In our first paper in this series we focused on defining mission-aligned investing. In our second installment, Mission-Aligned Investing: Approach we seek to answer the question: “Which mission-aligned approach is right for you?”

Mission-Aligned Investing Today

Whether the terminology is socially responsible, mission-aligned, sustainable or ESG, the goal remains to align the mission with financial capital. More today than ever, investors are passionate about a number of issues and are eager to incorporate their values within their investment portfolios. Building a long-term portfolio incorporating attractive risk and return characteristics while aligning with investors’ personal values is of ever-increasing desire.

The heightened awareness surrounding issues like climate change, the environment, religious beliefs, corporate concerns and workplace diversity make companies today popular targets for the growing number of mission-aligned investment strategies. In fact, the US SIF Foundation noted that more than $8.7 trillion1 was invested in sustainable, responsible and impact invested portfolios in the U.S. at the end of 2016, making up one-fifth of all assets under professional management. This marks a 33 percent increase since 2014.

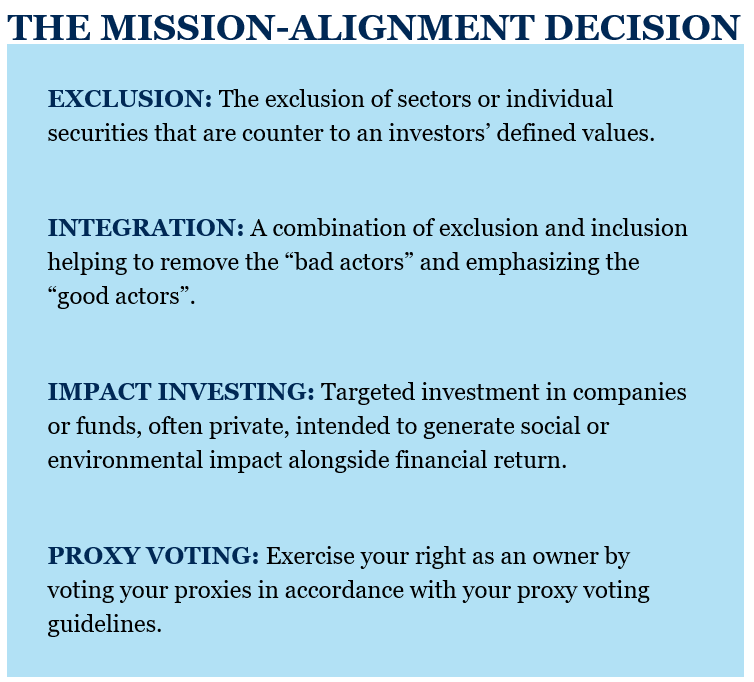

With such growth, it is imperative that investors interested in mission-alignment focus their discussion on defining their mission prior to investing. A well-defined mission empowers investors to customize their portfolio to limit risk, maximize return and ultimately incorporate their values to their investment portfolios.

1US SIF Foundation: “Report on US Sustainable, Responsible and Impact Investing Trends 2016.”

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.