed by employers immediately by reducing payroll taxes sent to the IRS. If credits exceed payroll taxes, organizations can request a direct refund from the IRS. Worth noting, though, is organizations that have received a PPP loan are ineligible for this credit. However, this credit can provide some welcome and immediate relief for those organizations that applied for a PPP loan but did not receive one.

4. Deferral of Payroll Taxes

This provision allows employers to defer payment of the 6.2 percent employer share of Social Security payroll taxes on wages paid between March 27 and December 31, 2020. The deferred payroll taxes are due to the government in two equal installments: one at the end of 2021 and one at the end of 2022. Similar to the Employee Retention Credit, this provision is not available for organizations that had loans forgiven under the PPP.

5. Economic Stabilization Fund

Established by the CARES Act, this $500 billion fund applies to larger nonprofit organizations with between 500 and 10,000 employees or less than $2.5 billion in revenue. The program is similar to PPP in that borrowers can apply directly through external banks. Loans provided range from $1 million to $25 million depending on the organization’s earnings and existing debt.

These loans are subject to an annual interest rate of no more than two percent per year with no principal or interest due for at least the first six months after the loan is processed. The proceeds must be used to retain at least 90 percent of the recipient’s workforce at full compensation and benefits through September 30, 2020.

While the funds supporting some of these programs are likely exhausted by this point, it is possible that the federal government will pursue further funding to meet outstanding demand. We encourage all nonprofits to consult their attorneys and tax advisors for specific guidance on what programs may apply to them. Doing so will help these nonprofits create a strategy to employ the programs efficiently within their respective organizations.

For more information, please contact any of the professionals at Fiducient Advisors.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.