Funding Statuses Improve but Challenges Remain

An Examination of Challenges and Developments

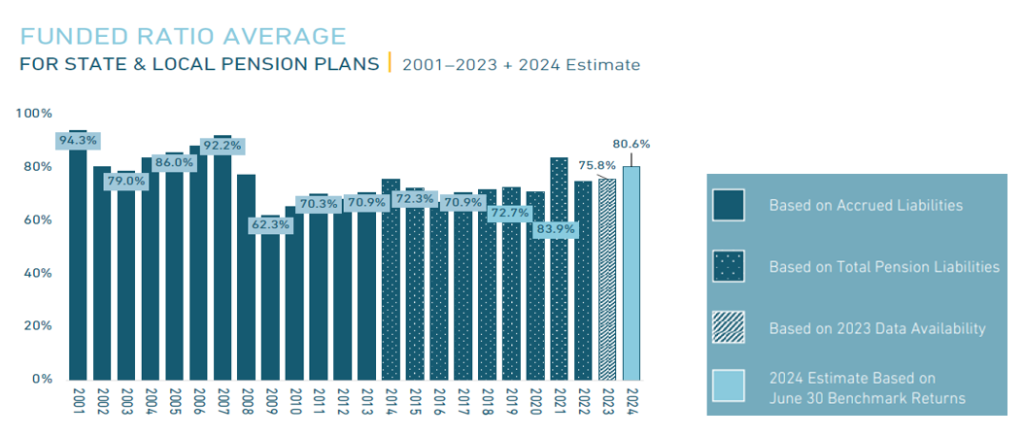

In 2024, public pension plans continued to be a critical component of retirement security for millions of individuals. While these plans have made strides in closing the funding deficit over the last two fiscal years as indicated in the graph below, public pension plans face persistent challenges, including strained financial budgets, demographic shifts and other factors. As we approach year-end, it is helpful to explore the current state of public pension plans, highlighting key issues and challenges.

Pension Funding, Asset Allocation and Discount Rate Trends

Public Pension Funding Ratios Improve

According to The Equable Institute’s latest annual report1, strong global equity and fixed income performance helped drive actuarial gains, on average, for state and municipal pension plans for the fiscal year ending June 30, 2024. This marked the second-best year-over-year increase in the last decade – see graph below. The aggregate funded ratio for statewide and municipally managed pension plans improved from 75.8% from the previous fiscal year to an estimated 80.6% for the fiscal year ending June 30, 2024.1

Source: The Equable Institute Annual Report 5th Edition: State of Pensions 2024

A public pension plan’s funded status can be influenced by several factors. While it is natural to assume investment performance is the primary driver affecting a plan’s funded status, managing pension plans incorporates a wide range of assumptions about future events which can also have significant impacts on the plan. These include investment returns, mortality rates, retirement ages, salary growth, inflation, contributions and more. With so many variables, there are areas where actual plan experience may not line up with projected actuarial expectations — leading to unanticipated changes in liabilities and contribution needs.

