Key Observations

• A late May rally pushed equity markets into modestly positive territory for the month.

• Fixed income investors saw some reprieve as interest rates moved off recent high levels amid concerns of weaker expectations for economic growth in the back half of the year.

• Growing concerns of a global economic slowdown are materializing as investors wait to see if the Fed will have to tip the economy into recession to get inflation under control: we expect elevated market volatility to persist

Market Recap

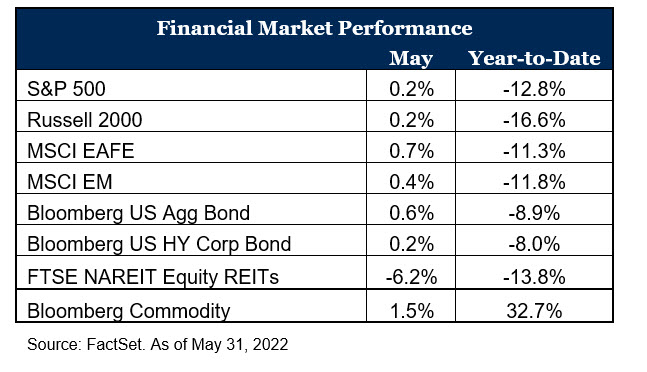

On the surface, market returns in May appeared to be uneventful and were modestly positive. However, the reality within the month was far from that. For much of May, equity markets largely fell as investor focus turned to whether the Federal Reserve actions to suppress inflation could lead to recession. However, favorable consumer spending data, a “buy-the-dip” mentality, flows into equities, and talks of a potential “Fed pause” in September led to a rally at the end of the month, reversing the market trend. Many major indexes ultimately posted modest positive returns for the month. Despite the positive May result, many asset classes remain negative year-to-date and in correction territory (down 10 percent or more) as persistently high inflation, tightening monetary policy globally and continued supply chain issues weigh on sentiment. Real estate (FTSE NAREIT Equity REITs Index) came under pressure in May following worse than expected housing starts data and fear that higher mortgage rates will cool the residential housing market.

Amid growing concerns for an economic slowdown, the fixed income markets resumed their more typical pattern and prices increased as interest rates fell from recent highs and the Bloomberg U.S. Aggregate Bond Index returned 0.6 percent for the month. As expected, the Federal Reserve raised their target rate by 0.50 percent, now targeting 0.75-1 percent1 and the market is all but pricing in another 50 basis point hike in June. The U.S. 10-year Treasury yield ended the month at 2.8 percent, modestly lower than where it began, but well off the intramonth high of 3.1 percent.2

The corporate high yield market eked out a modest gain following the risk on sentiment the last week of the month with the Bloomberg U.S. Corporate High Yield Index returning 0.2 percent. The persisting conflict between Ukraine and Russia continues to impact global commodity markets. European Union leaders are in discussions to further limit Russian oil exports to the continent, sending oil prices higher. Brent crude crossed $120 barrel for the first time since March3, sending the Bloomberg Commodity Index up 1.5 percent for the month.

