The four most dangerous words in investing might be: It’s different this time. But in many respects the COVID–19 crisis compels investors to view things another way. I’ll first clarify why this is so and then provide a thoughtful, and timely, approach to rebalancing your portfolio.

Financial metrics won’t prompt the All-Clear!

Yes, markets are forward-looking where investors project economic and company specific performance, anticipated outcomes are then reflected in the pricing of stocks and bonds. Effectively economists and others model potential outcomes that determine the relative attractiveness of an opportunity. The problem is we won’t have a true sense of economic fallout from COVID–19 until we have a handle on when businesses might begin to function in more normal fashion. This means that any all-clear will first be sounded by doctors and scientists… and they are navigating extraordinary uncertainty. In addition we as investors must acknowledge our personal biases. Like me, you’re hopeful this crisis is short lived and that calamity is contained. But at this point, investors have no true sense – and neither do the doctors and scientists.

Good stewards don’t have the option of simply kicking-the-can, they’re required to be intentional in their oversight of portfolios. And with March generating some of the swiftest losses and most volatile markets in history, your asset allocation is probably well off your stated targets. Should you simply sit on the sidelines and do nothing? Should you rebalance entirely back to target on a given day? We believe both alternatives are lacking. Instead we recommend this three step strategy… and ASAP.

1. Determine any extraordinary cash needs before rebalancing. Whether you’re a nonprofit, plan sponsor or individual investor, it’s imperative to evaluate liquidity needs. A hospital or university may have to rely more on their endowments for operational needs, pensions may be funded at lower rates and individual investors might need to tap into their portfolios much sooner than anticipated. Your first step should be to engage in an impromptu Three Levers exercise and carve out any required cash. See my Three Levers article on LinkedIn here.

2. Shift 50 percent back to target now. Each investor’s circumstances are unique and you’ll need to assess what’s best for you, but for most portfolios we believe it’s prudent to close the gap between your current allocation and your original target by half. Again, this is after you’ve carved out any extraordinary cash reserves. This first swing back toward target increases allocations to asset classes that are more reasonably valued compared to just a short time ago – but also accounts for continued uncertainty and the possibility that what appears cheap today may in fact become cheaper still.

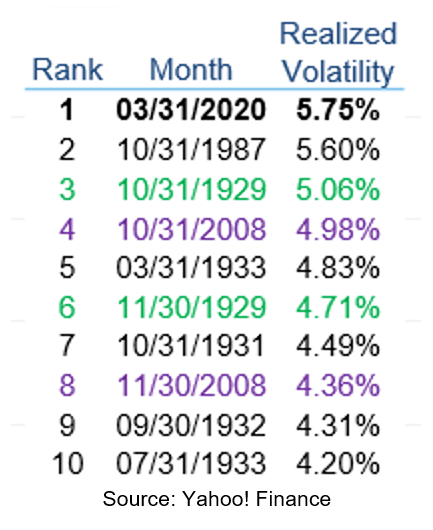

3. Take at least two more swings toward your target, over time. As seen in the graphic, March was the most volatile month ever for the S&P 500 and if history serves as a guide, volatility could be an unwelcomed guest for a while. We suggest employing a disciplined approach – perhaps partial allocations over several months – to evolving your portfolio back to target weightings.

It would be wonderful if investors could simply peg the market bottom, reallocate their portfolios and put this menacing downturn behind us. But given that COVID-19 adds a level of investment unpredictability – in a sense it is different this time – we believe adhering to this three step process affords investors the best approach to minimize your potential regrets.

For additional timely updates, look to our Research & Insights and please feel free reach out to any of the professionals at Fiducient Advisors. Be well.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.