Compounding has long been celebrated as a cornerstone of successful investing, offering the potential to grow wealth exponentially over time. Today, harnessing the power of compounding is more than just an investment principle; it is a strategic approach to help achieve financial independence and long-term security. The concept goes beyond simple returns, demonstrating how reinvested earnings can create a snowball effect that builds momentum with each passing year. Below, we will explore what compounding is, why time is its greatest ally and how individual investors can effectively leverage it to help meet their financial goals.

What is Compounding?

At its core, compounding occurs when the returns on an investment generate additional returns over time. This process allows your money to grow at an accelerating rate, as interest or investment earnings begin to earn returns themselves. Unlike simple interest, where returns are calculated only on the initial investment, compounding factors in reinvested earnings, creating a snowball effect.

For example, let’s assume you invest $10,000 in an account that earns a 6% annual return. In the first year, your investment grows to $10,600. In the second year, you earn 6% not just on the original $10,000 but also on the $600 earned in year one. Over time, this exponential growth becomes increasingly significant.

Why Time is Essential

Time is the single most critical factor in compounding. The earlier you start investing, the more opportunities you give your money to grow.1 This is because compounding requires patience to unlock its full potential. Consider the following comparison:

- Investor A starts investing $5,000 annually at age 25 and stops contributing at age 35, having invested $50,000 total. Their investments compound at a 7% annual rate.

- Investor B starts investing the same $5,000 annually at age 35 and continues until age 65, contributing a total of $150,000.2

Despite contributing significantly less, Investor A often ends up with more money by age 65. Why? Because Investor A’s money had more time to compound.

How to Harness the Power of Compounding

1. Start Early

The earlier you start investing, the better. Even modest contributions made consistently over a long period can grow to significant sums. For example, investing $100 per month starting at age 25 can result in over $190,000 by age 65 at a 7% annual return—far exceeding the total contributions of $48,000.3,4

2. Reinvest Returns

To take full advantage of compounding, reinvest your earnings rather than withdrawing them. This applies to interest, dividends, and capital gains. Many investment vehicles, such as dividend reinvestment plans (DRIPs), make this process automatic.5,6

3. Stay Consistent

Market volatility can tempt investors to stop contributing or withdraw during downturns. However, consistency is key to long-term success. Dollar-cost averaging—investing a fixed amount regularly—helps you buy more shares when prices are low and fewer when prices are high, reducing the impact of market fluctuations.

4. Choose the Right Investment Vehicle

Tax-advantaged accounts such as IRAs and 401(k)s can supercharge compounding by minimizing tax drag. Without taxes eating into annual returns, your investments grow faster. Ensure your portfolio is diversified and aligned with your risk tolerance to balance growth and protection.

The Cost of Waiting

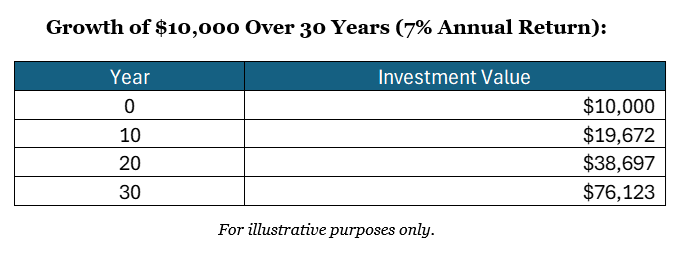

Procrastination can be costly when it comes to compounding. For every year you delay investing, you reduce the potential growth of your portfolio. For instance, a $10,000 investment earning 7% annually grows to approximately $76,123 in 30 years. Waiting just five years to invest reduces the ending balance to $53,865—a difference of over $22,000.7

Visualizing Compounding

This chart highlights how the pace of growth accelerates as time progresses, underscoring the importance of starting early.8

Unlock Your Financial Future

The power of compounding is an investor’s greatest ally, but it requires discipline and a long-term mindset. Whether you are just starting your investment journey or looking to optimize your existing strategy, Fiducient Advisors can help.

Explore our resources to learn more:

Take the first step toward unlocking the full potential of compounding today. Remember, the best time to start investing was yesterday; the second-best time is now.

1Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing | Investor.gov

2Compound Interest Calculator | Investor.gov

3Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing | Investor.gov

4Compound Interest Calculator | Investor.gov

5Dollar cost averaging | Fidelity. May 6, 2024

6When to Reinvest Dividends (or Not) | Morningstar. May 17, 2024

7,8Compound Interest Calculator – Investor.gov

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.