Key Observations

• Data indicates that the capital raise downdraft is slowing and likely troughing in several asset classes; however, the number of funds closing has shrunk dramatically and the time it takes to raise capital has meaningfully increased.

• Venture capital valuations have normalized with the euphoria around AI, but the space continues to face exit issues with significant value “trapped” inside of funds with limited options for liquidity.

• As more capital flows into the private markets and certain parts become more efficient, investors should remain focused on areas that still benefit from structural inefficiencies.

Introduction

The landscape of private market investing continues to evolve, shaped by shifting economic conditions, investor sentiment and structural market changes. Fundraising, deal activity and capital allocation trends reveal an industry navigating both headwinds and opportunities. While global fundraising has faced persistent challenges, certain asset classes remain more resilient. At the same time, venture capital remains in a state of recalibration, grappling with valuation resets and liquidity concerns.

As investors assess the path forward, the ability to deploy capital strategically and navigate market inefficiencies will be paramount. This report delves into the latest developments across private equity, venture capital, real assets and private debt, providing insights into the forces shaping today’s investment landscape.

Global Fundraising and AUM

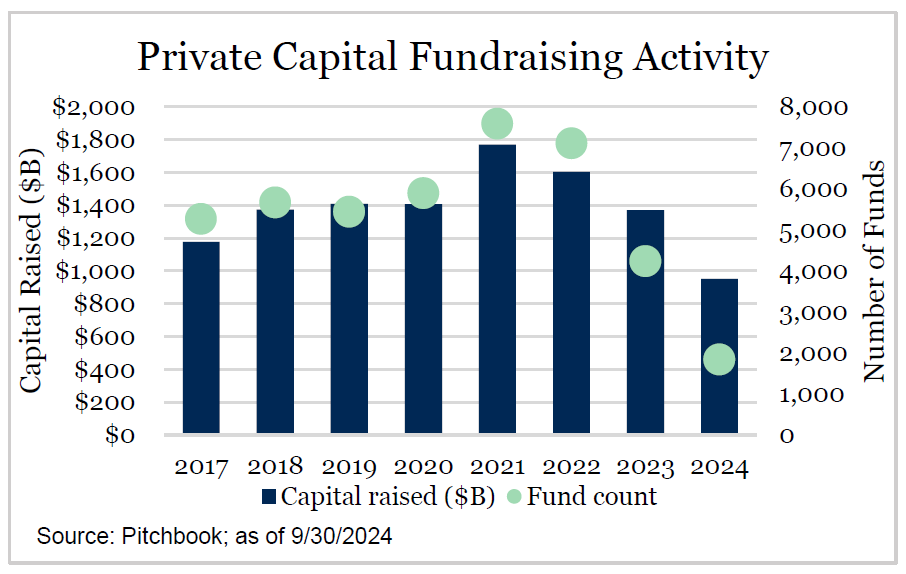

Ask anyone trying to raise capital and they will tell you that fundraising is difficult. If you don’t believe them, believe the numbers. On a dollar basis, through the third quarter of 2024, we saw the dollar amount of capital raised decline modestly once again. Assuming the fourth quarter follows trend, this will be the third consecutive year of declines in the dollar amount of capital raised.

More striking than the decline in dollar amount is the decline in funds holding a final close. By the third quarter, there was a trailing four quarter year-over-year decline of more than 40%.1 As of September 30, 2024, less than 1,800 funds globally held a final close while that number totaled more than 4,000 during 2023 (and peaked above 7,500 in 2021).1 A decline of this magnitude suggests exactly what one would think – a greater concentration in manager capital, specifically at the larger end of the market. Funds that raise $1 billion worth of capital or more accounted for 75% of all capital raised, which is substantially above the long-term average of 57%.1 This figure includes is all funds globally, not just private equity.

