Key Observations

- The United States inflation rate reached 7.5 percent in 2022, a level not seen since the 1980s.

- Many Plan Sponsors may have concerns about how this could impact their defined benefit plans.

- Historically, inflation tends to help plan funded status in terms of both assets and liabilities for corporate defined benefit plans without cost-of-living adjustments.

- Conversely, municipal defined benefit plan benefit formulas do commonly incorporate cost-of-living adjustments; as such, Plan Sponsors and participants for these particular plans should anticipate rising benefit costs.

- Read further for considerations and potential actions for Plan Sponsors to take in what may be a multi-year period of higher levels of inflation.

Higher Inflation Is Here to Stay

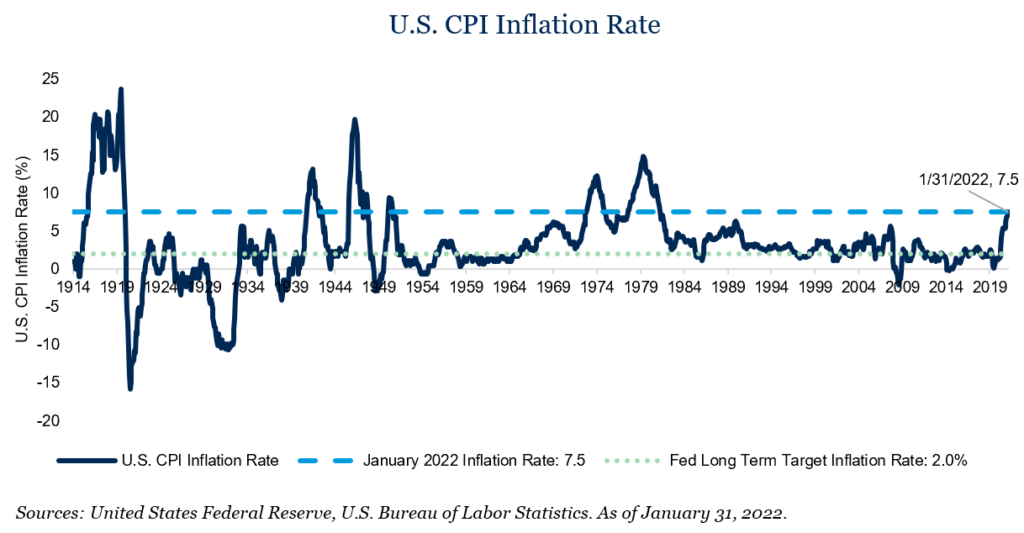

The United States inflation rate, as measured by the year-over-year increase in the Consumer Price Index, has increased materially since nearly approaching zero during the height of the COVID-19 pandemic in mid-2020. Since then, a combination of several factors drove the inflation rate steadily higher to 7.5 percent, a level not seen since February 1982 and well-above the Federal Reserve’s average annual target of 2 percent.

Some factors driving these high levels of inflation may prove to be more temporary in nature and revert back to historical average levels over time:

- Global supply chain disruption leading to inadequate supply to meet demand for items like semiconductor chips, automobiles and oil (a component that has only been further exacerbated by Russia’s invasion of Ukraine)

- A dramatic change in personal consumption patterns since the beginning of the COVID-19 pandemic that resulted in a sharp increase in durable goods consumption and a commensurate decline in services consumption (a reversal of the trend prior to the pandemic)

- The low starting point of year-over-year inflation coming off the near-zero levels of 2020

However, there are key components of the current inflation rate that are likely to endure without reverting back to normalized levels any time soon:

- Wage inflation: Workers are unlikely to see compensation increases gained in the past two years revert sharply in the near-term.

- Housing and rental inflation: Wage increases and pandemic-related stimulus have helped support ever-increasing home purchase and rental prices throughout the country.

Though inflation in the 7 percent range is unlikely to continue for multiple years, the less transitory elements of current inflation trends are likely to keep inflation higher than pre-pandemic levels. The bond market is pricing the five-year inflation rate at 3.1 percent and the 10-year inflation rate at 2.7 percent based on Treasury breakeven rates as of March 3. With no inflation normalization in sight in the near-term, Plan Sponsors should consider the potential effects an elevated inflationary environment could have on their defined benefit plan.

Inflation: An Ally for Funded Status Improvement

For corporate defined benefit plans, benefits owed to employees are most often accounted for and paid in nominal terms. Therefore, while higher inflation reduces the purchasing power of payments made to participants in retirement, Plan Sponsors are only responsible for paying out the nominal benefit amounts dictated by the plan benefit formula. Moreover, while wage inflation is a significant concern for organizations overall, pension plans that have frozen future benefit accruals are insulated from these increasing costs. In contrast, municipal defined benefit plans often have cost-of-living adjustments within their benefit formulas and have already seen benefit payment amounts increase.

