• As demand for ESG (Environmental, Social and Governance) products grows, the influence of ESG ratings and data providers continues to increase.

• Individual agencies’ ESG ratings often vary dramatically due to the subjective nature of environmental and social values.

• Corporate data disclosure remains unstandardized, which makes comparing companies a daunting task.

• There are many different approaches to implementing ESG considerations into an investment process. A multidimensional framework for navigating the ESG landscape may help achieve successful financial outcomes that are also aligned with organizational missions.

With increasing demand for Environmental, Social and Governance (ESG)-related corporate responsibility, the incentive for professional investors to adopt ESG-driven investment processes is greater than ever. As a result, more investment managers claim to actively incorporate various ESG considerations into their investment strategies. In fact, a 2019 survey conducted by Fiducient Advisors of 165 investment managers showed that 84 percent of those managers employ ESG considerations as a part of their investment process – nearly a threefold increase from our 2015 results1. With so many investment managers considering ESG factors during security selection, this merits the question: What data are they using to evaluate corporate ESG responsibility?

As the trend of Environmental, Social, and Governance consideration continues to rise, so too has the influence of ESG ratings agencies on how investors consider ESG factors. Quickly evolving and fueled by a recent influx in demand, the marketplace has become fiercely competitive. According to the Global Initiative for Sustainability Ratings there are more than 100 ESG ratings and research providers, ranging from non-governmental organizations focusing on a single issue to global corporations providing thousands of formalized ESG ratings on companies. However, it seems reasonable to conclude that having a shared purpose may not lead to shared interpretations.

Due to the overabundance of ESG ratings and data providers, this study will focus on two ESG ratings leaders, MSCI and Sustainalytics. The study will include an examination of the differences between the two ratings providers’ outputs; why their output is different and challenges with the underlying data points; and what it means for your portfolio when considering an allocation to ESG managers.

The Difference in Ratings

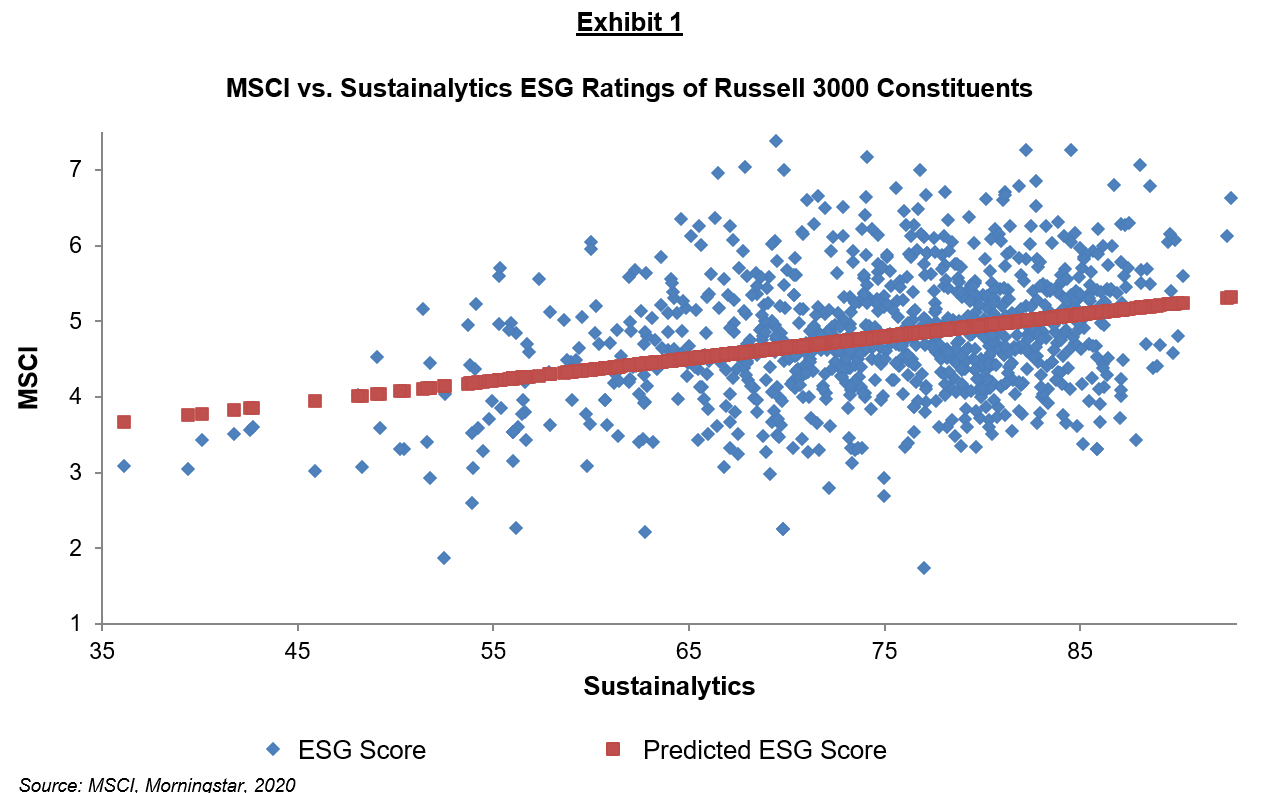

Individual agencies’ ESG ratings can vary dramatically. The scatterplot in Exhibit 1 plots the Sustainalytics ESG rating against the MSCI ESG rating for domestic stocks in the Russell 3000 Index.

These findings show that there is a low correlation between the two agencies’ ESG scores, which yield a correlation of 0.31. By comparison, credit quality ratings from Moody’s and Standard & Poor’s yield a correlation of 0.992. Two key differences explain the divergence:

1. Creditworthiness is clearly defined as the ability to repay debts and remain solvent whereas ESG ratings are subjective based on the rater’s philosophy.

2. Credit ratings are constructed using standardized, audited financial data whereas ESG data points are not. This causes ESG ratings agencies to make assumptions and subjectively interpret ESG data, causing a lack of uniformity in ratings scales, scope of criteria and definitions of ESG quality

The relationship between MSCI’s ratings and Sustainalytics’ ratings appears weak in international markets, too. Comparing the two providers’ ratings presented several challenges. In each of the three markets, domestic equities (Russell 3000), international developed (MSCI EAFE), and emerging markets (MSCI EM), there was a conscious omission of companies that were not rated by both agencies. Notably, Russell 3000 had the lowest common number of ratings relative to the total number of stocks in the index with 2,288 companies rated by both providers out of a possible 2,970 companies. In emerging markets, 1,302 out of 1,401 companies were rated by both providers. Both ratings agencies maintain nearly complete coverage of international developed markets with 909 out of 918 companies in the MSCI EAFE Index rated by both ratings agencies.

While the EAFE is the smallest population of constituents, the higher overlap between MSCI and Sustainalytics is possibly due to the divergent regulatory reporting requirements across global markets. In Europe, for instance, companies with 500 or more employees are required to publish a non-financial statement that includes disclosures. With that said, even in the most progressive countries, ESG reporting requirements are still in their early stages of adoption and implementation. Such disclosures are not required in the United States or in many emerging markets. This could also be a factor contributing to slightly stronger correlations in international developed total ESG scores, albeit still weak overall.

1Managers who consider ESG factors in their investment strategies may not necessarily invest based on an ESG mandate. Magnitude of ESG factor influence varies.

2Guttler and Wahrenburg, 2004.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.