We also observed that 85% of capital raised went to “experienced firms” rather than emerging firms.1 This trend has been magnifying since the onset of higher interest rates and has fallen into a bit of a self-fulfilling pattern. High performers at existing firms recognize the challenges in raising capital and may be hesitant to leave their current firms to strike out on their own. Anecdotally, data points exist at both ends of the spectrum. One individual leaves, raises effectively and efficiently and is off to the races while the another stagnates in market trying to raise capital. Additionally, many Limited Partners (“LPs”) are trying to streamline the number of line items they have in their portfolio which most often means concentrating manager relationships.

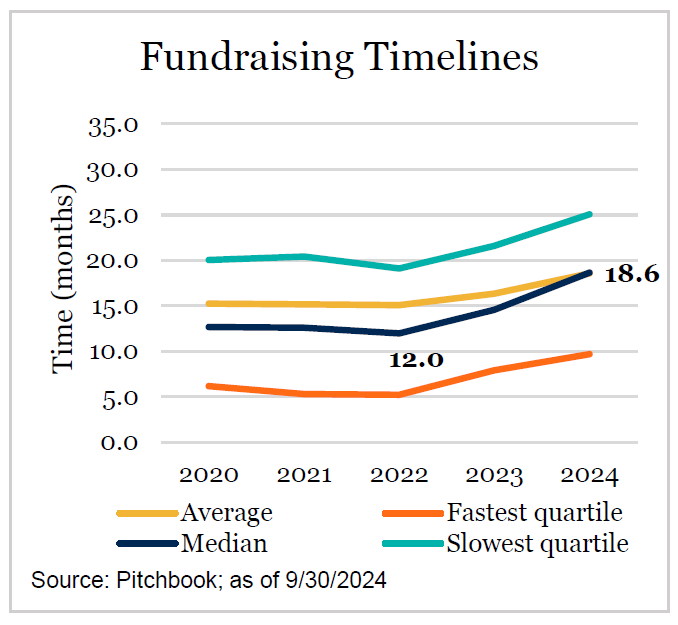

In sum, there have been fewer willing to take the jump in today’s market. Similarly, the time to close a fund has increased rather dramatically over the past two years. At peak speed, the median fund was raising for about one year. Today it is over 18 months.

But why has the fundraising market been so challenging? Public markets are near all-time highs, we continue to see the headlines around the deluge of pent-up demand for private markets and returns generally continue to be strong. Despite the strong indications around the market, there are a handful of factors we see as continued hurdles for LPs. Despite meaningful dry powder, distributions and exits remain low on a relative basis.

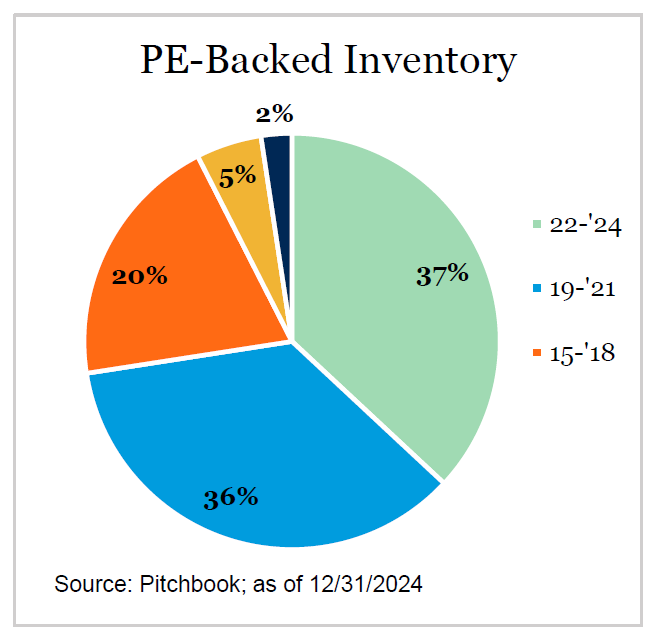

Many LPs are still working through the period of 2021 and into 2022 where distributions were sharply declining while capital calls were increasing meaningfully. As these funds mature, the allocations will rebalance, but it does not happen overnight. Funds have heard loud and clear from LPs that they expect to see liquidity, particularly as the inventory on companies ripe within their exit window continues to increase their share of overall market value. This has pushed many funds to seek less traditional liquidity measures like NAV loans, continuation vehicles or heavily structured exits. Many LPs are continuing to work through various portfolio construction and rebalancing exercises which has disproportionately hurt certain fundraising markets, such as venture capital.