A Shift in Market Sentiment

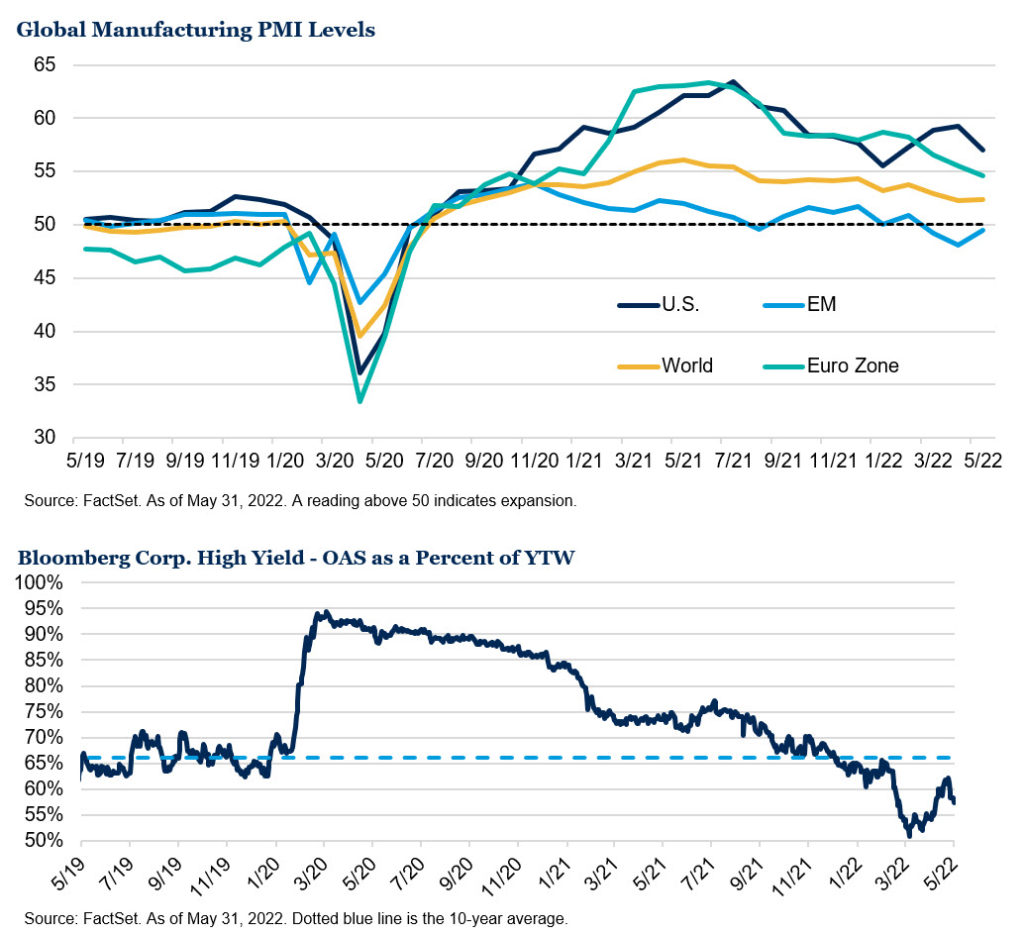

Market sentiment shifted during May with growing concern of an economic slowdown as the Federal Reserve continues to tighten policy to combat persistently high inflation. Despite favorable corporate fundamentals, over 77 percent of companies in the S&P 500 have reported positive earnings surprises in the first quarter according to FactSet4. Expectations for earnings growth in the second half of the year remain high but negative guidance has been growing as wage pressures and supply chain issues impact both top and bottom-line results. On top of that, we are beginning to see economic data, while still positive, trend off recent peaks.

The yield on corporate bonds is a general gauge of risk appetite of investors. Looking under the hood at the composition of the yield is often a more telling story. The total yield on a corporate bond is comprised of the risk-free rate and the credit risk – or default risk – of the issuer. This default risk is often referred to as the “spread” above Treasuries or Option Adjusted Spread (“OAS”). Yields have moved broadly higher this year but, early on, much of that movement was driven by higher interest rates rather than concerns about credit worthiness. In more recent months OAS has crept higher as a percentage of overall yield, an indication that investors are showing increased concern. Despite the greater share of yield, levels remain below the 10-year average and well below the level at the onset of the pandemic in March 2020.

Outlook

It has been a roller coaster ride thus far in 2022 and current conditions suggest the potential for volatility to continue through the year as we highlighted in our recent Market Volatility & Outlook Webcast. Slowing economic growth, high expectations for earnings, tightening monetary conditions and a difficult labor market may continue to play a role in the months to come. In periods of volatility, similar to what we are currently experiencing, the likelihood of making emotional and potentially detrimental decisions is rising. We continue to advocate for adhering to a long-term and disciplined approach to investing.

For additional information, please contact any of the professionals at Fiducient Advisors.

1. Federal Reserve, as of May 4, 2022

2. FactSet, as of May 31, 2022

3. FactSet, as of May 31, 2022

4. FactSet Earnings Insight, as of May 27, 2022

Use of Indices and Benchmark Return Indices cannot be invested in directly. Index performance is reported gross of fees and expenses and assumes the reinvest dividends and capital gains. Past performance does not indicate future performance and there is a possibility of a loss. See disclosure page for indices representing each asset class.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.