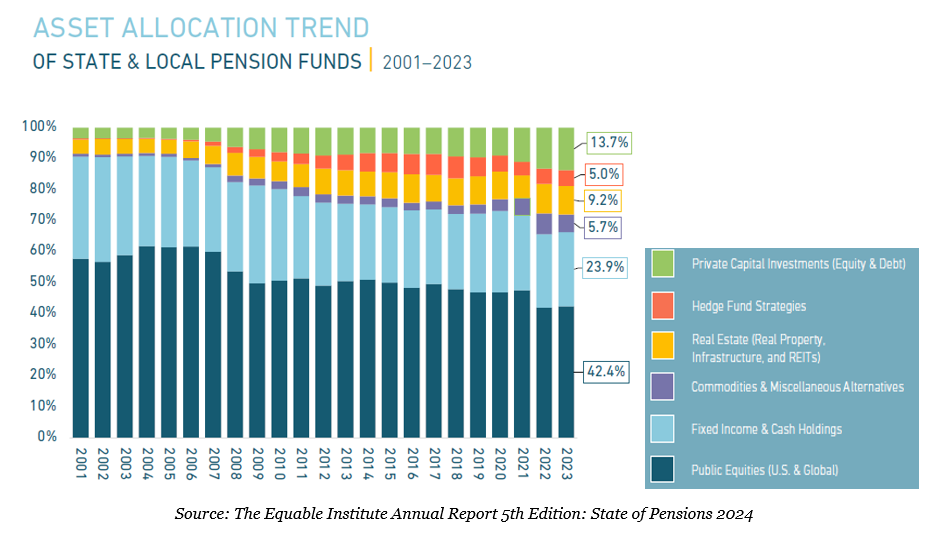

Public Pension Plan Asset Allocation Trends

For more than two decades, public pension asset allocations have shifted away from public equities and core fixed income investments into alternative investments such as private credit, private equity and private real estate, as Plan Sponsors searched for higher returns given historically low interest rates. A byproduct of this trend away from readily liquid, market-priced assets is the growing share of pension fund assets whose values are based on valuation models as opposed to market-based prices.2

On a go-forward basis, we believe Plan Sponsors will reassess their asset allocation profiles because of higher capital market assumptions, driven by the restoration of higher interest rates and lower investment hurdles due to the adoption of lower discount rates. We believe the allocation to alternatives is likely to hold steady, or decline, as Plan Sponsors reassess their allocations and risk tolerance accordingly. While alternatives will likely continue to represent a meaningful allocation, Plan Sponsors need to be mindful that if asset values are overstated today, then that means reported funding levels are likewise overstated. An overstated funded ratio can result in lower than appropriate annual contribution rates, which may mean larger unfunded liabilities in the future.

Public Pension Plans Likely to Pause on Lowering Discount Rates Further

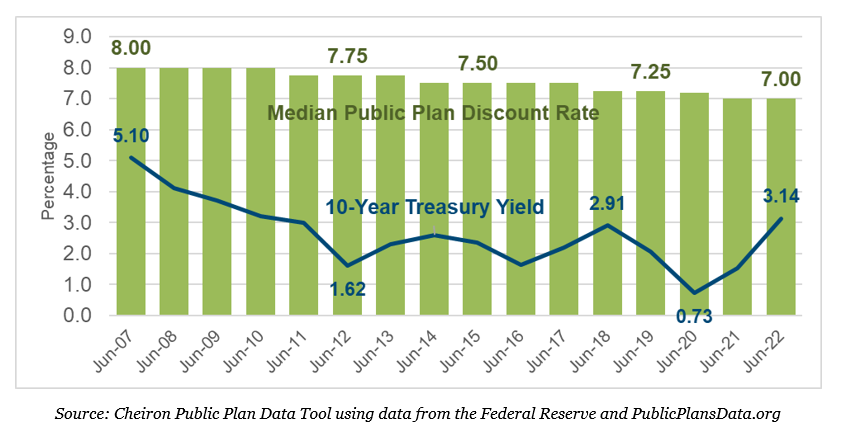

Discount rates, or a plan’s assumed rate of return, have steadily declined since the Global Financial Crisis as depicted in the chart below. Plan Sponsors have set more realistic investment return assumptions due to lower capital market forecasts primarily driven by a multi-decade low-interest rate background. Reducing the assumed rate of return leads to increases in reported plan liabilities on fund balance sheets, which in turn increases the actuarially required employer contributions. Some states and municipalities have phased in discount rate reductions to minimize the cost impact. Frederica Daniels, Vice President & Managing Actuary at USI Consulting Group, noted that “[in] the last decade, we have seen Plan Sponsors lower the expected rate of return by 1/8th of a percent (125 basis points) each year until a targeted decreased rate is achieved to smooth out the effects on the required contribution levels.” Still, making such changes can ultimately strengthen a plan’s financial sustainability by reducing the risk of earnings shortfalls, thus limiting unexpected costs.

