Year-end is fast approaching, with the holidays just around the corner. While the market malaise

may be front-and-center on the minds of many, individuals should not overlook year-end planning opportunities which may provide meaningful benefits.

- Harvest Losses

- Analyze Mutual Fund Year-End Capital Gain Distributions

- Manage Charitable Donations

- Satisfy Required Minimum Distributions using the IRA Charitable Rollover

- Consider a Roth Conversion

- Utilize Annual Exclusion Gifts

- Utilize the Lifetime Gift Tax Exemption

- Review Estate Plans and Beneficiary Designations

- Evaluate When to Collect Social Security Retirement Benefits

- Consider a Change in State Residency

Harvest Losses

Given the extent to which bonds and stocks have declined this year, tax loss harvesting can be a practical but meaningful planning opportunity for investors holding positions with unrealized losses in taxable accounts.

Realized losses can offset other realized gains; to the extent that realized losses exceed realized gains, net realized losses can offset up to $3,000 of ordinary income with any remainder resulting in a loss carryforward to be used in future years.

As an example, consider John and Jane Smith who currently have $8,000,000 of global equities in taxable accounts, for which the positions have a combined unrealized loss of $2,000,000. The Smiths sell the current positions and redeploy the $8 million of proceeds to equity index funds; in doing so, the Smiths have booked a $2,000,000 loss to offset current and/or future year realized gains, while their portfolio remains positioned to benefit from a subsequent market recovery.

Beware of the “wash sale rule” which states that a loss cannot be realized for tax purposes if a substantially identical position was bought within 30 days before or after the sale.

Analyze Mutual Fund Year-End Capital Gain Distributions

Mutual funds are required to pass along capital gains to fund shareholders. Regardless of whether the fund shareholder actually benefited from the fund’s sale of underlying securities, the shareholder will receive the capital gain distribution if the mutual fund is held as of the dividend record date.

Mutual fund families typically provide estimates for year-end dividend distributions over the course of October and November, with such distributions most commonly paid in December.

Capital gain distributions can be either short-term or long-term. Short-term capital gain dividends are treated as ordinary income and thus cannot be offset by realized losses; in contrast, long-term capital gain dividends are treated as capital gains and can be offset by realized losses.

It is important to review unrealized gains and losses across mutual fund holdings in taxable accounts and to compare those figures against capital gain distribution estimates to determine if selling a mutual fund position before the year-end distribution would produce a tax savings.

In addition, investors should be careful with late-year purchases of actively managed funds in taxable accounts. Investing in a fund just prior to its capital gain dividend record date could result in additional capital gains taxes. An investor might instead wait to invest in the given fund until after the dividend record date or could invest in an index ETF for the time being and swap from the ETF to the actively managed fund at a later date.

Manage Charitable Donations

Charitable donations represent one of the better planning tools which taxpayers can use to manage their overall tax picture.

In higher income years, it may make sense to give a greater amount to charity. This can be particularly true for individuals who are nearing retirement, where taxable income may fall several tax brackets after retirement. Conversely, in lower income years, it may make sense to pare back or delay charitable gifts.

For individuals who are charitably inclined but who now take the increased standard deduction ($12,950 for single; $25,900 for married filing jointly) rather than itemizing deductions, it could make sense to use a “bunching strategy” whereby a taxpayer gives multiple years’ worth of charitables in a single tax year to itemize deductions in that year and then foregoes charitable gifts over the next several years while taking the standard deduction.

In conjunction with the bunching strategy, donor-advised funds (DAF) have become increasingly popular as a charitable vehicle to obtain a current year tax deduction for DAF contributions, while allowing the donor to control the pacing/timing of grants from the DAF to qualified public charities.

