• Emerging markets equities performance has held up amid global concerns over the novel Coronavirus

• This is due to large country concentrations within the index relative to international developed markets

• Within countries with the largest index allocations, significant concentration in technology and healthcare has buoyed returns

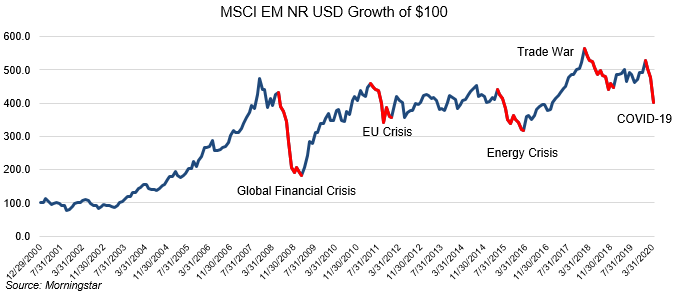

In the wake of the sharp declines across global markets driven by the uncertain and virulent spread of novel coronavirus, investors may have concern over the impact in countries where the pandemic originated; namely, emerging markets. To assess, we will look at performance of emerging markets in context to historical crises.

We observe while the recent downturn has been steep and fast, emerging markets have held up more than most would presume. When comparing year-to-date returns to their developed market counterparts, the MSCI EM and MSCI EAFE index closed the quarter at -23.6 and -22.8 percent, respectively. The results have largely been in-line with each other. Even from the market’s peak on February 19, the results are quite similar with the MSCI EM and MSCI EAFE index ending at -22.3 and -22.0 percent, respectively. Given the higher historical volatility in the emerging markets asset class, this begs the question: why hasn’t the recent downturn been worse? We answer this question by looking under the hood of the two indices.

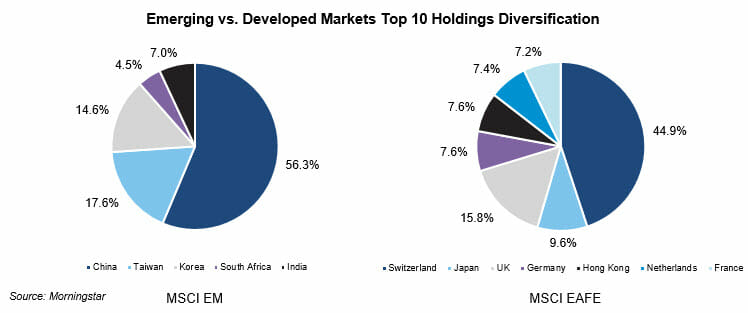

Key countries have larger influence over broader outcomes in emerging markets compared to their developed markets counterpart. This is a consequence of the market capitalization construction methodology for the two indices. We highlight this by looking at the top 10 holdings of each index below.

We can observe the composition of each index’s top 10 holdings are quite different. In emerging markets, China comprises over 56 percent of the top 10 holdings, followed by large weights in Taiwan and South Korea. The weight distribution in developed markets is much more homogenous. While developed international markets also have a significant concentration in Swiss stocks at 45 percent, its influence is muted due to the overall weighting of the top 10 holdings in the EAFE index. The MSCI EM index’s top 10 holdings comprise of 26 percent of the total index’s weight, compared to 12 percent for EAFE. Further, the top 10 holdings in China make up almost 15 percent of the total index weight, compared to top Swiss stocks at just five percent. Finally, China plus Hong Kong make up a total of 36 percent of the emerging markets index weight. Thus, returns of countries with a larger index representation are a much stronger force in emerging markets relative to developed.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.