Private Equity

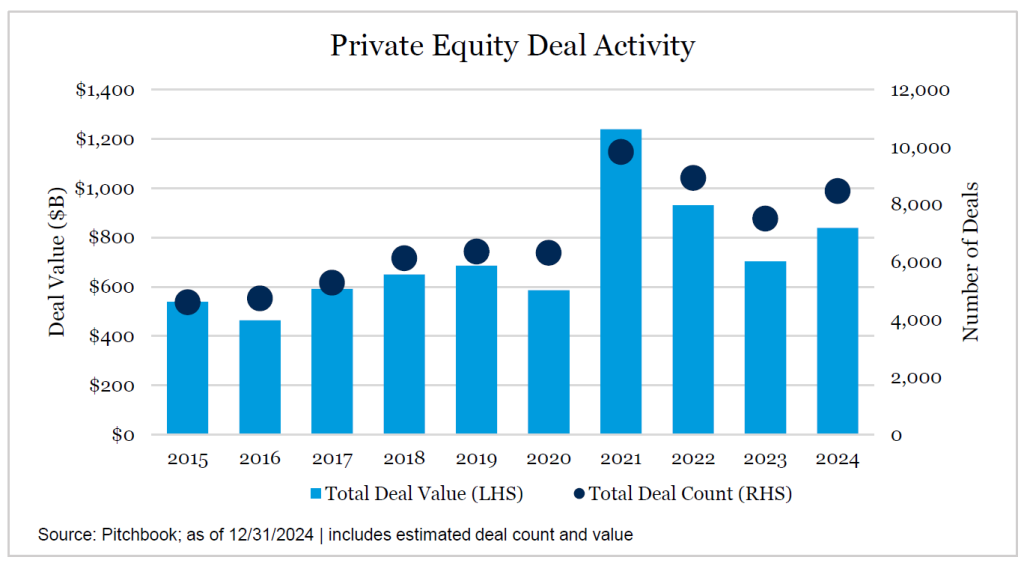

Deal activity in private equity (buyout, growth equity and turnaround strategies) increased rather substantially over the past year. The bounce back came on the heels of a more constructive capital markets environment where interest rates exhibited more stability than the two prior years. This allowed transactions to progress and ultimately close. Bid-ask spreads finally narrowed as banks and private credit lenders were in the market in a meaningful way. Broadly syndicated loan (“BSL”) volume nearly doubled for both new platform as well as refinancing activity.