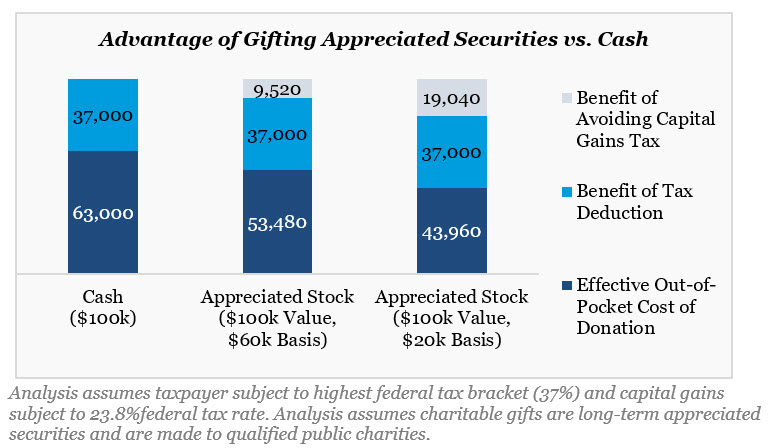

While some donors enjoy the convenience of making cash donations, one should not overlook the enhanced benefit of instead gifting long-term appreciated securities, as the charity receives the same economic benefit as a cash donation, while the taxpayer receives a tax deduction for the full market value of the gift and, importantly, avoids paying capital gains taxes on the gifted security.

Keep in mind that gifts of long-term appreciated securities to qualified public charities (including donor-advised funds) are limited to 30% of adjusted gross income (AGI) while similar gifts to a private foundation are limited to 20% of AGI. Charitable gifts in excess of the AGI limits result in a charitable carryforward which can be used over the next five years.

Satisfy Required Minimum Distributions using the IRA Charitable Rollover

The SECURE Act raised the beginning age for required minimum distributions (RMDs) to 72, from age 70½, previously; however, it did not adjust the age 70½ requirement for taxpayer eligibility to make a Qualified Charitable Distribution (QCD).

Under this provision, a taxpayer may gift up to $100,000 each year from an IRA to qualified 501(c)(3) charitable organizations (donor-advised funds, private foundations and supporting organizations are excluded). A qualified charitable distribution neither counts as an itemized deduction nor as taxable income, though it does count towards satisfying the RMD for that year.

This strategy may be beneficial for charitably inclined individuals who receive a greater tax benefit from the increased standard deduction rather than itemized deductions.

Consider a Roth Conversion

With global equities down sharply for the year and with income tax rates at historically favorable levels, the timing may be opportune for some individuals to execute a Roth conversion.

Individuals who believe their future tax rate might be higher than their current tax rate might consider converting a portion – or all – of existing Traditional IRA assets to a Roth IRA. Assuming the Traditional IRAs have no basis, the amount of the conversion is treated as taxable income; in exchange, the Roth IRA grows tax-free with qualified distributions also treated as tax-free.

Individuals with notable assets but with lower-than-usual income in 2022 might consider this strategy, as it allows the taxpayer to essentially pay a reduced rate on the conversion while taxable income is low.

This strategy can be particularly beneficial for individuals with a taxable estate, as the tax cost of the conversion effectively reduces the size of the estate, while the named beneficiaries one day receive a very tax-favorable asset, compared to inheriting a Traditional IRA. In some cases, high net worth individuals might consider pairing a Roth conversion with accelerated charitable giving, as the charitable deduction will help to offset the effective tax cost of the conversion.

Note that there are a number of factors (time horizon, overall net worth, tax bracket, etc.) to evaluate to determine whether a Roth conversion might ultimately be beneficial.

Utilize Annual Exclusion Gifts

Individuals are allowed to make “annual exclusion gifts” which do not have gift tax implications. In 2022, the annual gift tax exemption is $16,000 per donee (increasing to $17,000 in 2023).

For high net worth individuals with – or likely to one day have – a taxable estate, utilizing annual exclusion gifts is an effective way to reduce one’s taxable estate while also helping loved ones.

As an example, consider Mike and Mary Jones – a very wealthy couple with two married children (four spouses total) and five grandchildren. In 2022, the Joneses, as a couple, could gift $32,000 to each of the nine individuals for a combined total of $288,000, without such gifts counting against their lifetime gift tax exemption. In making these annual exclusion gifts each year, the Joneses are able to carve out a notable portion from their taxable estate.

It is also worth noting that medical payments made directly to a medical provider do not count as taxable gifts. Furthermore, tuition payments made directly to an educational institution do not constitute taxable gifts. Tuition is narrowly defined as the cost for enrollment; it does not include books, supplies, or room and board.