We have seen many public pension plans pause lowering their discount rate this year, and we believe this will likely continue. After decades of low interest rate policies, the Federal Reserve embarked on an aggressive interest rate campaign from February 2022 until July 2023, raising the Fed Fund’s Interest Rate from 0.25% to 5.5% to combat runaway inflation.3 As the general level of interest rates have increased, so has the projected return profile for fixed income investments, a key component of a pension portfolio’s asset allocation. As a result, there is less pressure to reduce discount rates than in the last several years. Most Plan Sponsors, however, will likely be patient in any upward adjustments to the discount rates to make sure the change in return expectations is not temporary. According to Daniels at USI Consulting Group, “This is analogous to decisions we have seen by governmental boards and councils for the 2023 and 2024 fiscal years, as many sponsors have held off on continuing to reduce the expected rate of return assumption by the 1/8th percentage point we had seen in the last handful of years.”

Economic Pressures and Unfunded Liabilities

Public pension plans continue to grapple with economic pressures which can impact state and municipal budgets. Inflation, fluctuating interest rates, market volatility and improved actuarial assumptions have made it increasingly difficult for pension funds to meet their long-term obligations. Despite improvements in funded ratios over the last two fiscal years, many plans are notably underfunded – see graph on previous page. With liabilities outpacing assets, governments have been forced to address funding gaps.

The persistent issue of underfunding is driven by several factors. Competing demands for state and municipal finances can result in funding less than the annual “required” contribution as determined by the plan’s actuary. This can further exacerbate a plan’s deficit should the plan experience actuarial losses as well. Additionally, the aging population, with a growing number of retirees compared to active workers, places added strain on pension systems from a cash flow perspective. Revised mortality tables reflecting longer life expectancies mean that retirees draw benefits for more extended periods, further aggravating funding shortfalls.

Unfunded liability costs continue to drive up state and municipal contribution rates, which are currently over 30% of payroll on average according to Equable’s State of Pensions 2024 report. Increased contributions have not been sufficient to balance the increase in outflows associated with pension benefit payments over the past two decades. Daniels notes, “This phenomenon is becoming ever more common as many municipal and town pension plans continue to see more and more inactive members receiving retirement payments compared to active members paying into the system. This phenomenon is becoming even more pronounced as more plans to freeze participation and require new employees to enter into a defined contribution program.”

As a result, mature pension plans today are tasked with addressing negative cash flow. Benefit payments out of the trust are greater than money coming into the trust, therefore putting pressure on investment returns to make up the difference between inflows and outflows.

Innovative Funding Strategies – Bridging the Gap

States and municipalities are tasked with finding sustainable solutions to ensure the viability of the pension plan. In response to these challenges, various innovative funding strategies have emerged. As we observed earlier, state and municipal plans have embraced alternative investments to provide an enhanced, diversified return stream with the goal to help shrink the funding deficit over time. Additionally, we believe, based on experience working with public fund clients, some pension plans are increasing contributions from both employers and employees to bolster funding levels. A growing number of pension plans have annual benefit payments that exceed contributions and are likely to accelerate in the years ahead. Cash flow matching strategies can serve to balance a plan’s short-term liquidity needs with longer-term investment goals and can help to mitigate the effect of selling assets in an inopportune time to meet near-term benefit payments.

Striving for a Sustainable Future

The state of public pension plans in 2024 is characterized by a dynamic interplay of challenges and innovations. Fiscal policy pressures, capital market volatility and demographic shifts necessitate continuous adaptation and reform. By embracing innovative funding strategies, striking a balance between investment risk and contribution volatility, and policy reforms, public pension plans can navigate these complexities with the goal to secure a sustainable future for retirees.

As we move forward, collaboration among public Plan Sponsors, pension fund managers and stakeholders is essential. This collaboration can help ensure that public pension plans remain a cornerstone of retirement security.

If you would like more information, please reach out to any of the professionals at Fiducient Advisors.

1The Equable Institute Annual Report 5th Edition: State of Pensions 2024

2The Equable Institute Annual Report 5th Edition: State of Pensions 2024

3Statista.com

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.