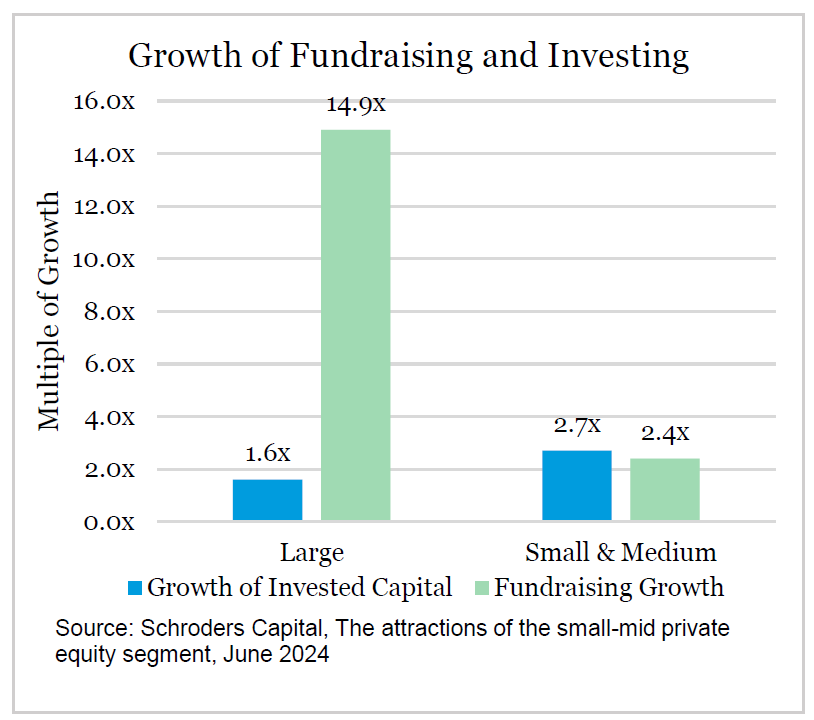

Add-ons continued to be a dominant part of the overall number of transaction activity, highlighting the continued desire to source growth through acquisition. Carveout activity, both in terms of count and value, also continued to increase as larger companies continued to look to divest non-core assets. Take-private value fell approximately 25%, despite being relatively consistent based on deal count, as public markets remained strong.2 The disparity between large and small continues to be stark within the private equity space, driven by the fundraising success of larger funds. More than 80% of dry powder is accounted for by funds that are $1 billion and larger.2

Furthermore, about 20% of all dry powder is held within large funds with a vintage year of 2020 or 2021 – two vintages that will be reaching the end of their investment period sooner rather than later. The data highlights that the fundraising success of the larger funds has drastically outpaced their investment activity.

