The word “unprecedented” is used a lot these days, but unless you were living in the early 1900s, the current health crisis could be aptly described as just that. For sure, there are some parallels between the COVID crisis and the environment we found ourselves in post-9/11. At that time, you’ll recall that there was a generalized anxiety around travel, public transportation and congregating in large groups. And while there was certainly a resultant economic impact of this anxiety, the advice we received from our leaders in government was to go about our daily lives and to not let the terrorists win. Go to work, attend meetings, cultural and sporting events, restaurants and movies. The closest thing we got to a modified life prescription was “If you see something, say something.”

Today, the prescription is to “stay at home”. Restaurants and movie theaters are closed, major sporting and cultural events cancelled. A term most of us had likely never heard of before (“social distancing”) has now become part of our daily vernacular. And this environment has indeed had an “unprecedented” impact on nonprofits whose revenues are dependent upon the willingness and ability of people to congregate together.

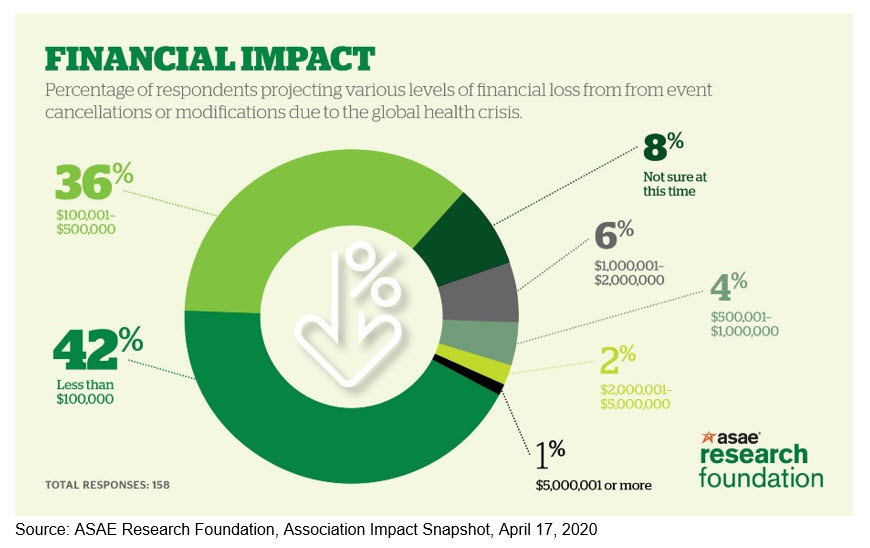

Simply put, these coronavirus cancellations are impacting bottom lines. For example, a recent study published by the ASAE Research Foundation quantified how widespread this problem is among associations, many of whom rely on meetings revenues.

How are nonprofits dealing with the financial impact of these coronavirus cancellations?

1. Event Cancellation Insurance

If an organization’s event (such as an annual conference or fundraiser) is deemed covered by the carrier, this should help offset the loss in revenues. Lost revenue can include any ticket sales, merchandising and sponsorship revenue. However, costs such as food and beverage, venue and advertising may not be recoverable. If the cancellation is due to an action by a civil authority (for example, a city prohibiting public gatherings beyond a certain size) the event may be covered if the reason (i.e., communicable disease) is in the policy. A nonprofit should be prepared to clearly and thoroughly document the extent of the loss, as a forensic accounting firm will likely be appointed by the carrier. Note, insurance experts tell us that for future events, communicable disease coverage is unlikely to be unavailable going forward, or available with a COVID-19 exclusion and at a significant premium.

2. Investment Reserves

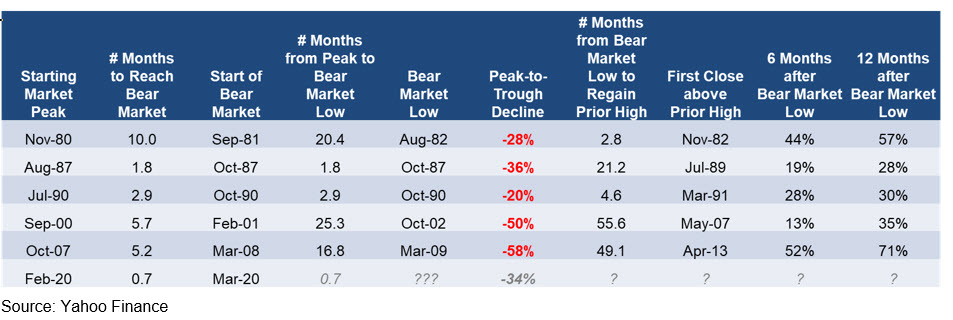

The bad news is that coronavirus fears have pushed the global equity markets into bear market territory and resulted in unprecedented (there’s that word again) levels of market volatility. Even by historical standards, the drop was both deep and steep.

Nonprofits with have meaningful allocations to the equity markets opened up their March 31 account statements to see asset values well below where they started on January 1. However, those same meaningful allocations likely led to sizable gains in investment values over the past five-seven years. Numerous organizations are looking at harvesting those gains to help offset lost revenues due to coronavirus cancellations. From the outset, some organizations will have setup up multiple investment pools; for example, a more conservative short-term fund and a more aggressive long-term fund. In doing so, these organizations can dip into their short-term fund without worrying about selling into a volatile equity market and redistributing between the two funds when calmer markets arrive.

3. Taking On Debt

As the economy experiences this shock, government authorities have sprung into action. On March 15, the Federal Reserve, noting that “the coronavirus outbreak has harmed communities and disrupted economic activity” cut its target federal funds rate to essentially zero percent. This means that debt is very inexpensive, particularly on the short-term end. Nonprofits may be able to leverage the value of their investments to set up low rate lines of credit sized at 60 percent of the value of their investments for no cost, no annual fee or obligation to use and nominal underwriting. For many groups, this can be a comforting lifeline, whether they choose to use it or not.

4. CARES Act

Eligible nonprofits (not all can participate at this time) are looking at programs such as the Paycheck Protection Program (PPP) to help offset revenues lost due to coronavirus cancellations. This loan can be used for payroll costs (including benefits), rent, utilities and mortgage interest and will be ultimately forgiven if a nonprofit can demonstrate that at least 75 percent of the proceeds were used for payroll. Otherwise, the loan converts to a two-year term at 1 percent, still a very attractive lending option. (Note, at press time the PPP was fully subscribed but expansion of the program is being discussed. Visit treasury.gov for more details.)

In Closing

How long the impact of coronavirus cancellations affects nonprofits remains to be seen. Unlike more recent economic crises, our current predicament is likely to be solved not by calculators and coins, but by microscopes and test tubes. In the meantime, every nonprofit should consider their own personal circumstances, utilize the tools most appropriate for their organization and keep their options open. There will come a time when “social distancing” is no longer a prescription for life. Until then, we can all strive to be assets to our organizations, sources of strength and comfort to our loved ones, and compassionate to our communities.

The information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisor research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.