Inflation improvement and weaker economic data shift Fed sentiment

Key Observations

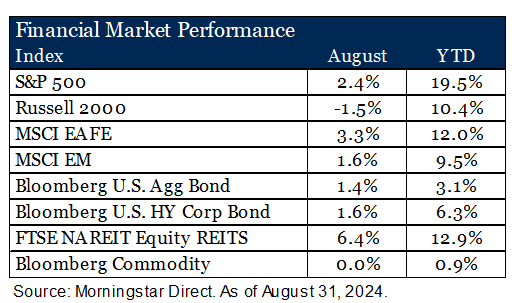

• Markets were generally positive in August, despite a tough start to the month as investors wrestled with weakening economic data, geopolitical unrest and global growth.

• Shifting language at the Federal Reserve’s Jackson Hole summit indicated a renewed focus on the employment situation more so than inflation.

• Markets have priced in a first rate cut in September, shifting the question of “when?” to “how much?”

Market Recap

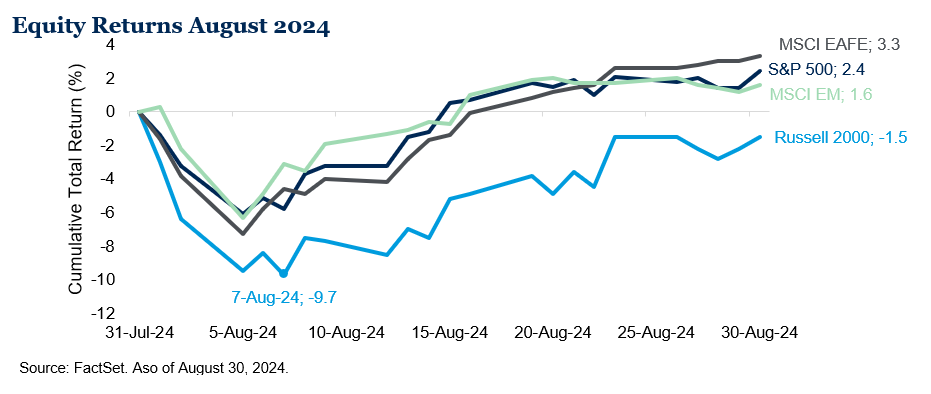

July’s volatility carried into early August as investors navigated the unwind of the Japanese yen carry trade, geopolitical unrest in the Middle East and growing concerns about economic growth following weak ISM and labor market reports. Equity markets initially declined in the first week, with U.S. small caps hit hardest. However, a favorable earnings season and shifting sentiment at the Federal Reserve’s Jackson Hole summit boosted markets later in the month. Most equity markets ultimately finished higher, led by international developed stocks (MSCI EAFE Index), which benefited from a weakening U.S. dollar.

The S&P 500 Index (U.S. large cap) also ended the month up, supported by a strong earnings season. With 93% of companies reporting, Q2 blended year-over-year earnings growth for the S&P 500 reached 10.9%, the highest measure since 2021.1 Small-cap stocks (Russell 2000 Index) rebounded but remained just below positive territory for the month.

Interest rates moved lower during the month on improving inflation as U.S. CPI fell below 3% for the first time since March 2021.2 This was a boon for fixed income and other related assets as both high-quality and below-investment-grade sectors of the fixed income market delivered positive returns. REITs were the standout in August, crossing into double-digit return territory on a year-to-date basis. Most components of the REIT index posted gains, with the self-storage sub-sector as a notable contributor. Commodity markets were mixed, resulting in a flat overall return. Metals performed well and were driven by strong demand and a weakening U.S. dollar, while energy prices declined amid uncertainty about global economic growth. Additionally, OPEC’s plans to ease production cuts later this year could create further headwinds for oil prices.

Shifting Focus Signals Cuts

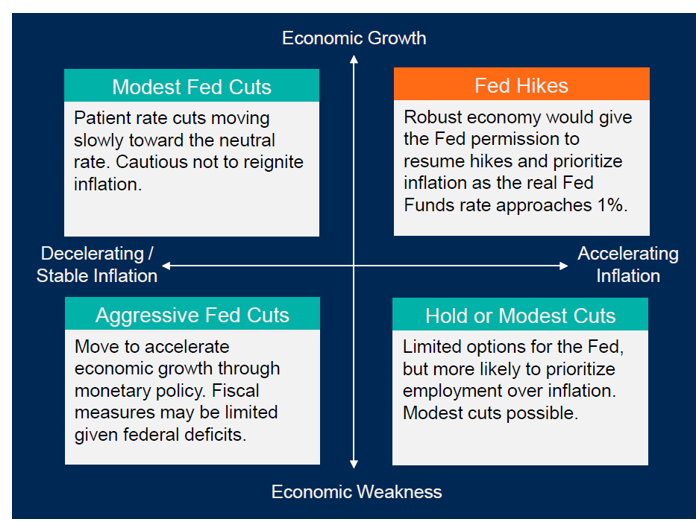

Sentiment shifted at the Federal Reserve’s annual Jackson Hole summit following weaker economic data, including signs of a cooling labor market with unemployment rising to 4.3% and significant downward revisions to previous non-farm payrolls.2 Inflation continues to progress toward the Fed’s 2% target, and Fed Chair Jerome Powell reflected this shift in his recent speech: “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”3 Markets now anticipate the Fed’s first rate cut will occur at the September 2024 FOMC meeting, shifting the question from “when?” to “how much?” Whether the initial cut is 25 or 50 basis points, as highlighted in our Mid-Year Outlook, we believe the ultimate direction of interest rates is downward, with multiple paths leading there. The Fed has indicated a willingness to support the labor market if needed. While all scenarios are possible, we believe the most probable outcomes are either cuts based on moderating inflation and economic resilience or more aggressive cuts in response to economic weakness.

Outlook

As summer fades and we approach the fall, we expect greater clarity from the Fed on upcoming policy actions, creating a potential tailwind for fixed income assets with several paths for rate cuts. While inflation is improving, recent economic data has been trending downward. We remain mindful that the upcoming election, global geopolitical tensions and unforeseen events may continue to keep market volatility elevated. Thoughtful asset allocation and constructing diversified portfolios to enhance resilience are increasingly important as we prepare for the markets ahead.

For more information on our research or investment consulting services, please click here to contact us.

1FactSet Earnings Insight as of August 16, 2024.

2FactSet. BLS. As of August 31, 2024.

3Federal Reserve Chair Jerome Powell, August 23, 2024. https://www.federalreserve.gov/newsevents/speech/powell20240823a.htm

Disclosures & Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

• The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

• Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

• MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

• MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

• Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

• Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

• FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

• Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

• Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

• Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

• Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

• International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impact by currency and/or country specific risks which may result in lower liquidity in some markets.

• Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

• Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrow.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.