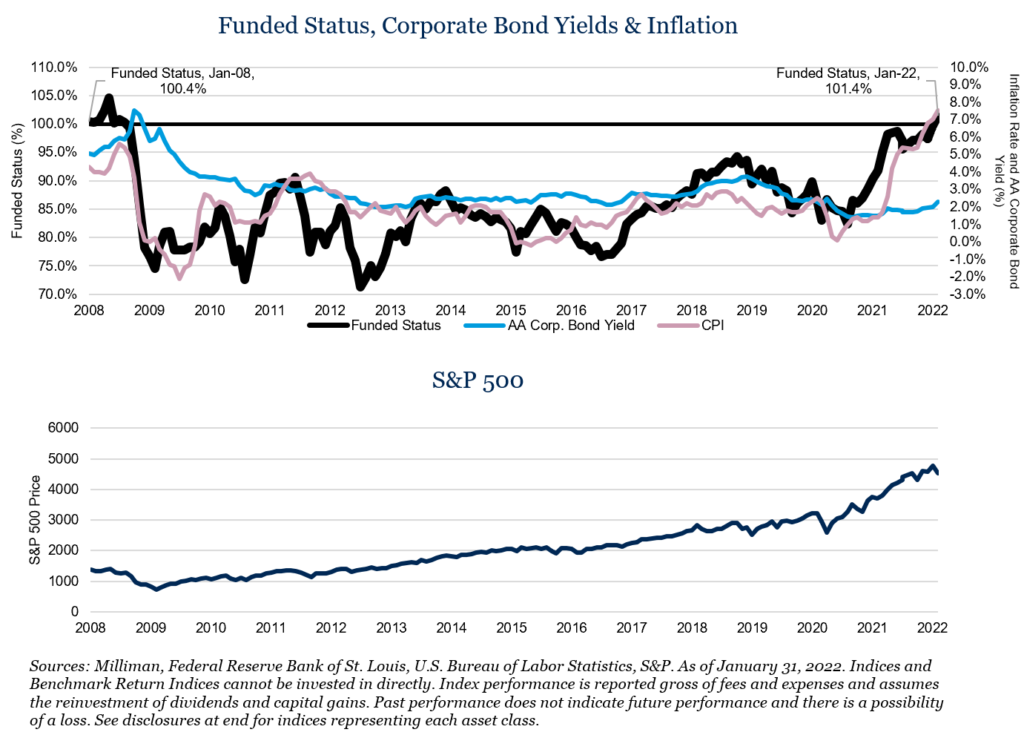

For corporate Plan Sponsors, an essential consideration regarding inflation is its impact on interest rates. Historically, higher inflation has led to higher interest rates, driven both by market forces as well as policy response. For Plan Sponsors with funded statuses below 100 percent and portfolios with hedge ratios below 100 percent, an increase in interest rates generally leads to an increase in funded status due to a reduction in the present value of plan liabilities. Many Plan Sponsors experienced this benefit in the past year.

According to Milliman’s Pension Funding Index study, the aggregate funded status of the 100 largest corporate defined benefit plans increased by 19 percent from 82 percent in July 2020 to over 101 percent as of January 2022. A key driver of this increase was the rise in the interest rates used to value liabilities of more than 0.80 percent, partially driven by increases in inflation expectations as the CPI inflation rate rose from 1 percent to 7.5 percent over the same period. U.S. equities also saw significant returns over this period, further boosting plans’ funded statuses.