Utilize the Lifetime Gift Tax Exemption

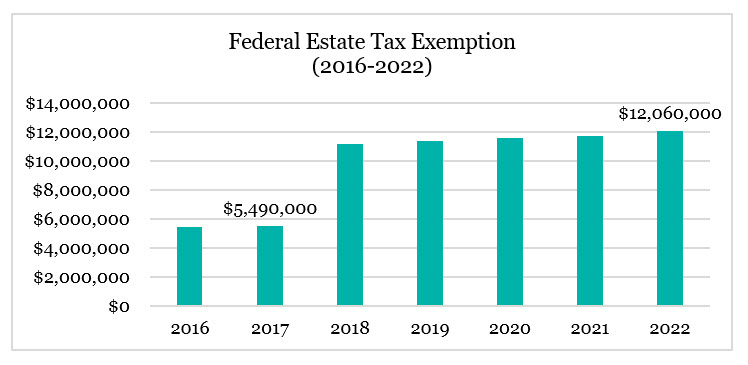

The Tax Cuts and Jobs Act (TCJA), which was passed in December 2017, approximately doubled the estate exemption from $5.49 million per person in 2017 to $11.18 million per person in 2018. The lifetime gift tax exemption currently stands at $12.06 million per person (and will jump to $12.92 million per person in 2023), with a top federal estate tax rate of 40%.

The increased exemption amounts, under TCJA, are scheduled to run through 2025, after which the basic exclusion amount (BEA) is set to revert to the 2017 level of $5 million per person, plus inflation adjustments.

In recent years, the Biden administration and certain congressional leaders have proposed, albeit unsuccessfully, to lower the exemption amount.

While the elevated exemption is scheduled to remain in place through 2025, high net worth individuals should not lose perspective of the unique planning opportunity to get additional assets out of one’s taxable estate.

High net worth individuals should evaluate current assets and assess how much might be needed for their remaining lifetime, with consideration to gift ‘excess assets’ to loved ones. Depending on the size of an outright gift, estate planning which incorporates making gifts to trusts may be advisable to provide parameters or safeguards for the intended beneficiaries.

As a reminder, the Treasury Department and IRS issued final regulations in November 2019 clarifying that taxpayers taking advantage of the increased exemption amounts would not be subject to a future clawback, should the exemption amount decrease from current levels.

Review Estate Plans & Beneficiary Designations

As a matter of best practice, individuals should periodically review estate plans and beneficiary designations to ensure such plans and documentation align with desired intentions, as well as with changing rules and limits.

Individuals who have recently experienced a significant life event (marriage, divorce, birth/adoption) may also need to make updates to existing estate plans and beneficiary designations.

As it relates to retirement account beneficiaries, the Setting Every Community Up for Retirement Enhancement (SECURE) Act, enacted on January 1, 2020, effectively eliminated what was known as “the stretch IRA,” for which a beneficiary could stretch required minimum distributions (RMDs) for an inherited retirement account over their lifetime. Under the SECURE Act, most non-spouse beneficiaries (who inherit a retirement account after 2019) will be required to fully withdraw all inherited retirement assets by the end of the tenth year after the original account holder died.

Evaluate When to Collect Social Security Retirement Benefits

Individuals nearing eligibility for Social Security retirement benefits should give proper consideration for when to start benefits.

A review of 2016’s new Social Security recipients1 showed nearly 60% of individuals collected benefits before their full retirement age (FRA), with only 10% waiting beyond full retirement age.

While general guidance is to wait until age 70 (if possible) to collect a higher benefit, there are a number of important factors to consider: anticipated life expectancy, income needs for the interim years when benefits would be delayed, availability of spousal benefits, etc.

Consider a Change in State Residency

Changing your primary state of residency is not as simple as spending more than half the year in a new state. With many states more aggressively contesting such residency changes, individuals should take extra precaution to ensure that “facts and circumstances” support the case for changing one’s resident state. Some of the factors that support a new domicile include: days spent in the new state for the year, driver’s license registration, voter registration, medical and dental care providers, country club or social club memberships, official mailing address to which mail and bills are sent, location of family heirlooms and artwork, etc.

As the year comes to a close, Fiducient Advisors is here to help guide individuals through these considerations. Please contact any of the professionals at Fiducient Advisors with questions. For additional information on Financial Planning please visit our website.

1 “It’s Tempting to Take Social Security at 62. You Should Wait.” By Peter Finch. The New York

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.