Venture Capital

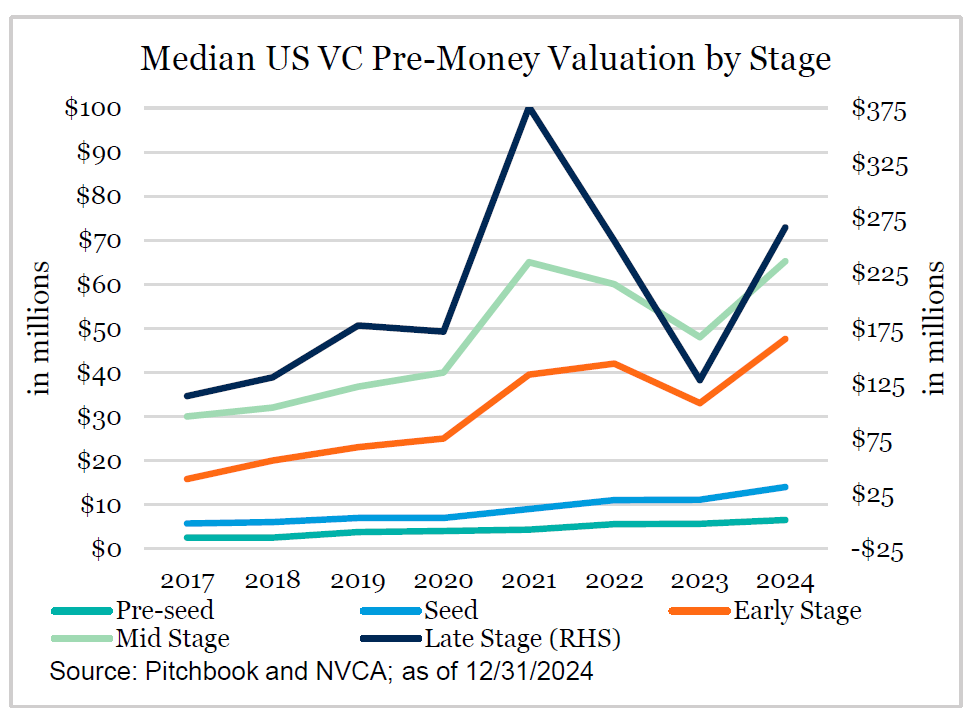

While venture capital has quickly moved to focus on the burgeoning space of artificial intelligence, the sluggishness of the reset persists. Some recent successes have given a sign of life to the space, but the reality is that significant value remains trapped inside of funds with uncertainty around exit avenue. Further, many companies and funds continue to be plagued by over-priced rounds in 2021 and questions persist around the public markets appetite for these companies. Even against this backdrop, we continue to think venture is a relevant and important space to allocate capital; however, it must be done in a measured way that recognizes the cyclicality and liquidity issues that can manifest for periods of time.

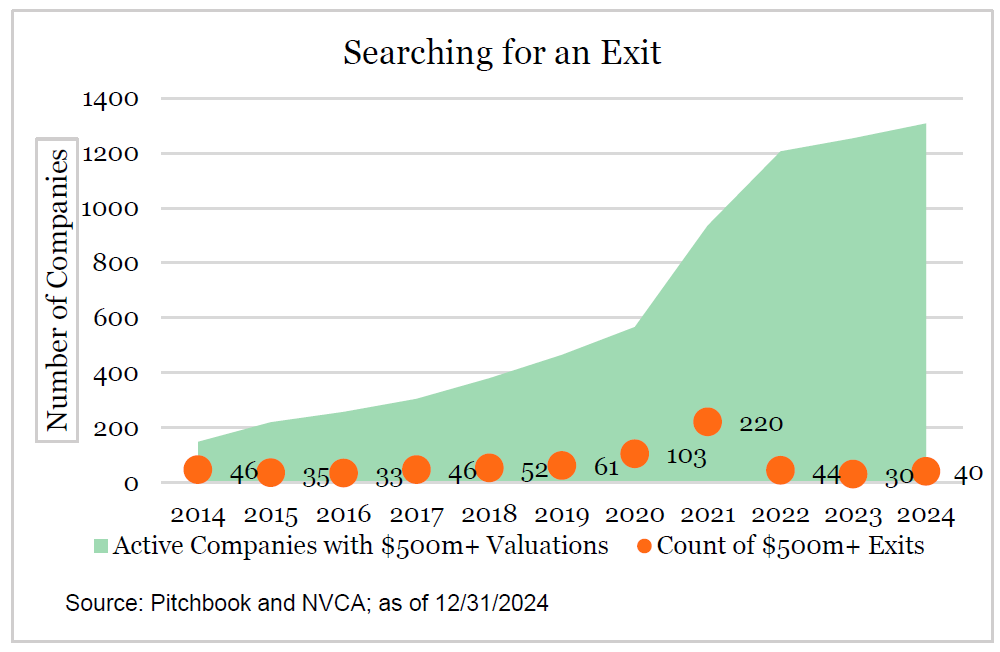

Exit volumes within venture remain depressed with meaningful value trapped, particularly by companies that are scaled. As highlighted, new creation of unicorns has been slower in recent years, but the aggregate value continues to grow, led by several companies who raised capital at substantial valuations. Although some companies continued to grow substantially, the percentage of flat and down rounds are the largest in a decade and the pressure to minimize burn rates remains incredibly high.

While the heartburn for many remains real in the venture space, we also recognize the existence of its opportunities given the void of capital. This dynamic is present across all stages of venture. As one would expect when demand for capital starts to exceed the availability of capital, prices start to favor investors. Pitchbook and NVCA measure the past year as their most “Investor Friendly” environment over the past five and highlight the demand to supply ratio of capital sits around 2x or higher for all stages.3