Asset Allocation Considerations

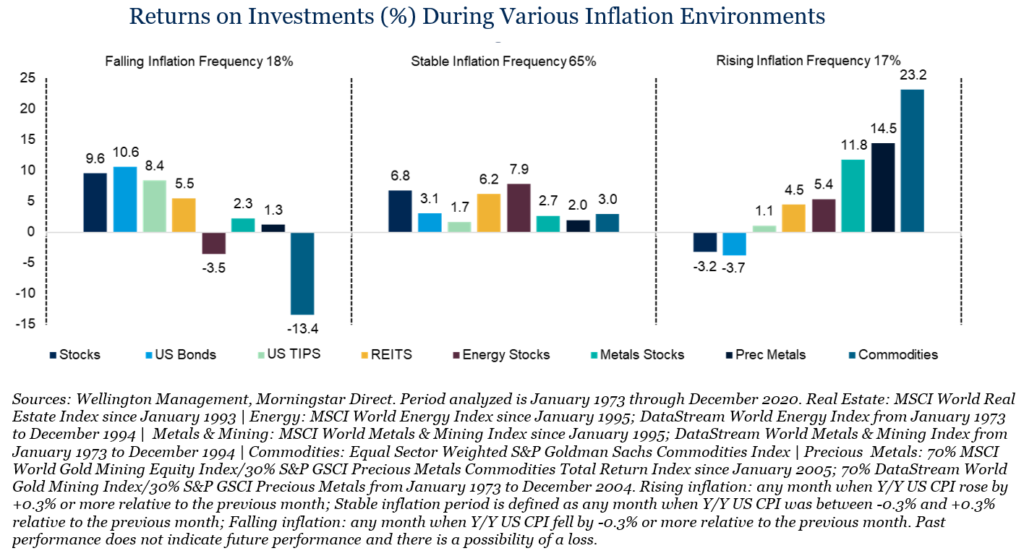

While the correlation between inflation and interest rates is not perfect, it is generally positive and should lead to lower liabilities for Plan Sponsors. Inflation should also be regarded as potentially additive to the asset side of the ledger. As seen in the chart below, in 65 percent of monthly periods when the monthly change in the inflation rate was +/- 0.3 percent going back to 1973, equities had an average annualized return of 6.8 percent. So even when inflation is increasing at a moderate pace, equities have historically done well. Of course, the overall level of inflation and the overall health of the economy must be at levels where businesses can pass increased costs onto consumers who are willing and able to continue their spending habits. In times of more sharply rising inflation where this may not be the case, represented by 17 percent of monthly periods going back to 1973, both stocks and bonds have averaged negative annualized returns.

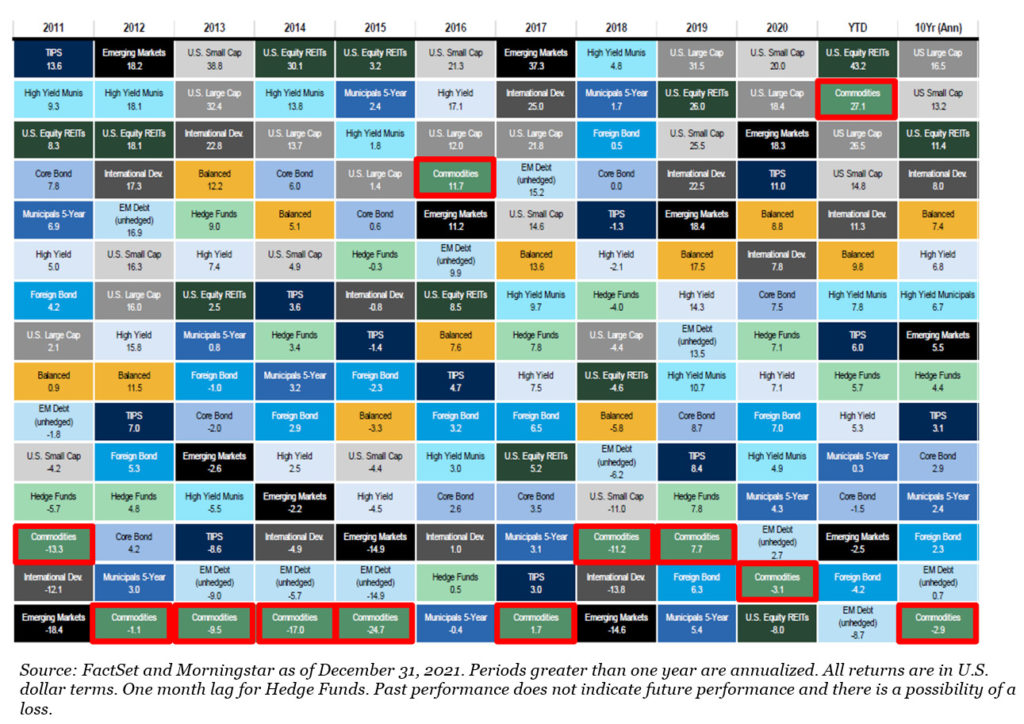

We believe this trend exemplifies the importance of diversification in defined benefit portfolios beyond traditional stocks and bonds. In our opinion, it also highlights the critical need for the inclusion and construction of a dedicated real assets allocation. A real asset is a value-generating, physical/tangible asset that has intrinsic value in-and-of itself. Examples of real assets include land, metals, real estate, infrastructure and commodities. We understand that the most common real asset class for many Plan Sponsors is commodities, which outside of 2021, have been one of the worst performing asset classes over the past 10+ years as shown below.

In our opinion and based on the data, a dedicated commodity allocation is a dated and unsophisticated approach to a real assets allocation. However, we believe the addition of a diversified real asset portfolio can help to strategically and tactically allocate among the various real asset categories, with the simultaneous goals of providing positive expected absolute returns, a hedge against rising inflation and low correlation to more traditional investments like stocks and bonds can be a tremendous ally in an environment of rising inflation.

Plan Sponsors should consider that although higher inflation will likely lead to lower liabilities and equities generally perform well in periods of low to moderately low levels of increasing inflation, a thoughtfully diversified real assets allocation can better prepare their portfolios for potentially higher inflation in the future without sacrificing much in terms of expected return if inflation levels subside.

Please reach out to any of the professionals at Fiducient Advisors for more information.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.