With the economy in the midst of its longest expansion in history and stocks near all-time highs, you would think that financial officers and board members of nonprofit organizations would be feeling good right now. But when it comes to investments and overall fiscal management, I am hearing three recurring points of concern.

1. Adjusting to lower investment returns

We are fresh off an exceptional year for stocks and bonds so whether we examine endowments, foundations or reserve funds, a snapshot of nonprofit investment portfolios appears rather attractive. But keep in mind that most nonprofits are long-term or even in perpetuity organizations that rely meaningfully on portfolio earnings to sustain their mission. What looks like a healthy investment program today could be greatly jeopardized if future investment earnings were lower… and that is exactly what we are forecasting.

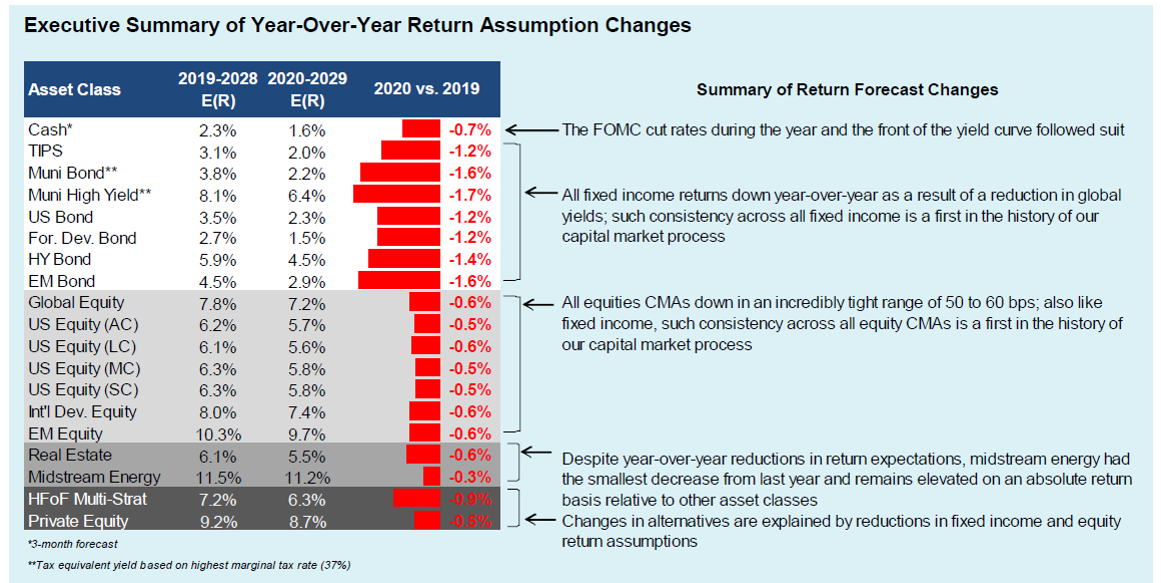

Fiducient Advisors annually updates our 10-year return expectations. For clarity, these are simply mid-point forecasts (think over/under bets) of how stocks, bonds, real estate and other asset classes might perform for the next decade. It is worth noting that, for the first time in our history of producing such analysis, we are forecasting lower returns in each and every asset class.

Without delving too deeply into the math (you can request our twenty page analysis for that), I’ll summarize and state that extraordinary recent performance combined with high relative valuations may very well lead to lower investment returns for nonprofits and all investors over the next decade. How financial officers and other stewards of nonprofit investment portfolios navigate this challenge could be one of the biggest determinants of whether their nonprofit struggles or thrives over the coming years. Should the finance or investment committee hold risk levels constant (i.e. not chase returns), the institution may need to reduce spending or develop additional sources of funding. As easy solution may not exist.