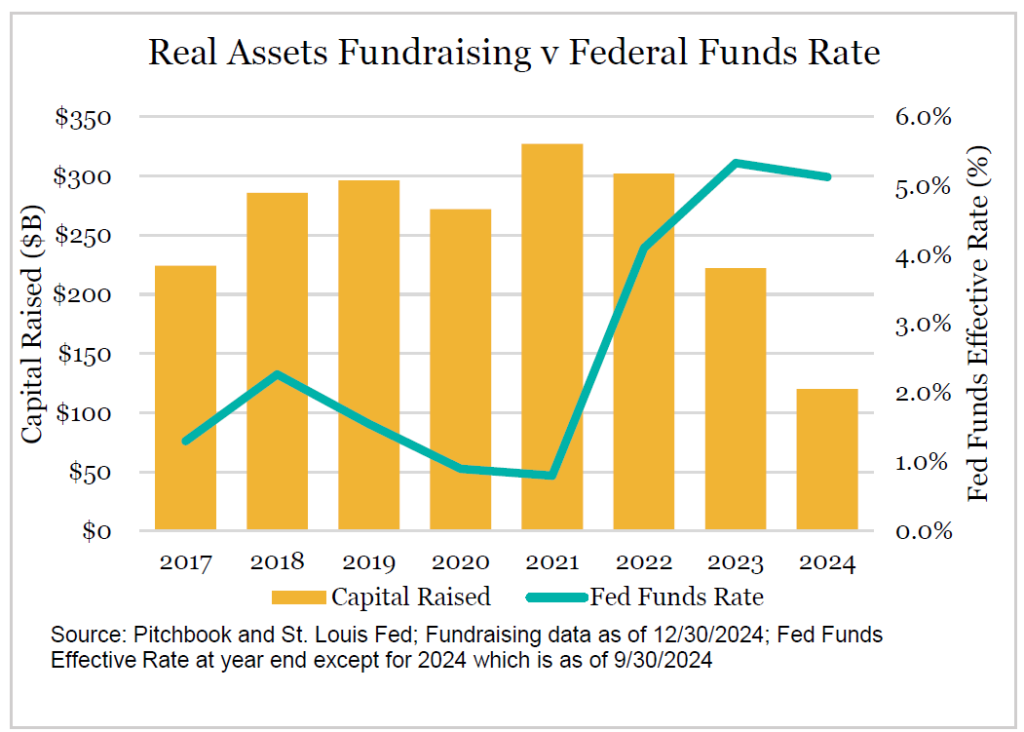

Real Assets

Although higher interest rates continue to be a headwind for many real assets strategies, there is growing optimism amidst a space that has been beaten up the past couple of years. Not only have higher interest rates challenged an asset class that is generally the most levered in private markets, but these strategies experienced a massive shift as an “alternative to yield” during a time when fixed income portfolios yielded very little. Through the first three quarters of 2024, private infrastructure fundraising outpaced private real estate (looking exclusively at drawdown structures). This highlights two trends which persist in the space: (1) continued uncertainty within multiple real estate sectors such as office and growing discomfort within some parts of multifamily and (2) the fact that we have seen many LPs take a broader approach to the space with the inclusion of data center assets, telecom assets or energy transition.

We continue to focus a significant amount of time on the interaction between publicly listed and private assets within this space. As additional asset and property types become more institutionally investable in both venues, collaboration is important to determine when to give up liquidity to access a unique part of the market versus maintaining liquidity through public markets exposure. Given the current dislocation across this space, there will undoubtedly be good opportunities over the next several years as many assets owners work through capital structure issues in the face of higher base rates and, in most cases, a different growth profile than was originally underwritten.

Private Debt

The private debt market continues to garner significant interest from many market participants. Capital raised in the markets remained steady from institutions. Private wealth channel activities continued in earnest via a variety of open-ended structures which somewhat skews the amount of capital flowing into (or out of) the asset class. Since 2020, there have been over 200 vehicle launches targeted at this space (tender offer, interval, non-listed REIT, non-listed BDC), garnering nearly $400 billion in assets.4 That activity has provided assets to private debt managers.