2. Tapping the best revenue sources

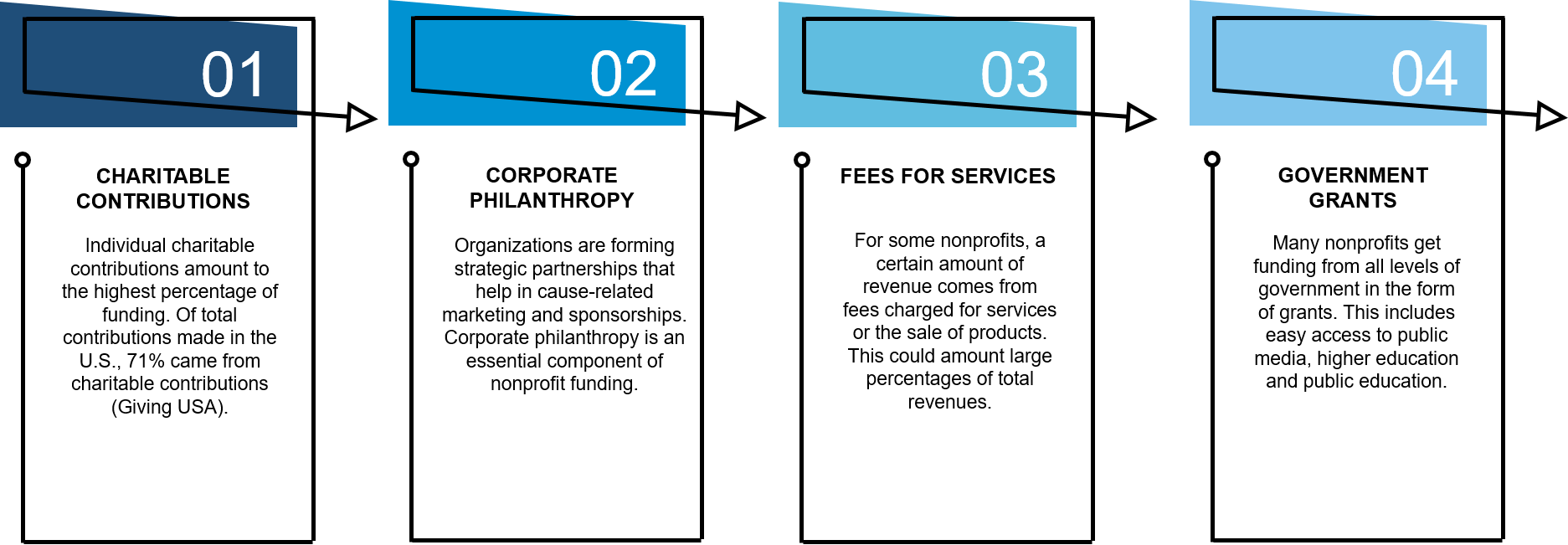

If nonprofits are likely to see lower earnings from their investment portfolios, it makes sense that financial officers and stewards would consider closing the gap by examining all revenue sources, and then thoughtfully pursuing those that offer the greatest upside. As you might expect a cookie–cutter approach will not work. For example many of our nonprofit clients have seen government funding erode, but certain nonprofits find themselves in a sweet-spot for public funding. It is essential for nonprofits to understand the full spectrum of potential revenue sources and to then hone in on those that offer the greatest potential benefit for their unique circumstances.

3. Avoiding complacency in investing and overall financial management

I must admit that the complacency challenge is my observation, not a self-proclaimed concern I regularly hear from nonprofit stewards. After all, how often are people aware that they are becoming a bit lax in a certain discipline? But 10-plus years into this bull market and economic expansion, complacency is exactly what good stewards should guard against. Are financial officers and board members as disciplined as they once were regarding capital expenditures, debt levels and revenue forecasts? Do investment committee members at your nonprofit now focus disproportionately on return, rather than risk? Are they enamored with private equity, venture capital and other present darlings of the investment community?

The late economics professor Hyman Minsky taught that all stable economies sow the seeds of their own destruction. The reason? Because stability itself induces risk-taking behavior – think speculative borrowing, undisciplined expenditures, etc. – that creates financial instability and eventually leads to panic and crisis. And while Fiducient Advisors is not forecasting an impending recession or market downturn, we do encourage nonprofit stewards to be especially thoughtful and intentional about their financial circumstances, initiatives and portfolio construction.

For additional information or assistance in examining the imbedded risks in your nonprofit’s endowment, foundation or reserve portfolio, please feel free to contact me or any of the professionals at Fiducient Advisors

Note: Information has been obtained from a variety of sources believed to be reliable though not independently verified. Any forecast represents median expectations and actual returns, volatilities and correlations will differ from forecasts. All returns displayed are hypothetical and do not represent any returns earned by clients of Fiducient Advisors It is not possible to invest directly in an index. Past performance does not indicate future performance. This does not represent a specific investment recommendation. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.