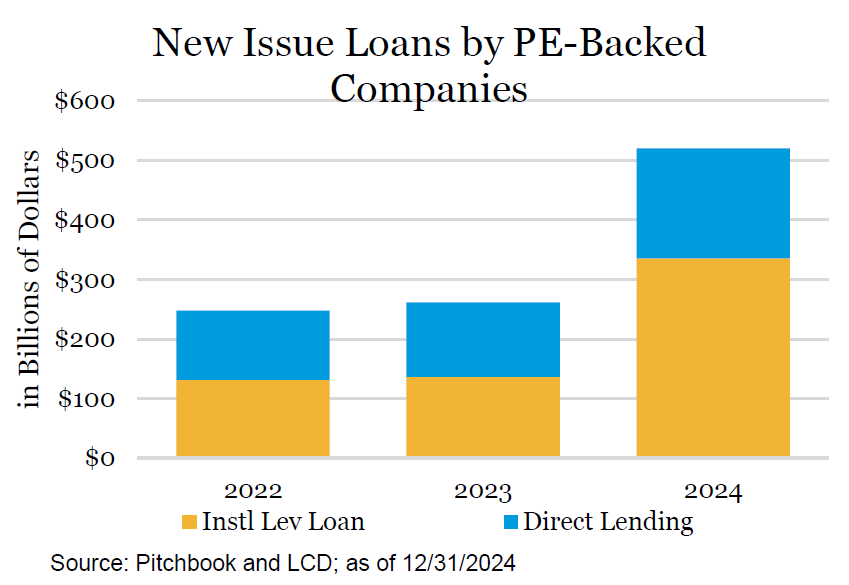

Additionally, capital deployed into PE-backed companies increased substantially in 2024 as the broadly syndicated loan (“BSL”) market bounced back meaningfully while overall new issue activity increased dramatically over 2023. More so than any other asset class, investors prefer experienced managers who collectively gathered 95% of all capital raised through the first three quarters of 2024.5

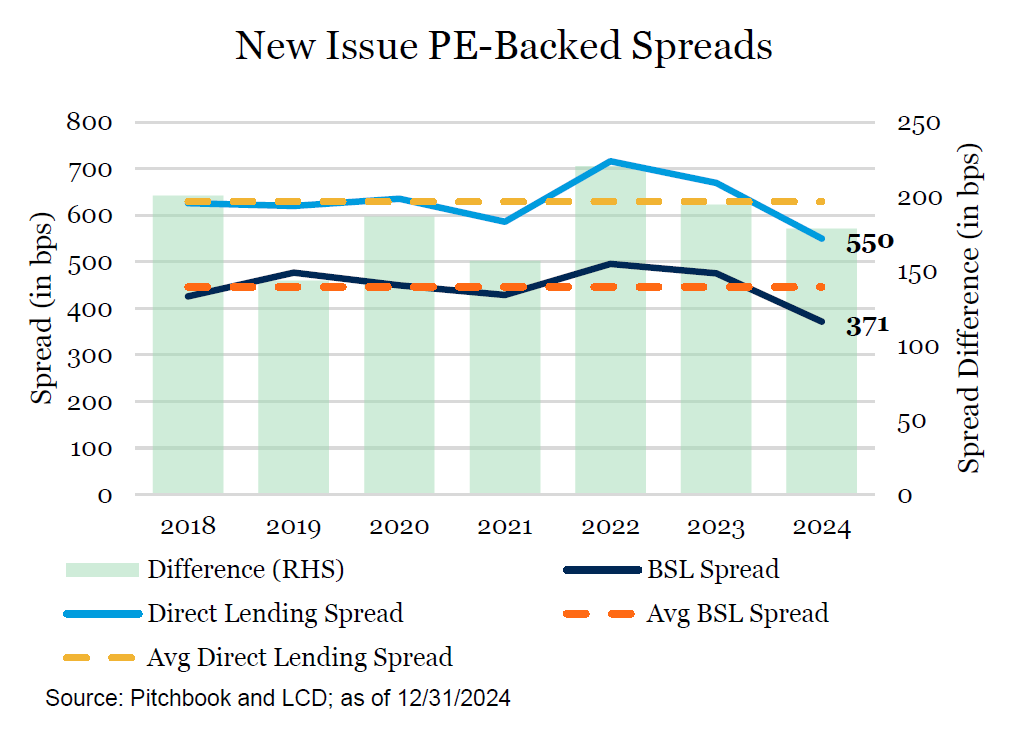

Spreads declined across both direct lending and broadly syndicated loans, reflecting a more competitive lending environment.

Additionally, Pitchbook LCD’s Global Private Credit survey indicates that many anticipate further narrowing of spreads in 2025. The narrowing of spreads partially offsets the rise in base rates that was seen during the Fed’s tightening cycle. Almost all loans in the private capital space are floating rate loans, so declining spreads alongside the more recently declining base rates ultimately yield more muted returns. Assuming spreads remain tight, we could see a flurry of refinancing activity for loans that were initially financed in 2022 and 2023 when spreads were wider.

Opportunities Persist

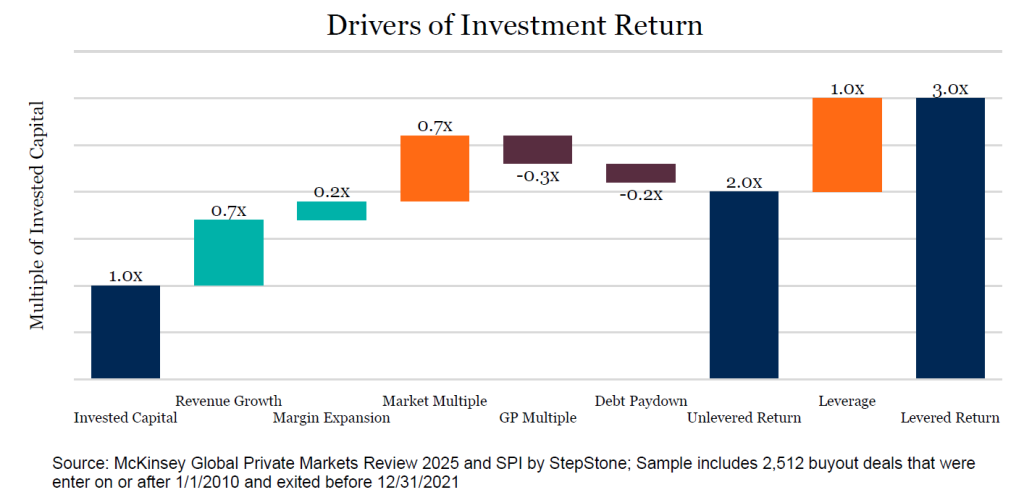

We believe success in private markets over the next decade will be more about how you invest rather than if you invest. It seems to be a foregone conclusion that more capital will be flowing into the space which will inevitably create pockets of mediocre returns but also immense opportunities. At the same time, the potential for more volatility in public markets means more potential bouts of ‘denominator effect’ concerns and potential liquidity issues. As we have stated in the past, the opportunity cost of illiquid capital is high and therefore should be prioritized for parts of the portfolio where it is most likely to produce outsized returns over time. Further, active selection will play a major role in ultimate returns. The chart below highlights where returns have largely been derived over the past market cycle and during periods of low interest rates. Projecting forward, higher interest rates and less multiple expansion challenge the primary return drivers of past years and place more of the opportunity with those who can help drive business momentum.

While consistency is a key ingredient in the success of a private markets program, maintaining a broad perspective on the overall market is integral to understand how the key pieces of the market interact and the follow-on impacts. Further, because decisions made in the space are often around for a decade, it is important to keep that time frame in mind. Ultimately, we remain confident in the return and growth potential within private markets and welcome future opportunities where we believe there will be increased differentiation across the market.

Unlock the potential of private markets and begin strategically enhancing your portfolio today. Reach out to the professionals at Fiducient Advisors for more information.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.